Hmmm, I wonder if next week will turn out to be another week of two halves - half the week trend-following, half the week counter-trending?

Well the week ended pretty positive after all, with a score of 56%. That’s the highest score in 8 weeks. Risk-on sentiment appears in control - the Dow is advancing, the commodity currencies are strong, so we should probably see another positive week next week - in fact I would say another 2 weeks at least before a technical correction.

Hey Tommor.

Positive it is.

Yeah, no doubt the Comms are in control.

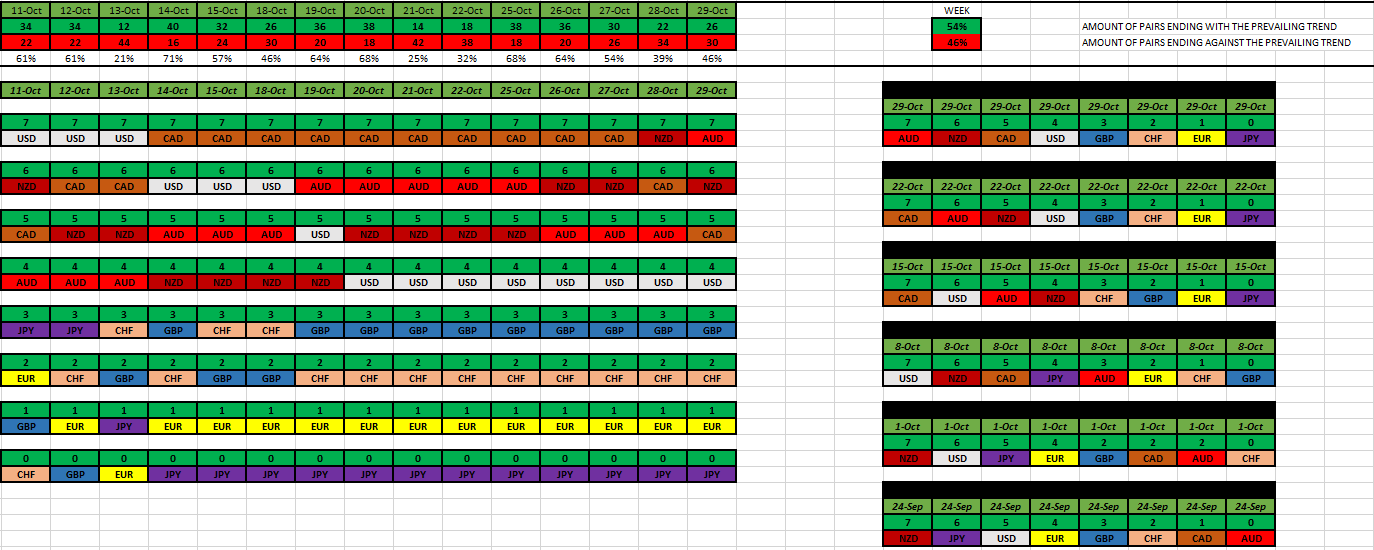

We just had the last week of the month go by and we didn’t have a whole lot of counter trending days. You can see up there, at the top, that Thursday and Friday were the backward days. I mean, that’s only to be expected. But it wasn’t enough to make the week end counter trending. Monday through Wednesday chalked up some good normal, trending days.

And it is evident how the Commodity Currencies have dominated. All they did was change up leaders, this week. And I thought that was interesting, also. The CAD had their interest rate decision day (Wed). Sure, they didn’t hike the rates, but I heard that it was a very positive, bullish talking meeting. I guess they raked up all their strong currency strength in the last few weeks. Probably taking a breather now (profits taken).

Well, that’s another month in the books. Look how it went. See the table on the right, the weekly standings? Look back at when the month started. Oct 1st. Sure, the NZD made top dog by this time, but the JPY was riding high along with their partner, the USD. Then as the month went along the Yen dropped so hard and fast. The CHF was already down there to begin with. Interesting. But the USD put up a fight for a little while, but then lost the war. Falling away now.

I think this month was characterized by the Comms coming together and being bought up. Both the CAD and the AUD got much stronger. I mean, even the GBP made a real turn around, cause they hit rock bottom then bounced up quite nicely. They are a risk on type currency. So it all matches for that risk on sentiment move this month.

