No, this is not an advertisement, lol. I’ve been wanting to test this strategy for some time now, so what better place to document it than here?

My plan is to enter a trade and let it ride, either to the SL or TP. Enter it, then forget it. Hey, it’s got to go somewhere, right? So if my trend lines and S&R’s are accurate and the stars are aligned, then more will hit the TP than not.

Sounds too good to be true, right? Well it probably is because I’m a dreamer. And I know there are a lot of skeptics out there when it comes to chart patterns, but for the most part they work for me.

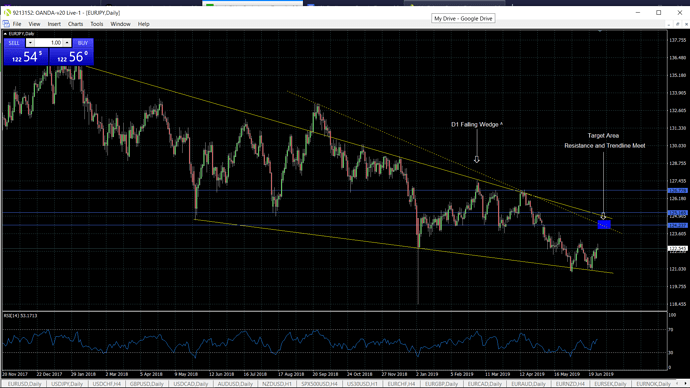

The whole idea is to keep things as simple as possible by only using basic chart patterns combined with RSI (my indicator of choice) to determine an entry point. That’s it, that’s all, no noise. This will take confidence, knowledge of chart patterns, some luck and lots and lots of patience…IF it even works. It will definitely be a test for me in all 3 categories.

My parameters are…

Account Size: $25,000 CAD

Trade Size: 10% NAV

TP: 1% Balance

SL: 1% Balance

I thought about using a 5% trade size (which I actually did with USDJPY) but the SL & TP’s were too far apart and could potentially take weeks to reach either end.

I’m using a Stop Loss instead of a Trailing Stop to give the trade more room to ride those waves. TS’s can limit losses but will also narrow the distance between the SL and TP, making it more likely to stop you out in the red during a dip or spike in price, unless of course you set it after you’re showing a profit. I have a love/hate relationship with stops, which I’m sure most of us can relate to.

I’ll be working off daily charts mostly. Weekly and monthly for overall direction, 4 hour for entry.

I’ve entered 3 trades since yesterday, (I hope these pics show up clear):

Jun 24/19 USDJPY: Long 16,951 units: 106.909. TP: 108.102. SL: 105.722

After over 24 hours this has gone 56 pips in the right direction ($118.08 profit) so far, and is 62 pips away from my TP, 176 pips from my SL. There’s still a good distance to go there. I’ll also add that another popular source has been showing a 96% sell signal ever since I entered it yesterday. Needless to say I was hesitant, but went for it anyways.

Jun 25/19 EURAUD: Short 27,847 units: 1.63285. TP: 1.62303. SL: 1.64243

I entered this one earlier today, so far so good, 23 pips in the right direction ($60.33 profit). 74 from TP, 120 from SL.

Jun 25/19 CADCHF: Long 83,405 units: 0.73984. TP: 0.74204. SL: 0.73764.

Another trade showing an 88% sell signal. I entered this trade shortly after the previous one. So far it’s up 7.1 pips ($73.19 profit). 15 from TP, 28 from SL.

I will update again, but it’s late now and way past my bedtime. Any feedback or constructive criticism is welcome.

Good Night from Canada.