Hello, guys.

I am looking for investors for my PAMM account.

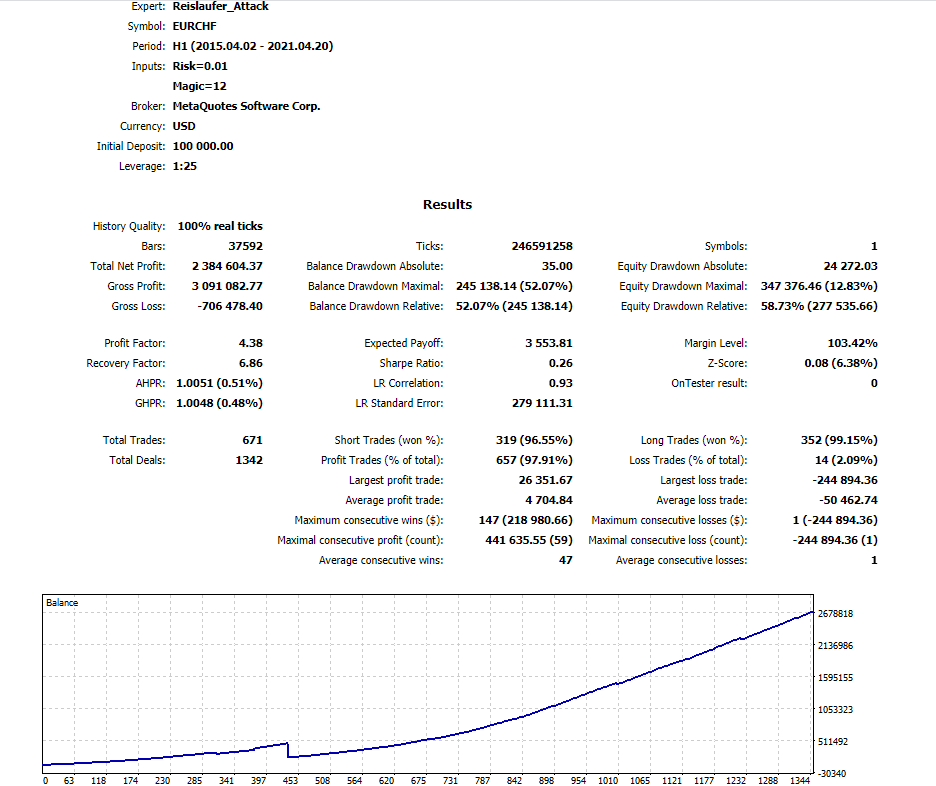

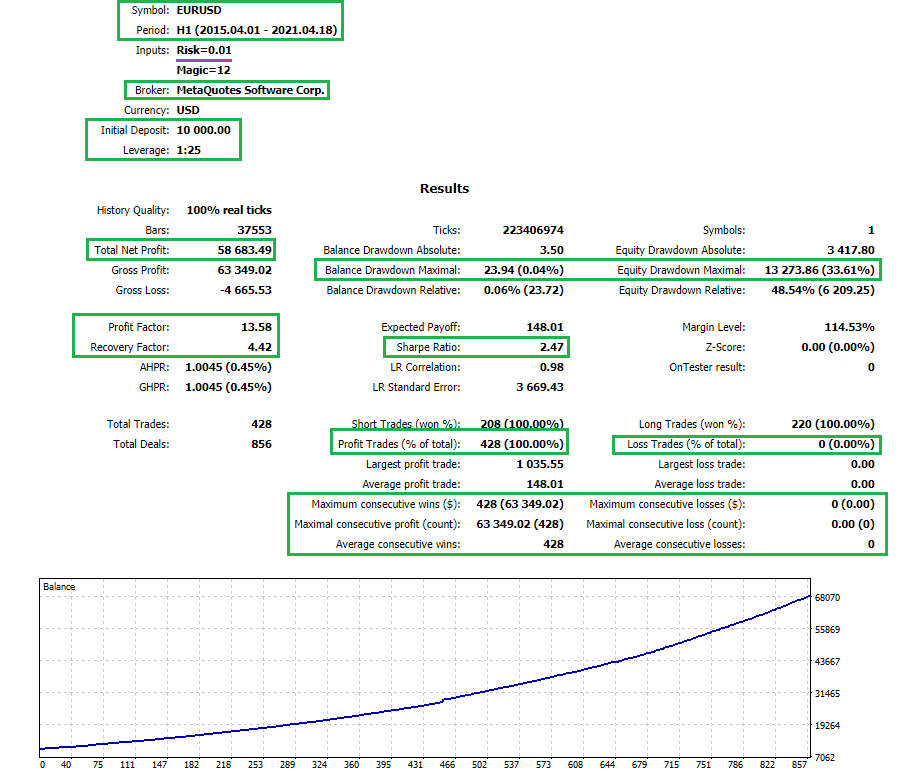

(Test environment: MT5)

It is operating only fully EA without human emotion or desire.

The most priory factor is safety!

EA does not use risky strategies such as martingale, grid as well as HFT scalping, etc.

Again, SAFETY is the most important!

It is suitable for long-term investors. (minimum 6 months)

Obviously, much better than a deposit on your bank.

Strategy:

EA will trade on EUR/CHF only.

Due to low volatility and less volume, it will open trade during the Asian session.

EA is using a Trailing Stop which is more effective.

All opened positions must close in a day.

Risk Management:

Leverage - Up to 1:100 (current 1:25) // Considered under ASIC or FCA regulation.

Auto Lot - 0.01 (ex $1,000 - 0.1lot

$10,000 - 1lot

$100,000 - 10lot )

Trailing Stop - Enable

Goals:

Monthly Profit - 10% ~ 30%

MDD - Below 20% // (current 12.93%) - ACHIEVED

Profit Factor - Over 1.2 // (current 1.72) - ACHIEVED

Recovery Factor - Over 1.2 // (current 3.70) - ACHIEVED

Sharp Ratio - Over 0.5 // (current 0.21) - This is because of Swap fees, as I mentioned above, EA will open trade during the Asian session which means it may charge Swap fees, which is an effect on the Sharp Ratio. However, I am trying to figure out to get more advanced performance.

If you are interested in my PAMM project, Join here:

Best regards,

you can join my PAMM account with minimum 100€

you can join my PAMM account with minimum 100€