Well, that’s what’s normal.

We made the switch this month from safe haven strong to commodity strong now.

That’s one month down, two to go (for this last quarter of the year).

If you ask me, I say following the trend just might be the better bet. I mean, unless I start seeing some big moves the other way it’s looking like a continuation this way.

Sure, the fundamentals…reasons…world affairs don’t match up nicely, but, we are in a different world now, I think. Maybe that’s why Mr. Oil is flying high. Oh, and Bitcoin also. I mean, you got to see where the money is going, right? There are 2 reasons, right there, saying there is risk on sentiment around. And I think the bond markets are signaling the same thing. It’s the shorter rates that are rising higher.

I’m just saying, there are factors around that make this risk on sentiment do make some sense. That’s all.

I see it like this. The market really wants this risk on sentiment. And here it is. But I think everyone is waiting for the other shoe to drop. Something really bad (and there are plenty of things out there that can be that bad catalyst). It just hasn’t happened yet. Until then, let the good times roll.

Mike

A strange week. The Dow progressed really well but the commodity currencies fell across the board (except perhaps against the GBP). A score of 44% for the week is pretty low - when the weekly score is that low, the next is usually positive.

Hey Tommor.

Yeah man, I agree about a strange week, alright.

Let’s see if I can shine some light on the subject by looking inside.

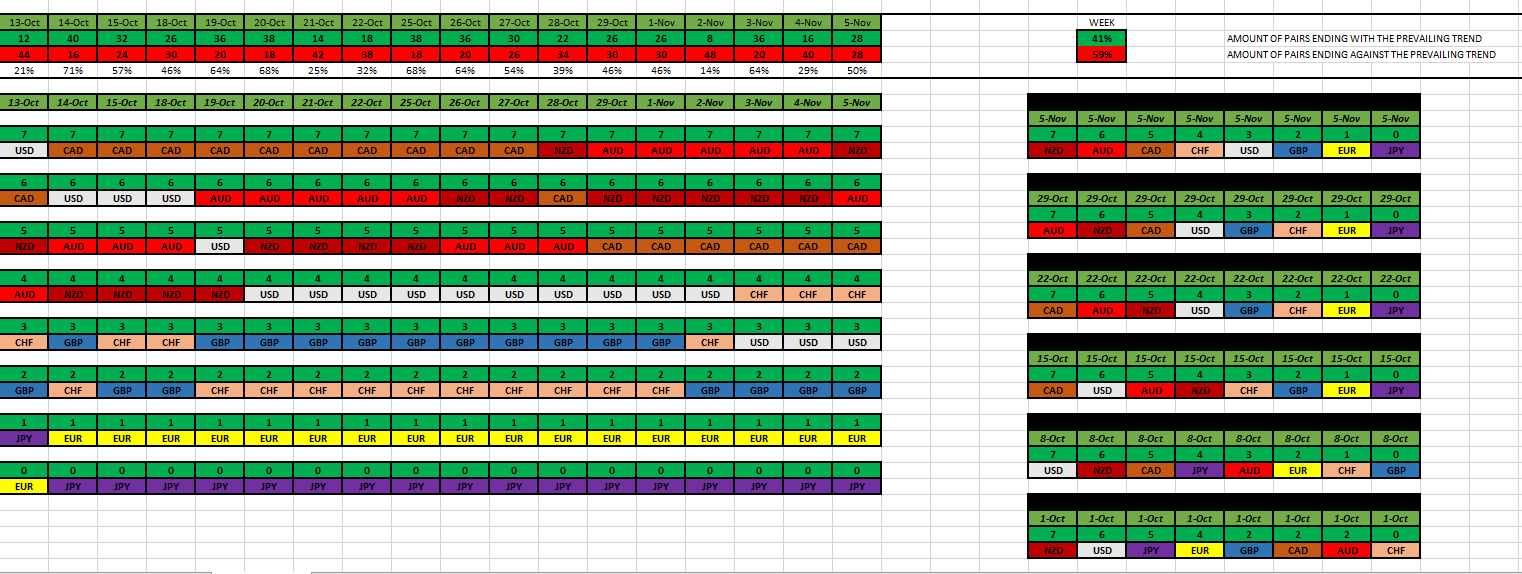

Well, I got a normality score of 41%. We agree that’s pretty low.

