EUR/USD Technical Analysis

~~ EUR/USD is currently in a corrective consolidation.

~~ It has completed the waves A and B and is now due for wave C.

~~ Further, the resistance of 1.19 proves to be a tough nut for the bulls and hence we expect the pair to retreat to the support.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

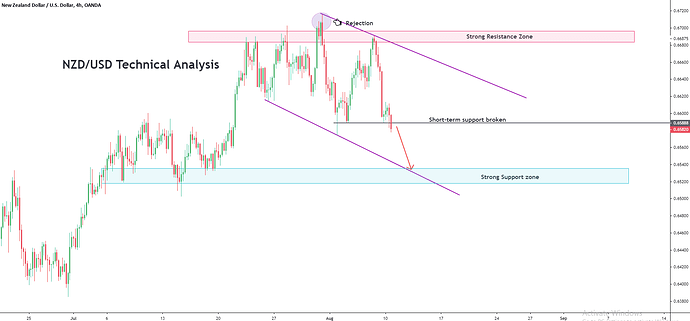

NZD/USD Technical Analysis

~~ The resistance zone of 0.668-0.67 has been a tough nut for NZD/USD.

~~ It failed to cross it despite three valiant efforts and the one time it crossed it was rejected at higher levels.

~~ So, the bulls are running for cover and we expect the pair to head down to lower levels in search of support.

USD/CAD Wave Analysis

- As suggested earlier in our premium analysis, the counter is currently in a bull cycle.

- It has completed wave B and is showing exhaustion at the lower level.

- Hence, we expect the pair to kickstart its wave C from here.

CAD/JPY Technical Analysis

~~ The counter has recovered from the lows with a strong V-shaped rally.

~~ It has now crossed a critical resistance level of 80.162.

~~ The structure resembles a bearish shark pattern and we expect the pair to rally to the completion zone for now.

EUR/USD Technical Analysis

~~ The counter has been rising sharply from the low.

~~ The entire structure looks like a bearish cypher pattern.

~~ We expect the pair to face resistance at the reversal zone marked in the chart and move back to support level.

GBP/USD Technical Analysis

~~ The counter is forming a descending triangle at the high.

~~ It made a fake-out at the resistive trendline and then sold off only to form a bearish flag pattern in the near-term.

~~ We expect the bearish flag to break down and the price to move to the short-term support zone.

AUD/USD Technical Analysis

~~ As we mentioned earlier, AUD/USD has formed a gramophone pattern.

~~It has now formed an inverted head and shoulder pattern the supportive trendline and has broken out.

~~ And the RSI indicator has also replicated the same pattern, which validates the strength in the counter.

~~ Further, the prices are now trading above a strong support level of 0.71727.

~~ Hence, we expect the pair to be bullish from here on.

USD/CAD Technical Analysis

~~ The counter has been trading with a bearish bias for long.

~~ The down move can be plotted with a pitchfork and the pair is making its last leg of the move down.

~~ Hence, we advise traders to go long at the lower parallel.

~~ And the upswing has a great chance to break the upper end of the range.

EUR/USD Technical Analysis

~~ The counter has made a bullish breakout from the consolidation.

~~ It is now taking support and broken resistance, which is a powerful sign.

~~ Further, the consolidation can be interpreted as wave 4 and it is gonna make a move to wave 5.

~~ Hence, we expect the pair to be bullish in the near-term

GBP/NZD Technical Analysis

~~ The counter has formed a topping out formation in the near-term.

~~ It made a double top and has broken a key support level of 1.99508.

~~ Further, the round number of 2.00 can act as psychological barrier in the near-term.

~~ Though a pullback to the top cannot be ruled out, we still expect the pair to be bearish in the near-term.

NZD/JPY Wave Analysis

~~ The counter is currently formed a flat ABC corrective wave.

~~ It broke out from a bear flag pattern, tested the broken support, and is now coming down with strong momentum.

~~ Hence, we expect the pair to be bearish in the near-term.

EUR/JPY Technical Analysis

~~ The counter had multiple supports- trendline, bullish flag support and price action support.

~~ But it has broken all the levels and bulls are trapped big time.

~~ Hence, we expect some long unwinding move in the counter.

NZD/USD Technical Analysis

~~ The counter is currently is descending channel pattern.

~~ It hit the lower parallel and bounced off with a ascending channel pattern.

~~ Hence, we expect the pair to trade with positive bias in the short-term.

USD/CHF Technical Analysis

~~ The counter is currently in sideways consolidation.

~~ It made a false breakout at the lower end of the range and has crept in and now forming a symmetrical triangle pattern.

~~ We expect the triangle to render a bullish breakout and push the price to upper end of the range for now.

EUR/GBP Technical Analysis

~~ The counter is currently consolidating in a wedge pattern.

~~ It hit the lower end of the range, formed an exhaustion candle and rose up sharply.

~~ Now, it is sliding to a demand zone where we expect buying activity to resume in the counter.

EUR/CAD Technical Analysis

- The counter is currently sliding down in a descending channel.

- It hit the upper parallel and is coming down strongly.

- Further, the RSI indicator has formed a head and shoulder pattern.

- Hence, we expect the pair to be bearish in the near-term.

NZD/USD Technical Analysis

~~ As suggested earlier, the counter found support at the supportive trendline and bounced off.

~~ Now, it has broken the resistive trendline as well and consolidating just above it.

~~ We expect the pair resume to bull trend and head to the immediate resistance marked in the chart.

~~ The support zone marked in the chart can cap the declines.

EUR/CHF Technical Analysis

~~ The strength of Swiss Franc bewilders us as it was able to contain the hottest currency like Euro.

~~ Despite EUR/USD & EUR/JPY moving to great heights, it is still in bearish territory and the counter has absorbed intense buying pressure.

~~ Technically, the formation resembles a round top and so a sell-off is on the cards when the Euro corrects against erstwhile currencies.

Thank you very much. This is very nice information for the new traders and also old traders.