Traders add to Japanese yen longs, pressuring USD/JPY lower, while GBP/JPY and EUR/JPY show bullish continuation signals.

By : Matt Simpson, Market Analyst

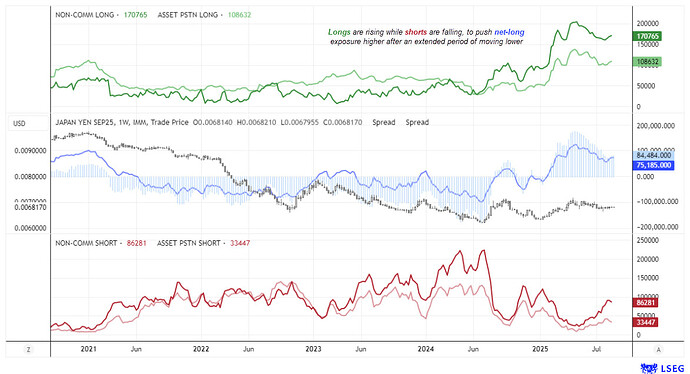

In my weekly analysis of the Commitment of Traders (COT) report, I noted that traders are gradually rebuilding net-long exposure to Japanese yen futures. Asset managers increased net-longs for a third straight week and large speculators for a second, with both groups adding to gross-longs while trimming shorts. After a multi-month decline from record highs, yen positioning is no longer at a sentiment extreme, paving the way for a stronger Japanese yen — and by extension, lower USD/JPY. This view also aligns with my bias that the Federal Reserve will eventually be forced to cut rates while the Bank of Japan (BoJ) edges closer to hikes.

Chart analysis by Matt Simpson - data source: CME, LSEG

That said, this bias is based on the weekly timeframe and specifically versus the US dollar. Yen strength is not yet broad-based across other majors, and daily momentum currently favours currencies like the British pound and euro. This leaves USD/JPY vulnerable to a short-term bounce even as the bigger picture points lower, while GBP/JPY and EUR/JPY may offer more attractive bullish setups until my core view of a stronger yen reasserts itself on the weekly chart.

View related analysis:

- Japanese Yen Rebound, USD Weakness, Commodity FX Diverge: COT Report

- AUD/USD Weekly Outlook: Odds of a Bullish Breakout on the Rise

- EUR/USD and GBP/USD Outlook: Bullish Patterns Form as Dollar Wavers

- GBP/USD, EUR/GBP: COT Data Appears Favourable to British Pound Bulls

Japanese Yen Technical Outlook Across USD/JPY, GBP/JPY, and EUR/JPY

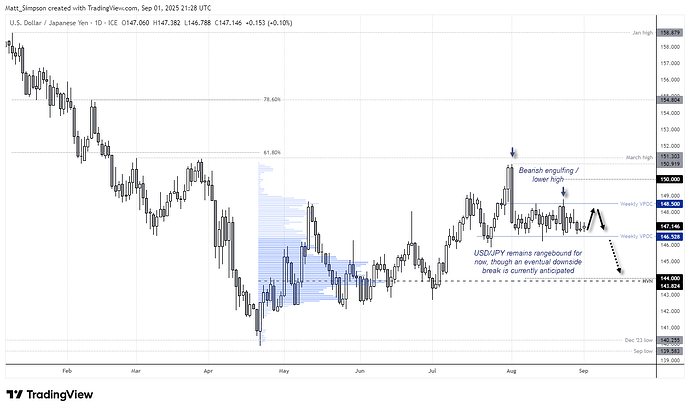

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

USD/JPY price action on the daily chart remains trapped between two key VPOCs (volume point of control) at 146.53 and 148.50. The broader bias favours a downside break while prices hold beneath 149, but with USD/JPY currently near the range lows, a short-term upswing within the range looks more likely.

Bulls may look for minor dips towards the 146.50–146.80 zone, targeting a rebound to the 148 handle before watching for signs of a swing high that could reset the move lower. A decisive break beneath 146.50 would be a bonus for Japanese yen bulls and USD/JPY bears, opening the way toward 144 support.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

EUR/JPY Technical Analysis: Euro vs Japanese Yen

The euro gained on Monday after the final revision of the S&P manufacturing PMI showed expansion for the first time since mid-2022. EUR/USD extended its rally for a third day, EUR/CHF posted a bullish engulfing candle, and EUR/JPY appears set to push higher after rebounding from mid-August lows.

On the daily chart, EUR/JPY found firm support at the 171 level, forming a double bottom above that zone and bouncing from its 50-day SMA. A cluster of dojis last week, followed by Monday’s strong bullish range expansion, suggests the correction from the 173 handle may be complete.