So, what happened then?

The week started out (Mon) with an EOD result of 46% normal. Meaning, 26 of the possible 56 pairs ended the day in normal territory (28 would be exactly half of them). So the week started out leaning slightly abnormal.

But then Tuesday’s EOD result came in way below normal. Only 8 pairs traveled in their respective trend direction. That’s kind of unbelievable to me. I just scrolled back in my data. The last time this low of a normal EOD was Aug 23 & 24th. Both of those days had only 8 pairs of the 56 total normal. And as I look back again, I see the record (for this year) being a 4, and even a 2. Let’s just say that this 8 is very, very abnormal. About every pair just went in the opposite way. That’ll be regarding their 20 & 50 EMA’s positioning.

So, Mon leaned negative, then Tuesday bottomed out. This all means that it was a safe haven money flow. The trend has been risk on. So this abnormal trending move went with the major safe havens, more so.

Wednesday came in bouncing back. It was a positive, normal trending flow (risk-on) day. 36 of the 56 pairs went normal. Remember, that day the US central bank (Fed) had their policy meeting time. Things seemed to be moving because of what happened there.

Then Thursday I think the Bank of England had their turn. Right? Somehow I don’t think it went well for them. I think I remember the GBP lose a ton of value that day.

Anyway, that day ended up going against the normal. Again, that means more safe haven play and no risk on move. Look there at the top row, only 16 pairs out of the 56 went normal.

You know, it just hit me. I guess I should note this.

I am aware that there are only 28 separate assets here. That’s 28 pairs that you can trade. Only. But the reason why my figures make it come out as 56 is because I’m adding up each currency as having their own 7 pairs. Cause when I dive into the specific currency’s, I want to see how many of them are trending or not trending, all by themselves. Therefore, adding them all up comes out to be 56.

Maybe this will clear some of that up.

Well, I lined them up from strongest to weakest. Top left to across. Then bottom left to across. And then what Friday’s results ended up. The NZD ended the week with 7 pairs trending strong. They were at 6 pairs strong the first 4 days of the week. But then the AUD had all 7 of their pairs trending strong those first 4 days. So they changed on Fri (specifically, AUD/NZD turned NZD strong).

Other notable things.

Just look at the CHF, this week. Boy have they gotten strong. Look there. Started the week out having only 2 of their 7 pairs trending strong (Mon). Tuesday chalked up another pair Swiss trending high. Wed chalked up another one, making them have a total of 4 CHF pairs trending high.

The USD got weaker. Kind of doesn’t make sense to me, but the numbers don’t lie. It ended up being the USD/CHF pair that switched from USD strong to CHF strong, as the week rolled out.

Now let’s look at the bottom 2 rows. This is what I think is interesting. Look at the JPY. First off, what’s their trend? Look above. 0. That means none of their pairs are trending high. So that’s what’s normal, regarding them. But Mon comes and the EOD result was 6 of their pairs trended with their trend (which is Yen weak). That should tell you that that day went selling the JPY. Then look at Tues. Every single JPY pair went against their trend, normal. Which is JPY strong. Interesting. But it wasn’t enough to turn the tide (their 20/50 EMA lines). Then look at Wed. It went back to every one of their Yen pairs going with their trend, which is a weak JPY. Now we know that was a risk on type day. That was the only day for risk on for the week. Then Thurs went the other way, again. Every single JPY pair ended the day Yen strong. Then Fri went in the same way. Yen strong.

Look. My only point is how polar the week went. And we know that it leaned much more to the safe haven side. This JPY in the last 2 days in a row, and then the CHF also, strength. But they kind of left out the USD. For the most part anyway (hence the USD/CHF pair flip).

And the point of my 56 number, previously stated, comes about because all I’m doing is adding up each positive day (green) and each negative day (red). There’s 28 possible pairs for a positive day, and 28 possible pairs for a negative day.

Let me put this up again.

Big picture view (right table) weekly standings. We still have the Comm currency’s all in the top 3 spots. The CHF moved up quite a bit this week. With the USD dropping a bit below them.

Even though the JPY had a good week, it wasn’t enough to cause their longer trend to change. What’s normal for a JPY pair is still, every single one, a weak Yen. See? Anyone can have a good week every now and then. But what turns the trend is to have multiple good weeks.

