JPY pairs show mixed signals after the BOJ meeting, with USD/JPY stuck in range, AUD/JPY eyeing retracement, and GBP/JPY rejecting 200.

By : Matt Simpson, Market Analyst

Japanese yen pairs remain at pivotal technical levels following Friday’s BOJ meeting, which delivered no fresh policy clues from Governor Ueda. USD/JPY continues to trade within its established range, AUD/JPY shows signs of exhaustion after a sharp rally, and GBP/JPY faces resistance at the 200 milestone. Traders will be watching closely for confirmation of range breaks or retracements across these key JPY crosses.

View related analysis:

- US Dollar, Japanese Yen, New Zealand Dollar: COT Report Analysis

- Japanese Yen Rallies as BOJ Begins ETF and REIT Unwind

- Australian Dollar Outlook: AUD/USD Under Pressure Ahead of CPI and PMIs

Japanese Yen Technical Analysis: USD/JPY, AUD/JPY, GBP/JPY

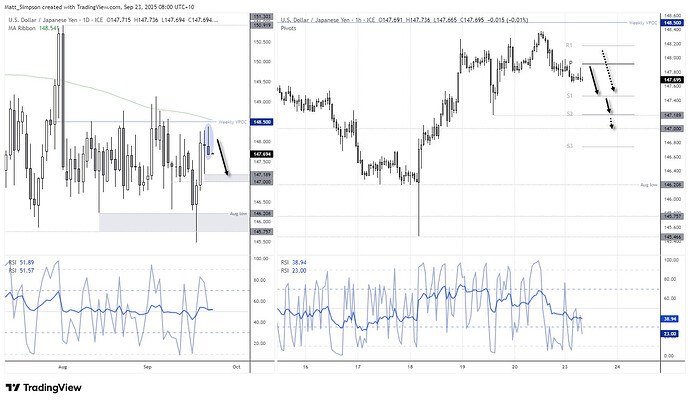

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

Friday’s Bank of Japan (BOJ) meeting failed to deliver a breakout for USD/JPY, with Governor Ueda offering no immediate clues on a potential rate hike in the coming months. As a result, USD/JPY remains confined to the 145.75–148.50 range it has traded within for most of the past two months.

A strong two-day rally leading into last week’s high could tip the balance towards an eventual bullish breakout, but one could argue it should have already occurred. Until a clear breakout takes place, the range remains valid, and range-trading strategies may be preferred.

The daily chart shows USD/JPY closed flat on Friday with a wide-legged doji near Thursday’s high. Monday’s false break of last week’s high resulted in a shooting star candle near the top of the range. Bears could seek to fade into retracements within Monday’s range and target the 147.19 low / daily S2 pivot or 147 handle.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

Click the website link below to Check Out Our FREE “How to Trade USD/JPY” Guide

https://www.forex.com/en-us/whitepapers/

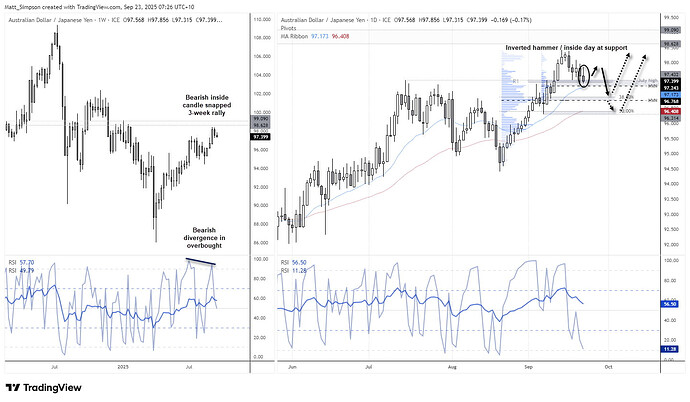

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

The strong rebound from the April low has carried AUD/JPY more than 14% higher, though early signs of a retracement are beginning to emerge. A bearish divergence formed on the weekly RSI (2) within overbought territory by last week’s close, and AUD/JPY snapped a three-week winning streak from arguably stretched levels. The BOJ’s decision to announce ETF and REIT sales saw AUD/JPY retest the July high, though it has so far managed to hold above the 97.24 high-volume node (HVN).

With an inverted hammer and inside day forming above Friday’s low and the HVN, a near-term bounce from current levels cannot be ruled out. However, a deeper pullback against the 14% rally remains possible, which could bring the 96.77 HVN or 96.31 near the 50% retracement level into focus.

Chart analysis by Matt Simpson - data source: TradingView AUD/JPY

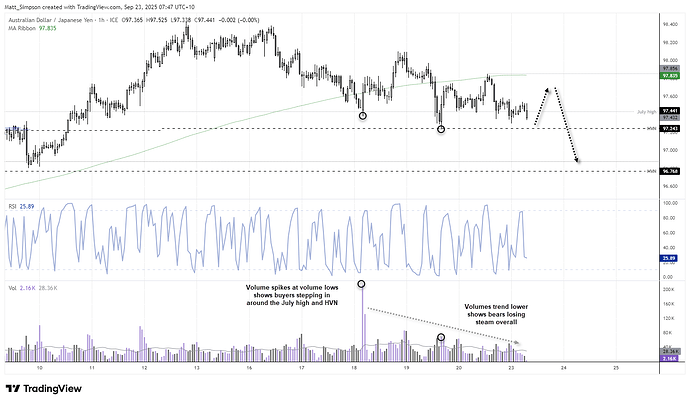

AUD/JPY Technical Analysis: 1-Hour Chart

The 1-hour chart shows volumes trending lower while prices declined towards the July high, which suggests bears may be losing momentum. Notably, volume spikes have coincided with two cycle lows around the July high and the 97.24 HVN, indicating that buyers stepped in at those levels.

