Hey Tommor.

Yep. Was very interesting how the week turned out.

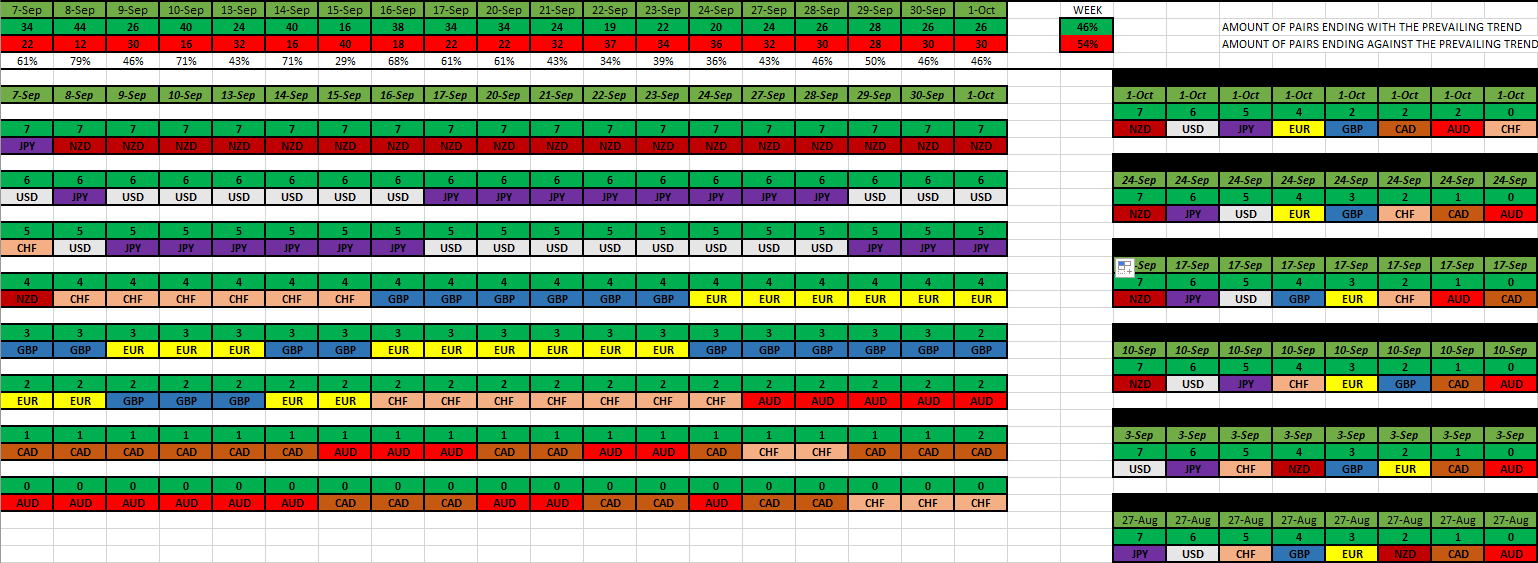

This is what the details look like.

As always, my numbers are very close to yours. Got 47% for the week.

Just in case anyone hasn’t figured out how I grouped that data. 3 different contexts going on there. The first is the top row going across. I started this back to Oct 1st. In the green (top row) is how many pairs that day ended up being normal. In red, abnormal. So that’s a quick look at the individual day, whether it went with the trend or not. Then I just put the % under it. It is showing how normal the day went.

But yeah Tommor, you’re absolutely right about the beginning of the week and the end. Just look there. Tuesday and Wednesday were big trending days, going with the trend. 64% & 68%. I bet everybody who was trading with the trend those days was happy.

I would be included in that camp.

But then those last 2 days of the week went in the complete opposite direction. Look at Thursday. 42 of the 56 pairs were moving against their respective trend direction (that’s in whichever way the 20 & 50 EMA lines fall). And then pretty much continued that way through Friday also.

So then, the next context I have there is right below that. It’s the break down of every currency. Since every currency has 7 pairs to them, this table shows how many of their 7 pairs are trending strong. And I’ve just ranked them from the strongest down to the weakest. But, we can see that the CAD has all 7 of their pairs strong CAD. Each of their 20 EMA lines are above the 50 EMA lines. And therefore they are on top. But then the AUD has all 6 pairs AUD strong. And guess which one is not? The AUD/CAD of course. And the same goes for those below. The NZD has 5 of their pairs NZD strong. And the 2 that are not are the NZD/CAD, AUD/NZD.

All of this shows what’s normal.

But this is the whole idea behind it all. If one of the CAD pairs moves weak CAD, well then, that’s not normal. Same with the JPY. If one Yen pair moves JPY strong, then that’s not normal. And that’s probably what happened Thurs & Fri. Many of those went that way, to cause an abnormal day.

Being able to see these previous days results like this, gives us a birds eye view of how the market is moving. Have you noticed that all the Comms are on top now? That means the risk-on sentiment has been prevailing.

Then on the right is the weekly break down. That lets us see how things have changed over a longer time period. Quite quickly.

See how the USD has come down? That usually means the Comms will rise.

And they did.

The GBP has come on up also. They are known more for a risk on type currency, more so than risk off.

I’ve just seen your post now, Tommor.

I’ll do the same.

Next week.

You’re calling for more counter-trending moves. Which means the Majors will, for the most part, dominate. Which means more risk-off sentiment. Right?

Man…I don’t know. I really could go either way.

On the one hand, I do agree with you. The fundamentals behind a risk-off environment do make sense. There’s so much not right going on in the world today. So many unknowns. Uncertainty. The market does not like that, at all.

But on the other hand, what is the trend? We cannot argue that the risk-on currency’s (Comms) have the upper hand. Right? It’s all right there in black and white. Therefore, that makes me think the market wants to go that way. I mean, regardless of what makes sense or not, rational or not, that’s the way in which it’s moving. And I say it could just keep going that way. They’ve only got up there very recently. How do we know this is not the beginning? Of course it could be a quick, short lived trend that comes and goes. No doubt.

Man…I just don’t know.

I can see both scenarios playing out.

Either a continuation of the risk on sentiment.

Or a move back to some risk off sentiment.

All I know is that I’m staying on the sidelines for now. I made a lot of money last week. Up through Wed. Then jumped. But staying out now. Cause I got to see how things go. Who knows? Why can’t this risk on keep it up to the end of the year?

I think it’s possible.

Nowadays, anything the market does could be possible.

Mike