I think it will be interesting to see what the CHF wants to do. Cause if they will continue to move up the ladder, then that’ll tell me that some safe haven flows want to come back. I mean, you got to see that they are the favorite. For as weak as the Yen has been this year, that only makes sense that they are not the favorite. And as for the USD, well, they can’t make a complete consensus of it. There is some selling of the USD going on, still.

Let’s see. Moving forward. I said this last weekend (I’m not ashamed of whatever I said).

Well, now I believe, we have encountered some risk off moves. Not enough to cause a change in what’s normal, though. But we have to see if this is gonna continue.

I still say the risk on currency’s are more in control (just like everyone’s equity markets have been).

So, I’m thinking a move back to risk on is possible.

I mean, who knows? All we can do is follow, right?

Whenever I start seeing a Comm come back down off of the top 3 spots, then I’ll start thinking that way. Until then, I still say, let the good times roll.

?

We’ll see.

Mike

Good analysis Mike.

Indeed, Tuesday was a really negative day. I scored Tuesday at only 18%, so it was the least trending day since 24/08, and one of the 6 lowest scoring days in the last 131 days. And so of course we ended with a counter-trend week overall.

What the heck’s next? I can only suspect the most consistently bullish currencies rise and the most consistently bearish currencies fall. As ever? Meaning the yen is going down some more but I haven’t a clue what’s going up. Buying every JPY pair might be a scatter-gun strategy but, hey, if it works…

Hey Tommor.

Looks like normality went negative this past week. I got 46%.

Here’s a look inside the numbers.

What’s considered normal again?

Looking at the table on the right shows how many of their 7 respective pairs are trending strong. That is, the 20 EMA price line above it’s 50 EMA price line.

Interesting thing to note about this past week, is that we haven’t had many changes. You can see the line up only has one change. The AUD and the CAD changed places. Which means that on the AUD/CAD pair the 20 & 50 EMA lines crossed. Making the aggregate amount of CAD pairs one more higher (6), and the AUD pairs one more lower (5).

So therefore, what’s considered normal hasn’t really changed, in this context.

The week went more contrary to this. Which means the Comms were more of a sell, and the majors were more of a buy.

But it wasn’t enough to turn the aggregate results, cause these placements haven’t changed much.

That’s not to say things might be changing though. This week went more safe haven buying than anything. Let me prove this.

Top table is daily results. Bottom table is the weekly cumulative line up.

Disregard the CNY.

Couple things I want to point out.

The USD was the most bought currency this week (+5.62%).

And for the most part, all other currencies were mostly a sell, with only one exception (GBP +1%). Very interesting.

And then look at the top table. Tuesday through Thursday was nothing but safe haven buying. Look at the CHF, JPY, USD. And on the other side of that is the Comms, which were dragging bottom. All that spells risk off sentiment, for the 3 inside days.

But again, added all up shows you that most of the currency’s got sold off this week. It was a USD dominated week. Plain and simple.

Now, look back up top. See how the CHF and the USD are sitting 4th & 5th place? Their strength showed this past week. But. All this makes for a very mixed market. Especially having the JPY sitting last. They are, lest we forget, a safe haven currency. And if they ever decide to come off last, then it’ll be over. Surely they’ll boost the other 2 higher. And then eventually make the Comms come off the top.

Be we have to see it.

As of right now, I don’t see it.

All we (I) want to do is know what is normal.

See whether the market changes from this.

Hope the market will continue a trend, one way or the other.

Mike

Hi guys.

Let’s talk normality.

Looks like we have another negative week. 46%. Same as last week.

Here’s what’s inside.

Well, I finally changed some of this so that we can understand it better. Finally.

I’m talking about that top row. It’s the daily results, with the entire week’s results over to the right. Now we are gonna to see how many pairs (out of the 28 total) went positive for the day, and how many went negative for the day. Then the %'s underneath. You can’t get any simpler than this.

Let’s look at it. Anything interesting, about this past week?

- Monday — A majority of all of the pairs ended with their normal trend (17 pairs). That’s 61% of the entire market went trending. This was a continuation of how Friday went. And remember, last week (as a whole) went net negative trending.

- Tuesday — Turn-around Tuesday came in exactly the opposite. Only 10 of the 28 pairs went normal. 36%. Back to the non normal environment we’ve seem to be in lately.

