Hello traders I hope you all have a wonderful week of trading. Like usual, I’ll be sharing my personal sentiment outlook on the financial markets and what to expect in the upcoming trading week. A word of advice: this will be my own opinion, and please do your own due diligence.

SPX

Starting with the global stock market index, the S&P 500 (SPX). Currently, the stock market seems to be evolving into a trading range after the previous bull run. The SPX is still contained between the 4200 and the 4070 key pivot points, respectively. So we are seeing that the markets are weary of continuing their bull rally. Even though last week’s FED rate hike can be seen as negative for risk assets, the FED signaling a possible pause in monetary policy may dampen the negative effect. In the US, we also still have the US debt ceiling deadline, and the economy is still processing the bank stress, which puts a more negative outlook on the US at the moment. However, this week we do have the US inflation numbers, which play a role in the future interest rate expectations of the FED and spark high volatility in the market.

From a technical perspective, the 4200 level will be a key level for the bulls to break if the bull rally continues and for more risk on sentiment in the financial markets. On the other hand, a break below the 4050 support level can be negative for risk assets such as equities and even currencies. The SPX is still trading above both the 50 and the 200-day moving average (DMA), which still puts more weight to the upside. But for now, in terms of risk sentiment in the markets, it is showing a neutral bias or in a “wait and see” stance.

BOND YIELD

The US 10-year treasury bond yield (US10Y) also shows a similar trend to the SPX, where the US10Y is still contained between 3.6% and 3.3%, respectively. Despite the expected 25 basis point rate hike from the FED last week, the US10Y still remains relatively stable. The stagnant US10Y does show how the demand for US bonds remains strong, which shows investors are somewhat more cautious about taking higher risk and higher reward investments, which aligns with what the SPX is telling us.

VIX

If we were to look at the VIX, which gauges the level of fear in the market, surprisingly, the VIX shot back down below 20 strongly after retracing from the 15 level. With the VIX remaining below the 20 threshold, do show risk on sentiment, which is contrary to what the SPX and the US10Y are showing us. So if the VIX were to further drop below the 20 level, this would show investors a bullish market expectation or a risk of bias. On the other hand, if the VIX were to shoot up above 20, it would then align with what the US10Y and the SPX are telling us.

INTEREST RATE

Last week, the FED raised the interest rate by 25 basis points, which was expected, and followed with Powell’s comment, which signaled the end of the FED’s monetary tightening, but rate cuts were unlikely in 2023. Looking at market expectations, the market agrees on a pause in the next FED meeting but is still expecting a rate cut in September. The expectation of an interest rate cut can be negative for the US dollar and positive for risk assets such as equities and other currencies, but this does show how the market is in a contrary position to “don’t fight the FED”. So maybe it is wise to remain cautious.

Source: CME Group

ECONOMIC DATA RELEASE

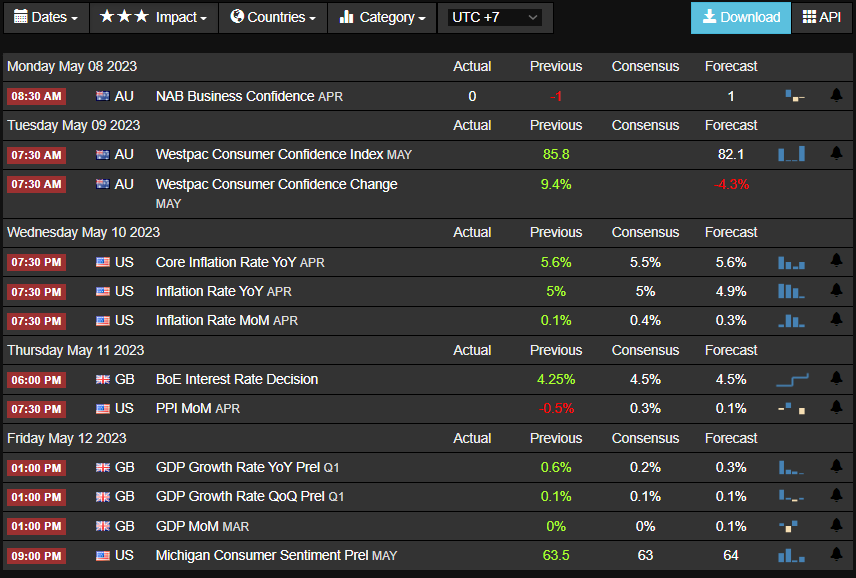

This week, key economic data releases will be concentrated on the AUD, USD, and GBP. With the main spotlight on the US inflation numbers, which can play a role in future FED rate expectations, and also the BoE interest rate decision, the market is expecting a 25 basis point rate hike as inflation in the UK remains above 10%. However, the comments from the BoE will be key for future interest rate expectations.

Source: Trading Economics