With Fed cut bets firming and political headlines unsettling investors, USD/JPY may hinge less on near-term data and more on whether long-end yields hold the line.

By : David Scutt, Market Analyst

- Payrolls revised down by 258k, unemployment lifts

- Trump fires BLS chief; Fed’s Klugler resigns abruptly

- Risk of earlier, larger Fed cuts back in play

- Long-end Treasury yields key if “sell America” risk returns

- Fundamental USD/JPY bias shifts bearish

USD/JPY Weekly Forecast Summary

A soft U.S. jobs report, huge downward revisions and an unemployment rate that nearly hit 4.3% have revived concerns over labour market momentum, though seasonal quirks and other indicators argue for caution. But Trump’s firing of the BLS chief and the abrupt resignation of Fed Governor Adriana Klugler risk fuelling fresh doubts over U.S. data and policy direction. With the prospect of earlier and larger Fed cuts now in play, the back end of the Treasury curve could again become the key gauge for any renewed “sell America” episode.

Payrolls with a Sting in the Tail

July’s U.S. jobs report was weak, with payrolls for May and June revised down by a combined 258,000. That’s pulled the three-month average down to just 35,000, well below the pace of a year ago. The unemployment rate rose to 4.2% and only narrowly avoided rounding up to 4.3%, even with participation falling for a third straight month. While the drop in participation may point to softening labour market conditions, other indicators, such as jobless claims, are yet to show similar signs of stress.

Caution is also warranted based on seasonal abnormalities with a weak payrolls report in July 2024 ultimately proving to be a false signal after revisions.

However, recent political developments risk compounding market unease. Trump’s immediate firing of BLS Commissioner Erika McEntarfer has raised questions over data credibility, while the abrupt resignation of Fed Governor Adriana Klugler opens the door for a more dovish, Trump-aligned replacement. With two Fed governors already dissenting in favour of cuts last week, there’s a risk markets could start to price in earlier and larger moves.

This combination may again raise the prospect of a “sell America” episode similar to what followed Liberation Day earlier this year, particularly if investors lose confidence in both the integrity of the data and the Fed’s ability to avoid a major policy error. In that scenario, the back end of the Treasury curve could become the key barometer of sentiment.