- Wednesday — Continued along the same sentiment. Non normal. 2 days in a row now. 29%.

- Thursday — Finally went back to some normal. Same as Monday. Same amount also.

- Friday — Went back to non normal. Counter trending.

-3 days went counter trending

-2 days went trending

So then, to compare their prevailing trends to last weekend at this time, did we have much changes?

Take a look at the right.

The only thing that changed was the USD and the CHF pairs switched. Meaning, the USD/CHF pair went to a stronger USD. Crossed 20 & 50 EMA lines. So now the USD has 4 of their pairs trending Dollar strong and the CHF, lost one, to having 3 now.

Well, the bigger picture shows that the Comm currency’s are still having more of their pairs trending stronger than all the other Major currency’s.

Don’t get me wrong. We’ve been having a strong USD lately. But not enough to start changing the longer term trends. Cause remember, the Dollar was top dog on Oct 8th (can’t see it there cause I didn’t go back far enough. Which you can if you look at my last weeks post). But it’s been dropping since then. Now maybe starting to climb back on up.

Here’s a quick summary of how this week went. % wise. Comparatively.

Top table is the daily individual results. Bottom is cumulative weekly running %'s.

The GBP came in the most bought currency +8.25% for the week.

The USD was next at +5.21% for the week.

Interesting to see that the JPY took 2 complete days. Wed, Fri.

And the most sold off currencies goes to the EUR and the AUD (-7.07%, -7.90%).

Well, regarding normality, all I can say is…good luck.

It’s very tough out there.

Cause on one hand you have the normal prevailing trend still intact. Speaking to the fact that they (the Comms) can still possibly produce some strength, moving forward.

But on the other hand, what seems to be trending is the non normal sentiment. To be more specific, it’s the USD that’s getting more stronger. Cause remember that they were on the down slope for a while there (end of Oct into beginning of Nov) . And have not continued this move.

It’s a tough market. What can I say.

If I would give some advise, it would probably be to say that you got to look for some specific opportunities. For instance, keep an eye on the JPY. They’ve been so low all year long. Will they want to add onto their gains of recent? 5 most bought days this month already. That is saying a lot.

Well, I think that’s the biggest anomaly going so far.

My two cents worth.

Mike

Hi Mike -

My apologies for absence, been involved in another (non-trading) project that took a lot of persistence.

Your analysis of the last week is spot on. I actually scored the week at 50%, exactly neutral trending, but the break-down of the individual days and the currencies’ behaviours tally with what you have said.

These sure are interesting times. I don’t think we’re out of them yet. I think these are good times for moving nimbly - adjusting stops to protect profit and taking the profits early.

