Hello trades, Welcome back to another forum where I share my personal outlook on market sentiment to get a feel for the market and how it is behaving, which I hope could generate a trading bias and to know what to expect in trading week ahead.

SPX

Starting with the S&P 500 (SPX), the SPX has remained in a rather tight trading range as it approaches the 4200 key resistance level, which has been an interesting level to help determine risk sentiment. However, it seems that the market is still worried about the debt ceiling and the falling bank shares that have been happening since the last couple of trading sessions. So the SPX still remains on “wait and see” before making any other clear direction in terms of risk sentiment. The SPX, however, is still trading above the 50-day moving average, which aligns nicely with the 4050 support level. So we do want to see a clear directional break either above or below 4200 and the 50-day moving average.

BOND YIELD

Similar to the SPX, the US 10-year bond yield (US10Y) also remains contained in a relatively tight trading range between 3.6% and 3.3%. Such a constraint in the US10Y still shows how the demand for bonds is still strong and can show how investors are still pausing in search of more risky and higher yielding investments as the US debt ceilings, recession fears, and the recent banking stress are still being processed by the market.

VIX

Taking a look at the VIX, which shows the level of fear in the market, The VIX still remains in a risk-on reading as the VIX holds below the 20 level, which shows how investors are complacent at the moment, which can be dangerous given the fact that the SPX and the US10Y remain stagnant, followed by the ongoing challenges that the global economy is facing right now as a high cost of living, a high cost of borrowing for business owners, and slowing economic growth.

INTEREST RATE

Looking at the FED interest rate expectation, the market is still pricing in the FED making rate cuts, with the FED fund rate by the end of the year to be at 4.25%–4.5%. Even though it is not entirely impossible, it will take a very strong and fast driving force to cause the FED to quickly start cutting interest rates.

Source: CME Group

ECONOMIC CALENDAR

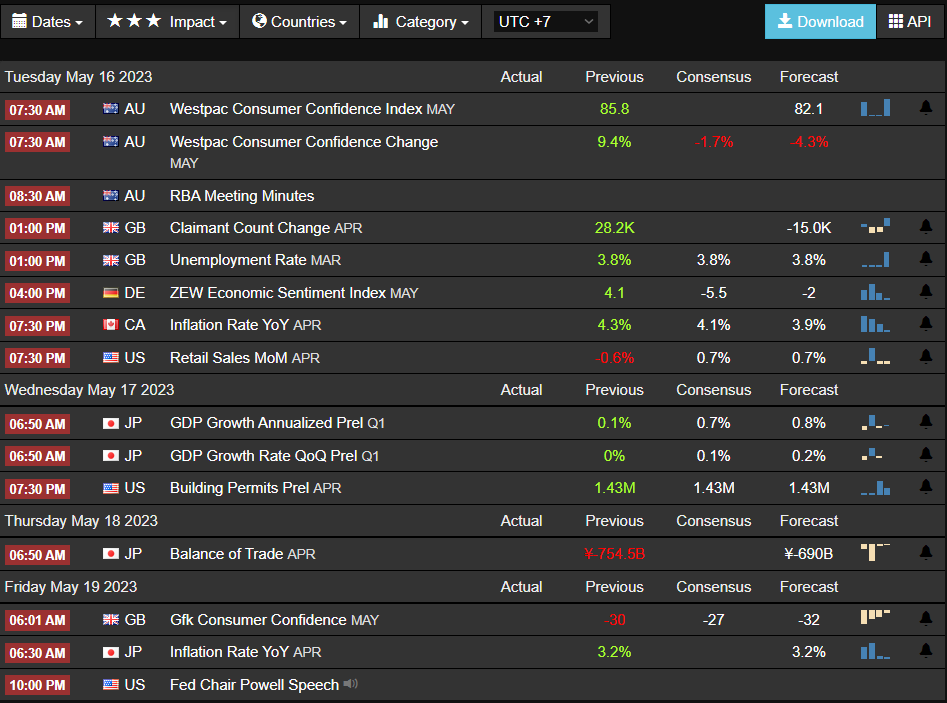

This week ahead, most of the economic data will be mid-tier economic data, with key highlights on the RBA meeting minutes that can give us ideas on what to expect ahead regarding monetary policy, the UK unemployment rate, which is expected to remain stagnant, and Japan’s GDP growth rate, which is expected to increase and Japan’s inflation rate to remain at 3.2% and FED Powell Speech to give a hint on what to expect ahead in regards to monetary policy.

Source: Trading Economics