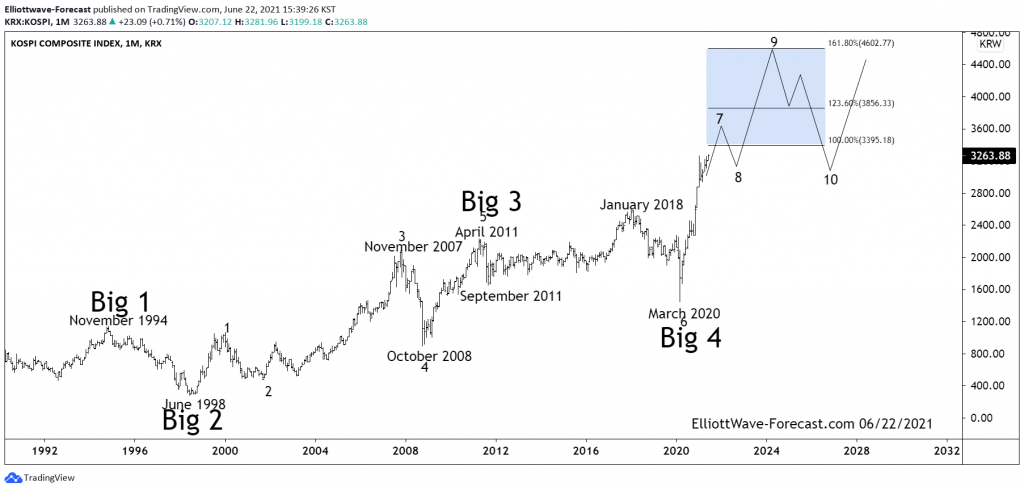

Kospi Longer Term Swing Count & Bullish Sequence

The KOSPI Index in the long term has been trending higher with other world indices since inception in 1983. The index began with a base value set at 100 and trended higher until it ended that cycle in 1994. The index then corrected that cycle with the dip into 1998 lows during the Asian Financial Crisis. From the 1998 lows the index did three bullish swings higher into the November 2007 highs. The pullback from there until October 2008 was strong enough to suggest it was correcting the whole cycle up from the June 1998 lows.

Secondly I would like to mention this is a swing count. It is not an Elliott Wave count. However I have put my thoughts on the chart as to the highs and lows regarding larger degree impulse sequence highs and lows. As per the rules an impulse travels in the direction of the trend in 5-9 or 13 swings. When the bullish trend renewed to the April 2011 highs it reached the .618-.764 Fibonacci extension of the June 1998 to November 2007 cycle. This is a usual area for a 5th swing of a cycle. The 6th swing dip to the March 2020 lows corrected that cycle up from the June 1998 lows. The analysis continues below the chart.

Kospi Monthly Chart

Thirdly, how these extension areas are measured. Take the Fibonacci extension tool on a charting platform. On this chart, point 1 will be at the beginning of the cycle at the 1998 lows. From there on up to the 2011 highs will be point 2. The point 3 will be down at the 2020 lows. The extension areas shown are the same as long as price remains above the 2020 lows.

Lastly in conclusion the bounce from the 1998 lows ended a cycle in April 2011. It actually made another high afterward however the dip to the March 2020 lows was strong enough to suggest the 2018 high was part of a larger correction as the strong pullback to the March 2020 lows corrected the cycle from the 1998 low. In the near term pullbacks should remain well above the 2020 lows and progress higher should continue.