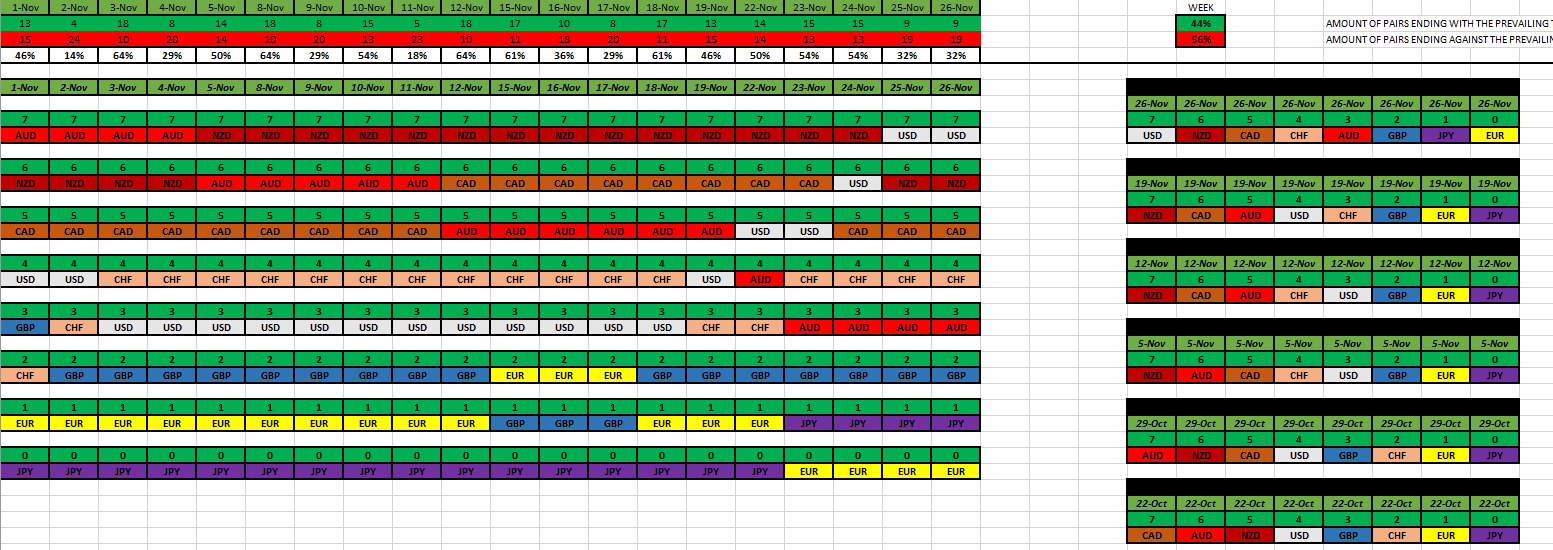

A 52% score for the week, and only 2 of the 5 days were negative.

But don’t let this fool you…

I don’t mind admitting I’m flat right now and am planning to take several hard looks at charts this weekend to see whether I even want to bother with the risk of any new orders. At first glance I kind of doubt it.

Hey Tommor.

Wow. Well, I think this is the first time we diverged from the numbers.

I got a score of 44%.

Look.

We agree about the 2 days only being negative. You can see it there, top row, last 2 days. Both days came in having only 9 of the 28 pairs ending normal for the day. Which means that 19 went the other way.

Anyway. What a week.

What we have as normal has changed now. Take a look at which currency has all of their 7 pairs trending their way. 20 over their 50 EMA.

The USD.

All we have to do is look back at our previous posts. It’s been something coming all along.

This is what I said last week.

Then this is what I said the week before that (2 weeks ago).

And then, this is what I said the week just before that one (3 weeks ago).

All that is just to point out that we are watching a slow moving, longer time frame perspective. The good thing of it is, we are not being whipped sawed back and forth too much at all. In fact, none of that. But it is a slow, long process, in which the trends are taking.

I got to say though Tommor.

If you don’t mind, I think change is definitely coming, if not here already.

Check this out.

The month of Nov.

The top table is the month running (daily cumulative). And forget the CNY. We’ll keep with our 8 currencies. I’ll tell ya what I see.

- The USD & JPY most bought currency’s this month. +17.80%, +17.69%. And this all started soon after NFP Friday (5th). Domination ever since.

- The Comm currency’s slipping majorly. Just look at the %'s, and compare them all.

- Classic risk off scenario. It can’t get any more clearer. Look at the latest line up. Top 3 are the safe havens. Bottom 3 are the risk on Comms.

- This past Friday was a HUGE moving day.

The JPY moved like they never moved before (this year). March 23rd was their nearest biggest day. +9.01%. How’s 14.46% feel now?

This was last weekend.

I have to say it Tommor. This is a game changer. Whatever happened on Friday is setting the stage for some things to come, I believe. See. First off, the day before we were on holiday (Thanksgiving). Our markets were closed, and the volume was very, very low. But you just wouldn’t believe the volume amount that came in on Fri.

It was the 3rd highest volume day this year (last day of Feb, and Mar 5th higher).

We are getting real close to months end. That is noteworthy, and could explain it.

Another very interesting point to be asked, is about why the USD was not bid up on Friday?

Have you all seen what the stock markets did on Friday?

Bad all the way around.

Since when do they fall in line with what the other markets are doing? Not lately anyway. Plus, I think all the bond yields crashed also. We’re talking across the board risk off sentiment.

Well, we got 2 more days to go in this month. It is going to get crazy, I think.

I mean, we’re heading into the years end. And I think the safe havens will have the upper hand.

I definitely was wrong a few weeks back. Thought the Comms could take this last quarter. No doubt they tried. Surely. At the start of it. But not now. After what happened last Friday, forget it.

