Hey traders Duane here

Starting a new thread here that will focus on achieving 2 Main Results from my System. This system has been used over the last 8 years as you would have seen in my other threads. However, it has been fine tuned and demo tested to achieve 2 Main objectives to show how effective it can be for Long Term Trading Success.

1. A 100% RETURN IN MY LIVE ACCOUNT

Current Live Account Rate of Return (February to June 2018)

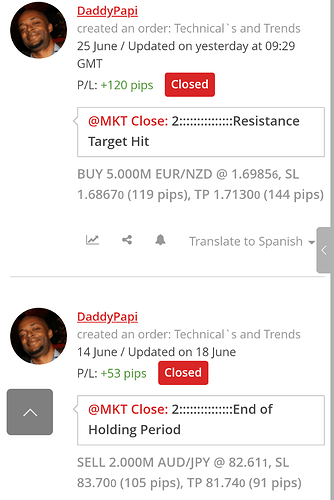

Trades Made Since February 2018

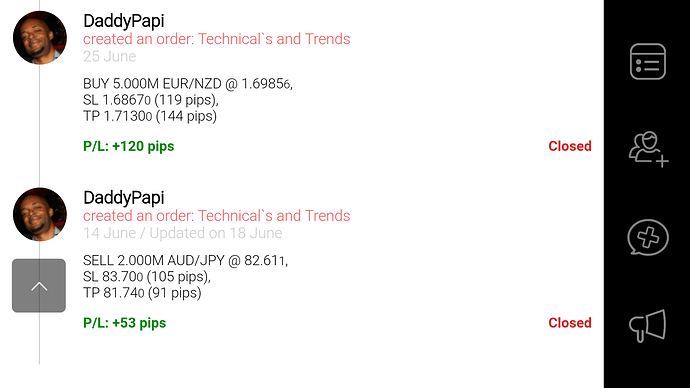

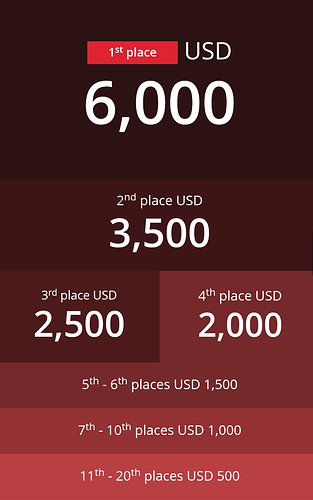

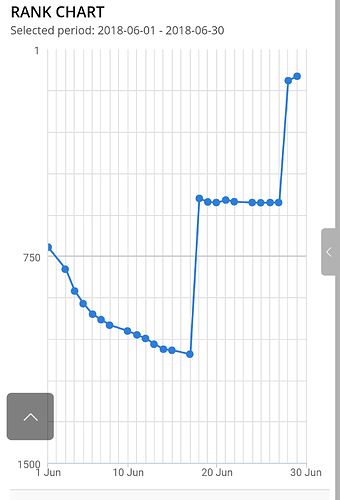

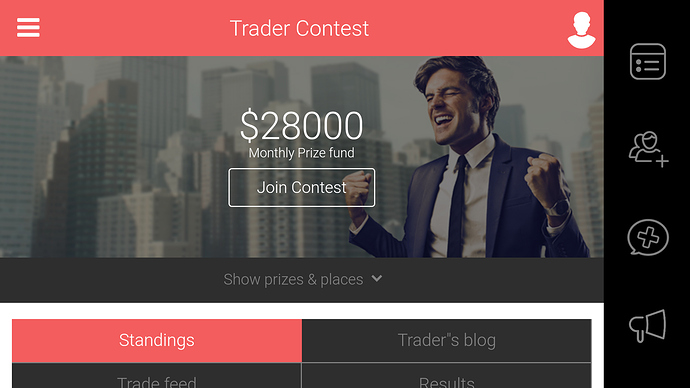

2. TOP 10 FINISHES IN THE DUKASCOPY BANK DEMO CONTEST

Over the years I have collected prize money from their trading and other contests.

However, the goal now is to finish consistently in the Top 10 over 6 Months to coincide with the Live Trading Goal of 100%.

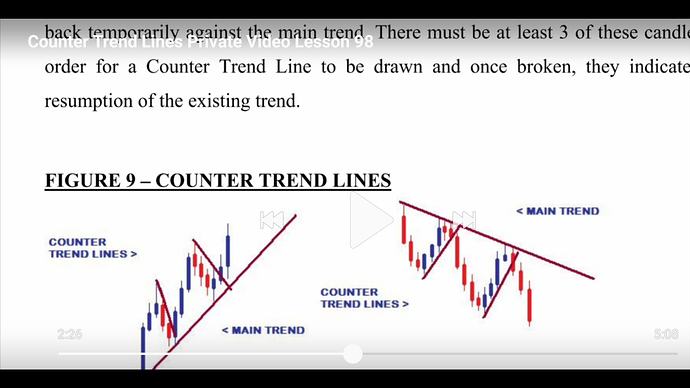

THE METHODOLOGY

Using the Consolidation Patterns, Trend Lines and Candlestick Patterns of the Daily and 4 Hour Charts, the goal is to capture trading gains that have a High Probability of Success. This will be based on my ability to accurately predict the 200 to 500 Pip Weekly Direction of the 27 Currency Pairs I analyze, then targeting gains of either…

1. 100 to 200 Pips over a Few Days.

2. 50 to 70 Pips within 24 Hours.

The Methodolgy requires that the Daily and 4 Hour align with each other based on certain criteria that I have developed (available privately). Once they are in sync, the trades are taken for the appropriate Pip Target.

THE TRADING PLATFORMS

-

For Market Direction and my Entry Signals which are based on the New York Close of the Daily Candle…the FXCM platform is used.

-

Once the Setup and Signals on the FXCM Charts give the green light, my Live Trades are done on with FxPro ( better user interface when executing trades)

MONITORING & STOP LOSSES

To prevent emotional decisions because of temporary movements against my positions, once a trade is made and the Holding Period is specified, the trade will not be looked at until I receive the email alert from FxPro…

As such, it also means that I do not use Trailing Stops. Assuming a target has been accurately set and the Stop Loss far away from entry and at a strong area, it will ve unaffected until the target is hit.

This is why only the 4H and Daily (rarely 1 H chart) are used for Stops - strongest and safest.

WHAT YOU WILL NOT SEE

-

Use of Indicators, Economic Analysis. (Complicated and Unreliable)

-

Use of Smaller Time Frames below 4H ( except on rare ocassions for Stop Loss placement on the 1 Hour)

-

The actual Trade Setup/Signal for an upcoming trade ( Entry, Stop, Limit). I will only be showing you the “after” of my trading decisions since this information is provided privately. Nevertheless, the explanations will be clear enough.

WHAT YOU WILL SEE

-

Video Analysis of Selected Pairs that could provide Trading Opportunities

-

The Technical Theories that support this analysis and Market Forecasts.

-

The Analyisis of Winning and Losing Trades using the Theories that support my decisions.

-

A Calm, Patient and Decisive Approach to Trading.

Trading will not be done everyday. 90% of the market has low probability setups. This is why most of my analysis involves identifying and avoidng traps that lead to losses.

In order to be successful, it is necessary to have a calm, Long- Term Approach with Stable Time Frames that offer few False Signals and to only expose your capital when it is absolutely necessary.

TRADE EXAMPLES

Here a Video that explains recent trade using one of the 2 approaches I now use.

CAD JPY 65 PIPS

Any questions on this trade or on the Methodology are welcomed.

Duane

DRFXTRADING