I first started Forex Trading a number of years ago, had an live account with a broker. With no plan, strategy somehow managed to increase my capital by 100%. As excited as I was at doubling the size of my capital, reality soon kicked in and not only did I end up losing the profit I made but, ended up blowing the account altogether. Since then I’ve had dummy account where I would practice for a week or two then put it on hold as day job and family life took over.

In the last three or four months I’ve been more determined than ever to succeed in this and have been researching different strategies, reading and watching clips on the internet. From the research I have carried out over the last three to four months I’ve settled on a strategy where I would look at support and resistance on different time frames. Looking at charts at every opportunity I got I realised that I could see which way the market was moving but, the issue then was at which point do I go into the trade. Before I could make my mind up on where to enter a trade the market had already moved around 20-30 pips in the direction I was expecting it to move whilst I sat there thinking what could have been if I had managed to make my mind up and get into the trade when I first realised it will move up/down.

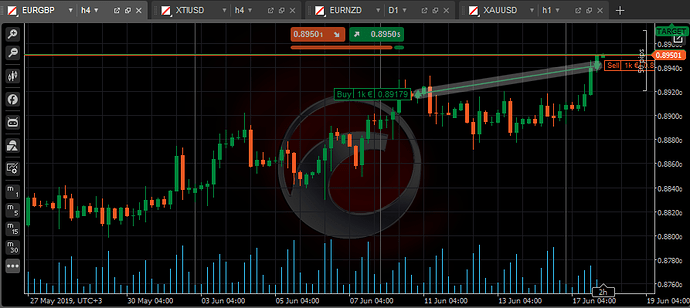

I’m still parcticing on a dummy account and having read the £10k Gamble - [The Journey], placed three trades just ahead of key economic data release last week. Good news is I’m still in those trades but, bad news is due to the data released I am out of the money on all three trades, hoping the market will correct itself and reduce the deficit.I’ll post the outcome of the three trades once they have been closed. In the mean time below are two trades I opened earlier this morning on a dummy account:

These were placed based on the support resistance analysis, lets see how they go.

1 Like

Does that thread share trades taken?

Looking forward to more updates!

2 Likes

I don’t mind sharing the trades. Being a amature, I am hoping for feedback from others and receive feed back from which I can strengthen my trading skills. After all, this is only a dummy account.

I’ve put on the two trades looking at the trends, AUDCHF is showing a downward trend on the weekly, daily, H4 and H1 chart. It has hit a resistance at 0.6880 before bouncing back up to 0.6910:

I entered the trade at 0.6888 but, looking back now I guess I should have waited for price to re-test 0.6910 and entered the trade if price failed to break out of this point. Lets see what happens, there’s economic data due out from Australia on Thursday morning, that definitely will have a say which way price moves.

I’m still in the EURGBP trade where there is an upward trend. However, the momentum on that has slowed significantly due to better than expected economic data being released today from the UK. The daily chart for EURGBP is showing it has it double bottom at 0.85 where it has found resistance at 0.85. The upward trend is heading towards 0.90 which is not far of the 2019 high:

I’m watching this carefully to see how my analysis is coming along. If price follows the trend it should it 0.90 where there might be resistance. If 0.90 is broken we could be looking at 0.93 which was previously achieved in August 2017. However, we need to take into account Brexit

Still waiting for a break through on EURGBP above the 0.8910, it seems to have hit a resistance which it has yet to break through. The Daily and H4 chart are still showing an upward trend be it a little flat at the moment due to lack.

Another potential I’ve encountered is the EURNZD. The pair started the year around the 172.00 mark before hitting a low of 163.00 in April. It then went on another run up hitting 172.00 again yesterday. Although there has been some retracement, if there is further break up above 172.00 then we could be hitting a new high for the year, in the region of 174.00, last time achieved November 2018.

Going to wait out and see if there is another break above 172.00 before entering a trade.

The EURNZD is still struggling to break the 172 resistance, this is still in my radar as trend on the Daily and H4 chart is showing there is an upward momentum which the bulls are pushing for.

The first two trades I opened, AUDCHF and EURGBP, I’m still in one trade whilst the other has closed after hitting my SL.

As this is a demo account I’ve been experimenting with various time frames. I must admit, after all this research, my preference now is the longer time frame of daily and H4 although I still look at H1. The first two trades I’ve done I used very tight SL looking at the H1 chart, this is not something I will be doing when I start trading on live account.

