My dear Trading Diary,

I start writing my entire process of analyzing the positions of certain pairs that caught my ![]() .

.

Since this process is very messed up, a lot of emotions play a role and there will be swearing at times. But I will replace it with emoticons of course.

I know, you’re probably thinking - man, you’re a professional, so haven’t you learned a damn thing all these years? And you think well, but we are all flesh and blood.

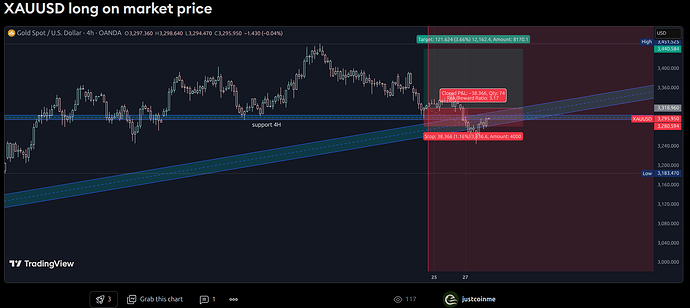

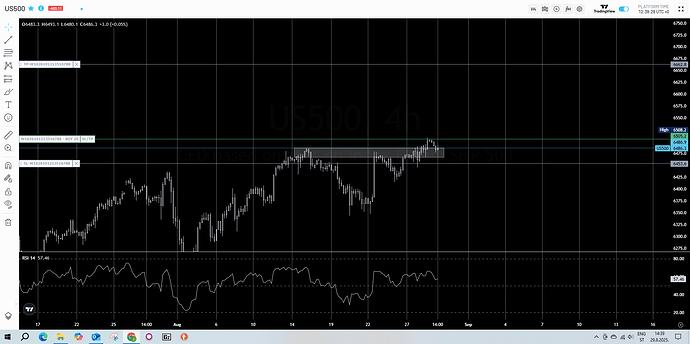

The technique I use is very simple, and it’s the first one I’ve come across. In fact, it is the first one that instinctively appeared before my eyes when I attended the first conference for CFD brokers, back in 2007. It wasn’t until later that I found out it was called “Price action”. Of course, it is my mix, which suits me and shows results, but it can mostly be reduced to price action.

Are you asking me about macroeconomic fundamentals? Of course I follow the main announcements of the central banks! What kind of question is that?!? But since Trump is back in Washington, I don’t know who influences the market anymore ![]()

I took advantage of the return of the Redskin (I’m not mocking, I’m just stating the obvious, and using Native American terminology) to start writing things down.

A state of chaos shows the most opportunities, because in chaos there are much more fractal movements than in a peaceful environment!

Wish me luck!