A little info about me

You may have noticed I’ve been a member for 2 years and lurked the forums reading/learning for who knows how long before that. My first ever trade was through FxSolutions before they had MT4 the only platform offered was called GTS. Unfortunately they recently went out of business. Anyways back to my first live trade this was before I did any research into forex, trading, technical analysis ect. Looking at a tick chart price kept selling off so I entered short and went to bed. The next morning I woke up to $100 dollar profit from a vary over leveraged trade. Remembering the age old advise from everyone who isn’t a trader “buy and hold” I though it’ll double again tomorrow you all know what happened next yup margin call within 24 hours. It really does happen to everybody sooner or later. Within a few days of this unfortunate event I found babypips and started reading the school taking all the quizzes.

Sometime after finishing BP school I still didn’t really understand the markets or how to trade. Switching back to a demo account I started to follow Taymen’s teaching. This guy had what appeared to be the perfect system with what was supposed to be super easy simple indicators RSI, Bollinger Bands, and one other I can’t recall at the moment. Of course everyone makes their system look the most simple and easy when it’s not. This guys ego was about as big as the distance between the united states and Australia. Everything had to be done just so in small lessons full of fluff one after another for hundreds of pages. I never did get profitable with his system it was to over complicated and confusing for me to fully grasp. Although others did vary well with it.

Soon after this I took a break from forex for almost a year every so often glancing back at Oanda’s MT4 charts just to see what was going on. You could say the charts where summoning me back chanting trade me trade me. This was about the time ICT had joined the forums and started his 2nd or 3rd thread. I didn’t join into his following just yet, I was more occupied with learning Harmonic trading at the time.

Determined to learn all the super secrets of Harmonic trading I purchased these two books “Trade What You See How to Profit From Pattern Recognition” and “Harmonic Trading Profiting From The Natural Order of The Markets” and followed TMoneyBags and his thread “30 Pips a Day Keeps Your Money at Bay”. After a good 6 months of studying TMoney and his methods I then joined a Harmonic signaling service which introduced me to the idea of the “Potential Reversal Zone” or PRZ for short. The way they they taught the PRZ it was automatically calculated by the size of the harmonic pattern by some sort of secret algorithm only available through their paid subscription and indicators. I only stayed with this signal service for one month since they wanted much more than I or any normal low income family could afford. But the Idea of a PRZ was stuck in my traders tool box to be brought back to attention months down the road.

Soon after giving up on Harmonics the so called next big thing on another forum was a thread about supply and demand zones. The way the thread leader made it sound so easy I was instantly hooked. Off to google I went on a good month long search for supply and demand how to’s and tutorials when finally I found this vary informative recorded webinar by Sam Seiden honestly can’t recall the name but he has a bunch of free recorded webinars starting in 2007 till current anyone wishing to learn more check out Sam’s videos over at fxstreet. His videos cleared up a lot of questions about what exactly supply and demand was and well it just wasn’t for me BUT it did work a lot like PRZ’s do with harmonics. So with that added bit of info in my tool box I then joined ICT’s at the time current thread.

He evidently was having a meltdown or was in trouble with the government for giving trade advise and had deleted all youtube videos. Anyways one kind member was sharing all the video’s they’d downloaded and/or recorded of his video’s and webinars through a popular torrent website. As you may have guessed I downloaded 60 Gigabyte torrent and began to watch, study, and take notes on everying. This process took months and months. Literally 60 Gigs is a lot of space luckily I have a external hard drive for such things. After done researching all of the video’s I had a note book full of different trading methods all of which where supposed to work together to form one awesome almost bullet proof trading plan. Well this isn’t exactly how it worked out for me. It quite literally was way to much for my simple mind to comprehend all at once though I did give it a really good shot.

Over the next few months I decided to take bits and pieced from everything I’d learned over the last 2 or 3 years to make a trading plan I could easily understand and trust in.

Fibonacci Retracement - Used in Harmonics as well as most other systems studied.

Support and Resistance - The most basic part of technical analysis.

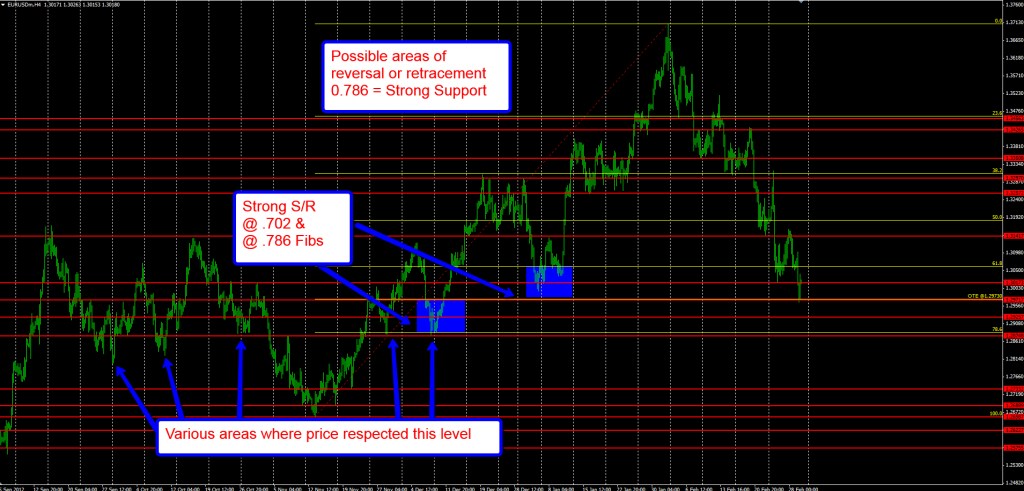

Potential Reversal Zone - My version of the PRZ is a combination of Support/Resistance, Supply/Demand, Optimal Trade Entry, and Harmonics. First I look for a potential OTE which happens to fall in what is known as Harmonic fib levels. Then I find all S/R levels within 618-786. All of these S/R levels where then connected into zones (idea taken from S/D zones) to form one or more hopefully highly probable reversal zones reducing risk to an acceptable 20 or so pips.

Now we have a PRZ within the 4H OTE which is in the direction of the current trend. The PRZ for me was important because I never could figure out which fib to enter at 618, 701, or 786. This is about as highly probably as it gets for this system anyways.

Please don’t ask a bunch of questions about my trading strategy I don’t intend to be a teacher. The above description is about as detailed as it gets.

As the first post says I only intend for this thread to be a journal not some sort of teaching seminar. If this post helps you in anyway great glad help if not well that’s ok to.

Wishing you all the best

Johnny2pips