The 1-hour chart highlights a strong uptrend, with a bull flag consolidation pointing to potential continuation. The bias favours a breakout above 172.37, with bulls eyeing a retest of 173 and possibly 174. Pullbacks toward the 172.16 HVN or the 172 handle may offer dip-buying opportunities.

Chart analysis by Matt Simpson - data source: TradingView EUR/JPY

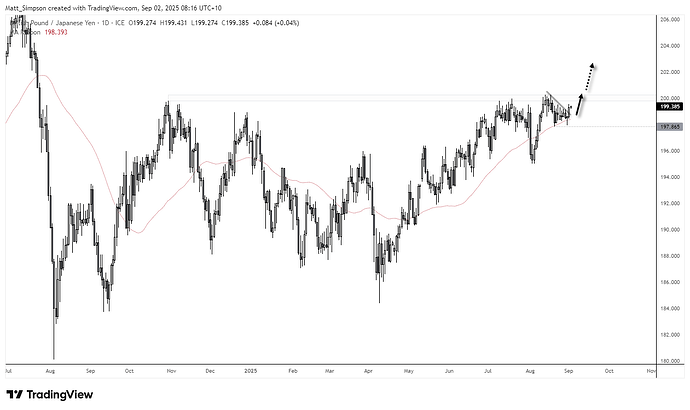

GBP/JPY Technical Analysis: British Pound vs Japanese Yen

A similar setup to EUR/JPY is unfolding on GBP/JPY, though with a key distinction — sterling bulls are attempting to clear a major resistance barrier around the 200 handle. Given the strong bullish trend structure, the bias remains for an eventual breakout.

The rally from the April low to the July high was followed by a healthy correction, which was quickly absorbed by buyers. Momentum has since turned higher after GBP/JPY bounced from the 50-day SMA near 197.85.

Bulls may look to buy dips within Monday’s range to enhance risk–reward potential, targeting a break above 200.00 with scope for further gains if upside momentum accelerates. However, a move below 197.85 would invalidate the near-term bullish bias.

Chart analysis by Matt Simpson - data source: TradingView GBP/JPY

Key Economic Events for Traders (AEST / GMT+10)

03:30 EUR ECB President Lagarde Speaks (EUR/USD, EUR/JPY, DAX)

08:45 NZD Terms of Trade – Export Prices, Export Volume, Import Prices, Terms of Trade Index (Q2) (NZD/USD, AUD/NZD, NZD/JPY)

09:50 JPY Monetary Base (Aug) (USD/JPY, EUR/JPY, Nikkei 225)

11:00 AUD MI Inflation Gauge (Aug) (AUD/USD, AUD/JPY, ASX 200)

11:30 AUD Current Account, Net Exports Contribution (Q2) (AUD/USD, AUD/JPY, ASX 200)

13:35 JPY 10-Year JGB Auction (USD/JPY, EUR/JPY, Nikkei 225)

19:00 EUR Core CPI, CPI, HICP ex Energy & Food (Aug) (EUR/USD, EUR/GBP, DAX)

19:30 EUR German 2-Year Schatz Auction (EUR/USD, EUR/CHF, DAX)

21:30 EUR ECB’s Elderson Speaks (EUR/USD, EUR/JPY, DAX)

23:00 SGD S&P Global Manufacturing PMI (Aug) (USD/SGD, EUR/SGD, STI)

23:30 CAD S&P Global Manufacturing PMI (Aug) (USD/CAD, EUR/CAD, CAD/JPY)

23:45 USD S&P Global Manufacturing PMI (Aug) (S&P 500, Nasdaq 100, USD/JPY)

00:00 USD Construction Spending, ISM Manufacturing Employment, ISM Manufacturing New Orders, ISM Manufacturing PMI, ISM Manufacturing Prices, Total Vehicle Sales (Aug) (S&P 500, Nasdaq 100, USD/JPY, Gold, Crude Oil)

00:00 EUR German Buba President Nagel Speaks (EUR/USD, EUR/JPY, DAX)

00:10 USD IBD/TIPP Economic Optimism (Sep) (S&P 500, Nasdaq 100, USD/JPY)

01:00 NZD GlobalDairyTrade Price Index (NZD/USD, AUD/NZD, NZD/JPY)

01:00 USD Milk Auctions (S&P 500, Nasdaq 100, USD/JPY)

01:30 USD 3-Month Bill Auction, 6-Month Bill Auction (S&P 500, Nasdaq 100, USD/JPY, Treasury Markets)

03:00 USD 52-Week Bill Auction, Atlanta Fed GDPNow (Q3) (S&P 500, Nasdaq 100, USD/JPY, Treasury Markets)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.