The AUDCHF trade followed the trend down. It is still showing a downward trend on the Daily and H4 chart as well as H1 chart. Given that Daily and H4 chart are still showing a downward trend, aided by the poor news that came out of Australia yesterday morning I could have stayed in the trade having taken some profit. As I used a shorter time frame and tighter SL & TP, my trade has closed. Once the trade moved in my favour I moved my SL to break even then moved it again by 20 pips where it eventually closed after retracement. Not much of a gain but, it was an experiment which I am fairly satisfied with:

I’m still in the EURGBP trade which is still struggling to break the 0.8910 resistance barrier. Watch this space.

1 Like

Yeah 1D and 4H are timeframes I use too. Although ideally it would be 1W and 1D. Just don’t have the patience though.

I’m following a thread where someone uses the monthly trend but trades using weekly SR. This logic seems to make sense and I’m going to likely apply the same startegy as I do not have the time to look at anything on a shorter time frame, especially having to do a day job too. So, patience is a must. Good luck with your trades and do let me know how you are getting on. I will keep posting my trade plans here. Looking to go long on EURNZD.

I think that you are doing really good job. Certainly you are making progress in your learning and it is excellent that you are keeping your trading journal so that you are able to analyse all your deals. Btw, significant trend lines usually will be tested several times

Thanks for your advise regarding testing of the tend lines, figured that one out after several failed trades where price would come back to re-test before moving in the direction of the trend.

I’ve been watching EURNZD, Gold and WTI Crude for about a week now. I mentioned earlier in the thread (6th June 2019) that there is an upward trend on this pair and will need to wait for a break above 172 and then has to find support. The pair broke through the barrier on the 10th June 2019 and has found support. I’m currently long on this pair, aiming to reach target of 174.00 and the red line is my SL:

I’m also long on Gold, which has developed an upward trend Daily, H4 and H1 chart. Price has tested the 1350.00 but did not find any support. After testing the 1350.00 range it has dropped down to 1340.00 where it looks like it has found support. I’m looking for a re-test of 135.00 and have placed an order to enter trade at 1355.00:

Who’s your broker btw? Now curious about trading commodities.

@ponponwei I’m using dummy accounts with three different brokers; CMC Markets, IG Index and IC Markets. They all have their own benefits, I’m still dileberating which one I should open a live account with.

Finally closed the EURGBP with 20 pips profit. Could have stayed in the trade if I wanted to as it is still an upward trend on the daily and H4 chart. Since closing the trade it has moved up further 10 pips:

I’m still in the EURNZD trade, currently above the entry price, keep you posted on this.

Nice work @aalim79… hope you get it all worked out on the demo and go live again… love your charts by the way. Clean and readable.

I’l be sure to pop in here once in a while if you don’t mind

Thanks for sharing your journey @aalim79! I think this topic should be moved to trading journal? Keep posting!

@macilme Thanks for the encouraging comments. I’m getting there, looking to go live by the end of the month. Feel free to drop in anytime leave feed back/comments/suggestion. I’ve been reading your thread as well, got a long way to go to catchup but, will get there soon

@chimmyfx Thanks and I will be posting more.

1 Like

Been taught a lesson today, the analysis work needs more refining. I was in the EURNZD trade last night and did not pay much attention to the support level, only followed the trend and entered a trade whilst randomly picking a SL point. I entered the trade at 1.7272 and this morning price had reached 1.73 moving up with the trend, all was going well and I didn’t have anything to complain about until Mario Draghi decided to speak at a conference. The economy is not performing as well, may require more stimulus from ECB. This is what happened to EURNZD:

The drop to 1.72 I could deal with and I was hoping it would find support there however, that was not the case. Price continued to drop until it reached 1.7140, the SL I plucked out of thin air without doing good anaysis on where it should be set. So what happene next? Price hits my SL, finds support there and is currently steadying itself just above 1.7140.

Lesson of the day for me - ANALYSE. Do not pluck out numbers from thin air!

Hey @aalim79,

Just a heads up to let you know your thread’s now moved to the Trading Journal Section of the forum since that’s basically where it should be as suggested by @chimmyfx.

This way you’re easy to find for anyone else who would love to follow up on your Journey