U.S. Long Bonds in Focus

Source: TradingView

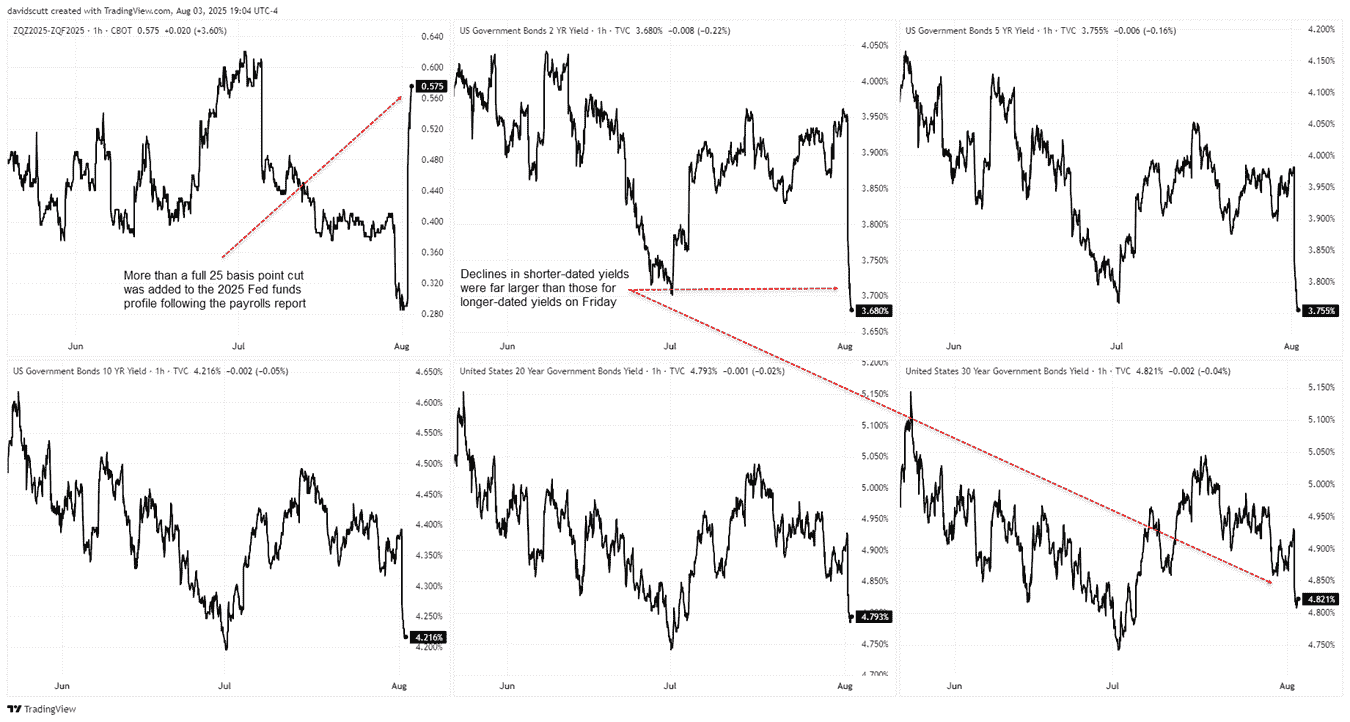

Following the payrolls report and political fallout, there was a noticeable bull steepening of the U.S. Treasury curve on Friday, with shorter-dated yields registering far greater declines than for securities with far longer maturities. The U.S. 2s30s curve saw its largest one-day steepening since March 2023, adding to nervousness that fragile confidence in the U.S. fiscal trajectory may soon fray again given recent developments.

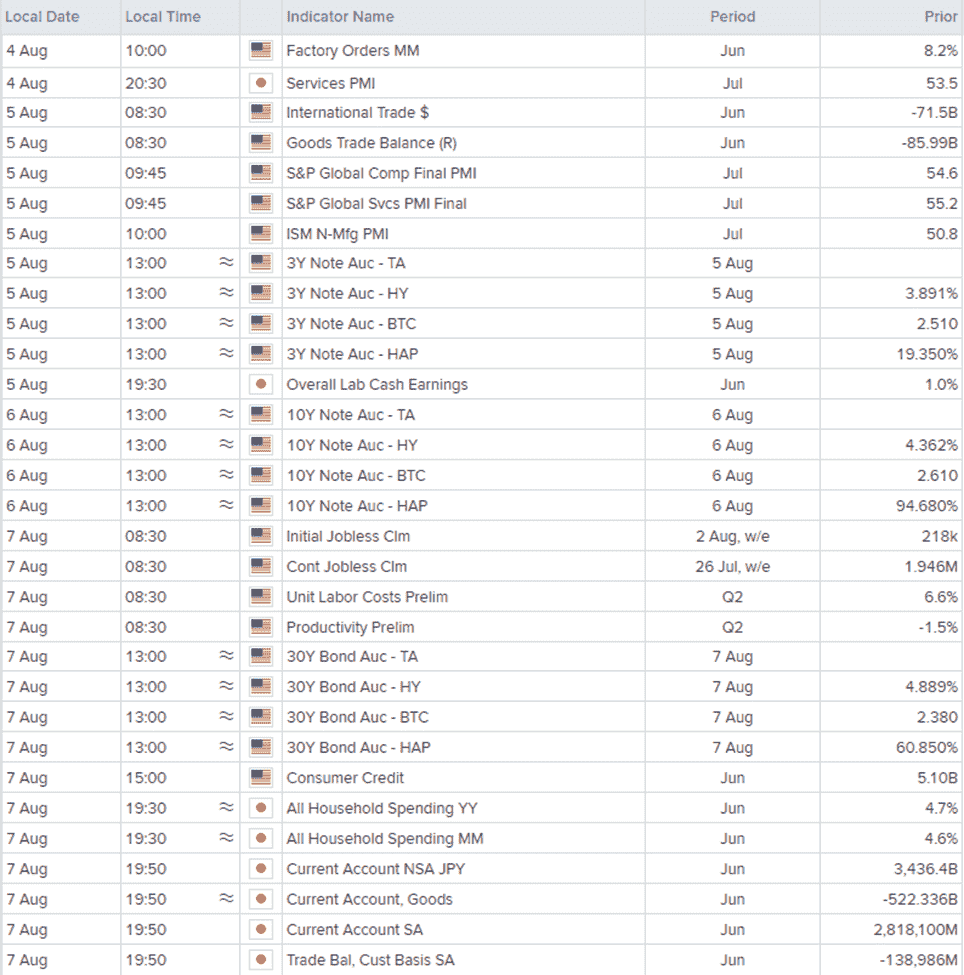

Data, Debt Auctions Headline Risk Events

In an otherwise quiet week for U.S. economic data, alongside the ISM services PMI on Tuesday and jobless claims on Thursday, that puts upcoming auctions of U.S. 10 and 30-year Treasuries on Wednesday and Thursday respectively squarely in the crosshairs for traders. If there’s any evidence of weakening international demand, it may act as a catalyst to spark multi-asset volatility, making them even more relevant for USD/JPY given the yen is a known funding source for carry trades.