And who wants to talk about what’s going on in the world today? If there ain’t a catalyst upon us now, there never will be.

We’ll just have to see what straw it will be that breaks the camels back.

Sorry.

That’s a little how I’m thinking.

But you have to see the facts though.

Oh…I got one more thing I think was important to share.

Here’s a look at the last 30 days. It’s a perspective. Between the safe haven currency’s and the Comm currency’s. Check this out.

USD = WHITE. CHF = PINK. JPY = PURPLE.

- The CHF began the strength. Surely by the end of Oct they were very positive.

- It took the USD and the JPY a little while to get some traction (were in negative territory). Got back up to break even by NFP Friday (5th).

- The USD took off next. The week following NFP.

- The JPY went back to doing what they do best.

- The CHF came back down also.

- The USD dominated higher.

- On Friday the CHF & JPY both join up to the USD. But what a move by the JPY!

How about the other side of things.

The Comms.

AUD = RED. NZD = DARK RED. CAD = BROWN.

- If I would have gone back to the beginning of Oct you would have seen the AUD & NZD much elevated. Needless to say, their both positive through Oct.

- Nov changes the story. Heading into NFP the NZD retraced a little and ready to move higher. But in the week of the 8th the market says no way.

- And what a drop off, in the most recent. Huh?

I think we are seeing a change in trend, right before our very own eyes.

These are parts of the whole. The sentiment is lining up.

So much agreement going on. Even the equity markets! (For a change).

But we’ll see how long that lasts.

My two cents.

Mike

Absolutely Mike, the game has changed. In fact its like we’ve swapped ends, changed the shape of the ball and moved the goals all at once.

I’m probably going to wait for the dust to settle after Friday’s stampede and then get back in the game mid-week. I can stand a few days calm.

Yes, I agree.

IMO, AUDUSD is a bellwether pair. Around the 1st of this months the relative strength chart of each currency reversed direction and a week later continued to move away from each other very strongly.

To me that was a definite indicator of an overall trend change, away from Comms.

Based on the above, I opened two shorts on my demo: AUDJPY on 9/11 and AUDUSD on 11/11.

I know Tommor likes to see an established trend first but I think it is important to catch the trend as early as possible - in its strongest phase.

This is early in my analysis but it is showing some good results.

[Removed for Forums policy violation] changes in the log values of forex rates, price indices, and stock prices are assumed to be normally distributed!

I’ve got no evidence to argue with that, but its hard to see how it could be dependable enough to help trading across a few days or weeks per trade.

I find after an extraordinary move like those we saw on Friday that the chances are about 50:50 of either an early strong continuation of the move, followed by a hefty retracement, or a hefty retracement followed by late strong continuation of the move.

For me there is no greater probability of one over the other so I’m sitting out.

Hi Tommor and Mike

I would like to pose a question:

We know that the market can be in a risk-on or risk-off phase. During risk-on, for example, USD, JPY and CHF are strong and Comms are weak.

Are there any other identifiable distinct phases? For example, when EUR and GBP are strong which currencies do we expect to be weak - USD?

The reason I am asking this is to try to define some natural rhythms of the market to see if we can identify trends and ride the wave. And when the market is ranging or is not in one of the identifiable rhythmic states, we will stay out.

Really appreciate the work you put into your posts!

What are the natural rhythms of the market is exactly what we’re trying to pick out. Conclusions are tentative, partly because this sort of general analysis needs a lot of data, partly because the market itself reacts to itself. So even I myself and not 100% certain we’ll unlock a key secret. But at the least we can identify when extra caution might be needed.

Looking at this thread in combination with Dennis’s on the individual currencies’ strengths and weaknesses would be good - see Trading the Trend with Strong Weak Analysis

A trend-positive week, at 63%. Highest score since September, which is ironic considering the market tumult we’ve dived into more recently. And its a high score even amongst the positive weekly scores, most of them are well below this level.

The immediate result is some nice profits from trend-following positions I had trickled money into since Black Friday. The secondary result is I won’t enter any new entry orders this weekend, prefer to wait for trend retracements for opportunity.

For the wider market, where are we going? I think we continue, but less steeply. Commodities will fall, but not as fast, and I note oil is recovering: safe havens will be accumulated, but not as greedily. When trends are not so steep, frequent retracements offer good entries.