Bulls may look to fade dips towards the HVN in anticipation of a countertrend bounce towards the 97.85 high and the nearby 200-bar SMA.

If such a bounce materialises, it will be important to reassess the potential for a swing high and resumption of the downtrend. Conversely, a direct break below the 97.20 area would assume bearish continuation, placing the 96.77 HVN into focus for sellers.

Chart analysis by Matt Simpson - data source: TradingView AUD/JPY

Click the website link below to Check Out Our FREE “How to Trade GBP/USD” Guide

https://www.forex.com/en-us/whitepapers/

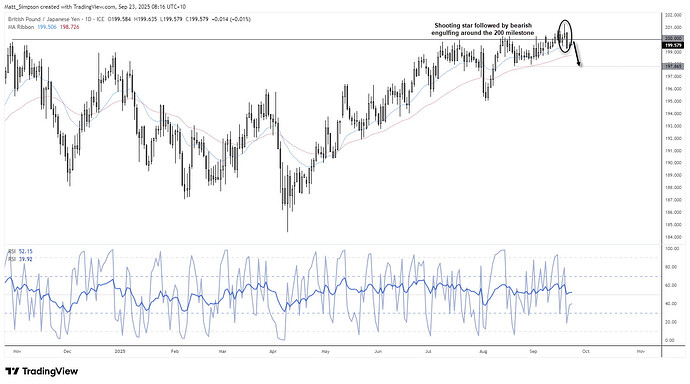

GBP/JPY Technical Analysis: British Pound vs Japanese Yen

The 200 level is clearly a major milestone for bulls to overcome, so it’s not surprising to see volatility increase around it. Despite three daily closes above 200 in the past week, GBP/JPY printed a shooting star followed by a bearish engulfing candle, which confirmed a close back below the 200 level and last Wednesday’s low.

With bears showing strength at cycle highs near such a key psychological level, they may look to fade any retracement within Friday’s bearish range.

A move towards 199 appears feasible, with a break beneath that level bringing the 197.87 low into focus.

Chart analysis by Matt Simpson - data source: TradingView GBP/JPY

Key Economic Events for Traders (AEST / GMT+10)

All Day JPY Holiday – Autumn Equinox (USD/JPY, EUR/JPY, Nikkei 225)

00:00 EUR Consumer Confidence (Sep) (EUR/USD, EUR/GBP, DAX)

01:30 USD 3-Month Bill Auction, 6-Month Bill Auction (S&P 500, Nasdaq 100, USD/JPY)

02:00 USD FOMC Member Barkin Speaks (S&P 500, Nasdaq 100, USD/JPY)

02:00 EUR German Buba President Nagel Speaks (EUR/USD, EUR/GBP, DAX)

03:15 CAD BoC Senior Deputy Governor Rogers Speaks (USD/CAD, EUR/CAD, CAD/JPY)

03:30 EUR German Buba Balz Speaks (EUR/USD, EUR/GBP, DAX)

04:00 GBP BoE Gov Bailey Speaks (GBP/USD, EUR/GBP, GBP/JPY)

05:45 CAD BoC Deputy Gov Kozicki Speaks (USD/CAD, EUR/CAD, CAD/JPY)

08:00 KRW PPI (Aug) (USD/KRW, EUR/KRW, KRW/JPY)

09:00 AUD Manufacturing & Services PMI, Judo Bank Manufacturing PMI, Judo Bank Services PMI (Sep) (AUD/USD, AUD/JPY, AUD/NZD)

15:00 SGD CPI, Core CPI (Aug) (USD/SGD, EUR/SGD, SGD/JPY)

17:30 EUR HCOB Germany Composite PMI, Manufacturing PMI, Services PMI (Sep) (EUR/USD, EUR/GBP, DAX)

18:00 EUR HCOB Eurozone Composite PMI, Manufacturing PMI, Services PMI (Sep) (EUR/USD, EUR/GBP, DAX)

18:30 GBP S&P Global Composite PMI, Manufacturing PMI, Services PMI (Sep) (GBP/USD, EUR/GBP, GBP/JPY)

19:00 GBP BoE MPC Member Pill Speaks (GBP/USD, EUR/GBP, GBP/JPY)

19:30 EUR German 2-Year Schatz Auction (EUR/USD, EUR/GBP, DAX)

20:00 GBP CBI Industrial Trends Orders (Sep) (GBP/USD, EUR/GBP, FTSE 100)

22:30 USD Current Account (Q2) (S&P 500, Nasdaq 100, USD/JPY)

22:30 CAD New Housing Price Index (Aug) (USD/CAD, EUR/CAD, CAD/JPY)

22:55 USD Redbook (S&P 500, Nasdaq 100, USD/JPY)

23:00 USD FOMC Member Bowman Speaks (S&P 500, Nasdaq 100, USD/JPY)

23:45 USD S&P Global Manufacturing PMI, Composite PMI, Services PMI (Sep) (S&P 500, Nasdaq 100, USD/JPY)

00:00 USD FOMC Member Bostic Speaks (S&P 500, Nasdaq 100, USD/JPY)

00:00 USD Richmond Manufacturing Index, Shipments, Services Index (Sep) (S&P 500, Nasdaq 100, USD/JPY)

02:35 USD Fed Chair Powell Speaks (S&P 500, Nasdaq 100, USD/JPY)

03:00 USD 2-Year Note Auction (S&P 500, Nasdaq 100, USD/JPY)

03:00 USD M2 Money Supply (Aug) (S&P 500, Nasdaq 100, USD/JPY)

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.