Source: LSEG (Calendar reflects U.S. ET)

While the Japanese calendar will likely play second fiddle to developments in the United States, June wages data released on Wednesday will be important to gauge whether it will be sufficient to boost demand-side inflationary pressures, bolstering the likelihood of the latest inflation pulse becoming self-sustaining. As such, Friday’s household spending data will also be worth casting an eye over from a fundamental perspective.

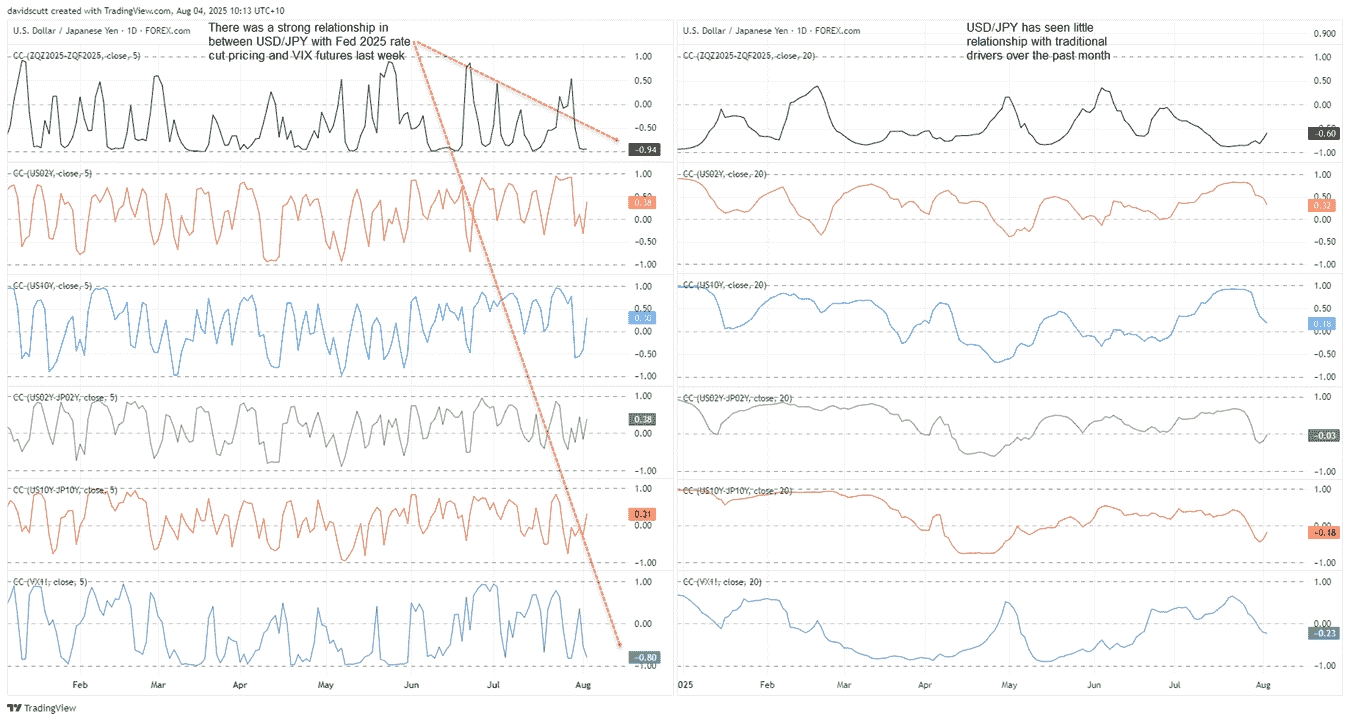

Fed Pricing Drives USD/JPY Movements

Despite the long end of the U.S. Treasury curve providing a source of potential volatility this week, right now, it’s Fed rate cut expectations that are in the driving seat for USD/JPY. That can be seen in the next chart with a strong inverse correlation with market pricing for Fed rate cuts this year over the past week, sitting with a correlation coefficient of -0.94. USD/JPY has also seen a relatively strong inverse relationship with VIX futures over the same period at -0.8.

