Like many other traders I first started with binaries, then moved to forex and yet I don’t feel satisfied with the results. Forex was better for sure. I like trend-following systems actually and have enough patience to wait for a decent profit target, and this is why it fits me better.

But I’ve ran into another trouble here. The size of my initial capital. I’ve heard real pros don’t risk their own money, but who’s gonna give you the capital if you don’t have all those licenses and a good enough track record that can be used as a proof. With PAMMs you can’t realy gain a good size of a capital to trading with at once. It takes years to attract enough capital to trdade and make a lliving with profit split. .

LMI is the prop that I find to have the best profit split (80/20, where 80% belong to trader) but I’m afraid that the only thing they care is for traders to pay for practice and make them fail afterwards.

Did anyone here worked with LMI or any other prop firm? Is the method actually working or its a scam of some kind?

Yes, They give you a 10K account, but if you lose 500$ they close your account, so in reality you only get a 500$ account.

I really like the part that you have to pass a practice session and then a qualifying session, and you can restart the session if you pay, 100$ for practice and 120$ for qualifying.

There is probably someone out there stupid enough to pay 600$ or 700$ for a 500$ account.

So in the end even if you pass everything first time. seems like the 10K is 70$ subscription cost, you will get 430$ but then you will have to give them part of the profits.

For me i would save 500$ and open a account, and all profits would be for me.

Check put Apiary Fund *(apiaryfund.com). Scroll through the website and if you are interested, give them a call and ask your questions. If you pass through their training program (no charge for training) you can trade their money. IMO, honesty and sincerity is what makes them different.

It’s true from the math perspective. Yet, trading with prop firms has got a different purpose. People use these practices and qualifying sessions to lower the risk of their daily trading routine with the perspective of getting some real money to trade with. Demo can’t give you this feeling that you risk something.

So basically, for $70 you don’t simply get the chance to get $500, but you get the experience of trading under the pressure of real money loss risk. Futures trading is about relatively big money. $500 can be lost in just one trade. It’s only 50 ticks away from the entry for the majority of the assets. So yeap, you can invest your own $500, but the pressure can be too big in this case. If $70 is more of an affordable loss, you can pay this money for the experience and trade safely for 2 weeks with the hope that if you stay disciplined enough, you will keep trading in the same manner having the real funds on the account.

So yeah, its important to understand that you don’t get 10K for real, but you pay prop to trade safely with limited daily risks and limited max drawdown. And in the end you can trade with their capital in a safe manner. Hopefully later you will be able to withdraw the first profits, open your own account, and keep trading IN THE SAME MANNER. That’s the biggest point about this quest - to train yourself to manage risks and money PROPerly

Firms like these tend to make the best attempt to allure you by giving the claims on high profits through maintaining high leverage. I won’t say that it is not possible, but that hold a lot of risk. It’s like you are keeping a lot on stake in order to focus on quick profits. So I would suggest you to think twice before making the final decision.

Hi @Doubar,

You might want to check the5ers. I’m with them at the moment. Passed the evaluation and trading the PM1 40k account. What I really like about them is their growth plan. Basically, they double your account balance every 10% profit you make. Though, drawdown is only 4% and you’re out so proper risk management is the key.

Thnx everybody for your comments and alternative suggestions. I’ve looked through a HUGE number of a prop firms before asking for your comments, but thanx anyway for suggesting the alternatives.

I’ve read a few discussions about this company and to tell the truth, it does not build up much trust. Expected Weekly ROI of at least $750 from $1,000 Trading Capital is a bit over the top and brings the end to discussion of this company IMHO.

Thanx, that makes sense. I’ve heard futures trading = high leveraged trading, so yeah, that’s risky. And I do understand prop firms are making money on both ends, whether you win or lose. If you CAN trade, they will get their share of profit, if you CAN’t trade well, they will get your participation fee. Not that I like this fact a lot, yet I understand that this is how business works. My only concern is whether the exepectations are really realistic and whether they gonna keep the promise if I prove I CAN trade.

Paying $400 to get a chance to win the account that allows you a $400 max drawdown. Seriously? What’s the point?

@Morluhelm, that’s a good point about psychological training. If you can really get the experience of trading with a serious risks and profits for $70 per month, that can actually make a good deal. I wish the experience was free, but that’s true it wouldn’t have been that effective.

Look at the scaling plan. Not just the initial account. You get to double your account every time you make 10%. If you can make it, then you are in with great money.

Yes, you pay 400. You will 10k account. Goal is 6% or 600 with 4% or 400 drawdown. If you pass this evalution, you get the PM account.

Next 40k account. 4k goal. 1600 drawdown.

And so on. 80k. 160. 320k. 640k. 1.28m. You look at it in the short term, my friend. Not the overall picture.

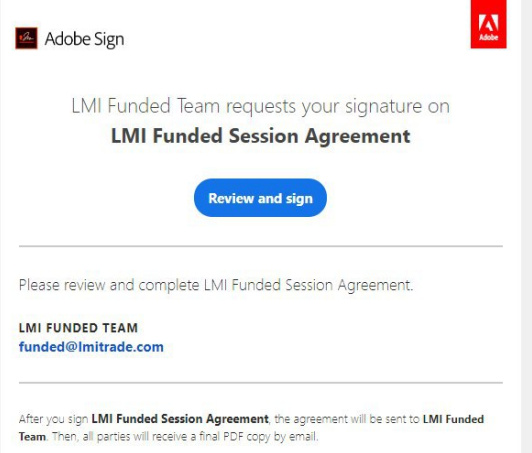

In one of the trading chats I’ve seen the discussion of LMI already. One of the guys got funded and shared the screen of an e-mail wondering if the digital agreement counts.

The other guys said the digital signature is ok. I don’t know though how it all went after the agreement was signed.

Here, I’ve found it in the chat history. I asked the guy by the way how his account is doing at the moment, so will let you know if I get a reply.

Great! I really appreciate, thank you so much! I agree, that beureacratic procedures don’t matter. That’s good though that the third party (Adobe) is involved in a process. That’s a bit more reliable than a mere e-mail with no signatures. I’d prefer a real paperwork, but I guess it can take much more time in this case for mailing all it back and force.