Source: TradingView

Curiously, the historic relationship between U.S. Treasury yields and yield spreads between the U.S. and Japan has been nowhere to be seen over the past week or month, shifting from the trend seen earlier in July. The same applies to VIX futures, while the correlation with Fed rate cut pricing has also been weakening. Perhaps that reflects month-end flows and positioning, or potentially a return to investor unease evident for long periods earlier this year.

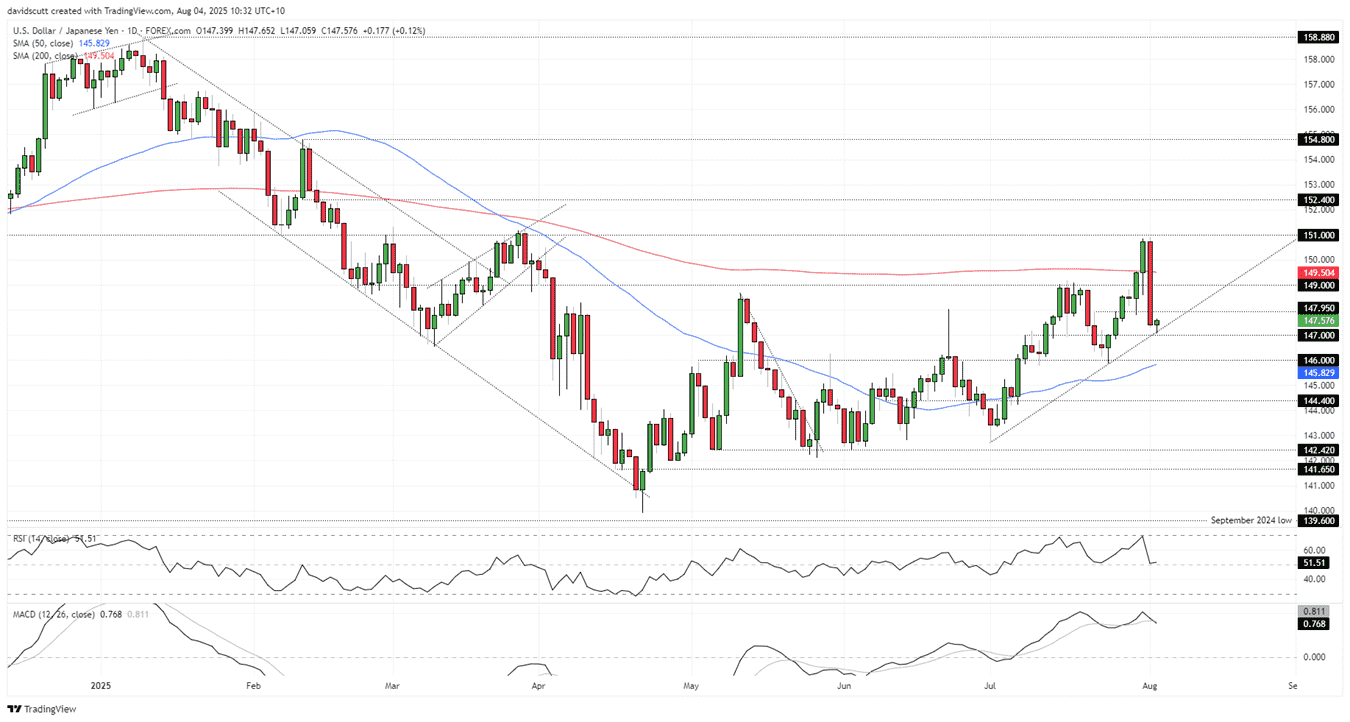

USD/JPY Technical Analysis

Source: TradingView

Following Friday’s violent reversal back beneath the 200-day moving average, USD/JPY has managed to bounce in early Asian trade on Monday, attracting bids at the intersection of uptrend and horizontal support at 147.00. That’s the first downside level to watch with a break beneath putting 146.00, 50-day moving average and 144.40 support on the radar for shorts. Should 147.00 support continue to hold, 147.95 and 149.00 are the initial levels to watch.

While momentum indicators continue to provide a mildly bullish signal, favouring upside, from a fundamental perspective, the bias is now bearish with renewed uncertainty, market pricing for September Fed cut hovering just below 90% with riskier asset classes sitting at elevated levels. If we see volatility increase, it may be difficult for USD/JPY to rally in such an environment.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.