Hello traders, I have just made a change to the title of the usual “personal weekly sentiment analysis” to make it more of a shorter title. Likewise, I will be sharing my personal market sentiment for the week to get a general feel of the market regarding risk which hope could create a bias in trading.

SPX

As usual, an easy metric for risk appetite in the market will be the S&P 500 (SPX). The SPX last week was struggling in the 4100 to 4200 price range. Looking at price behavior, the SPX has been rather showing signs of bull exhaustion as we see shorter bullish bars. Despite falling inflation in the US, we still have the upcoming FOMC meeting next week, at which the market is expecting the FED to make another rate hike of 25 basis points. The FED rate hike expectation can be negative for the business and retail markets due to the high cost of borrowing and cost of living; hence, it can be negative for risk assets such as the SPX.

Technically, in the meantime, the bullish stance in the SPX still remains intact, but the stochastic recently printed a divergence after the SPX made a new high in March. A key level would be the 4072 support level and the 4200 resistance level, respectively. While a break of the 4200 does put risk-on sentiment, a break below the 4072 support level would be negative for risk-on assets such as equities and risk-on currencies such as the GBP, AUD, and CAD.

BOND YIELDS

If we take a look at the US 10-year bond yields (US10Y), We can see how the US10Y is currently in a rather narrow range between 3.6% and 3.35%, respectively. While last week showed how the US10Y struggled at the 3.6% level, which aligned nicely with the 100-day moving average (DMA), it does give a bias of falling yields in the upcoming trading week, which gives more of a bearish bias to the US dollar. However, we still have to keep in mind the upcoming FOMC meeting next week and the possibilities of a rate hike, which could raise the US10Y and boost the US dollar. So the 3.6% level would be key in the upcoming week as rising yields would show signs of risk-on market sentiment, but a further fall of the US10Y would give a sign of risk-off market sentiment. However, currently, the path of least resistance for the US10Y would be to the downside, as several technical factors are pointing downwards for the US10Y.

VIX

If we look at the VIX index that shows risk appetite in the financial markets, the VIX has been falling quite aggressively since last week’s trading sessions, where the VIX continued on its downward path below the 20 level and currently remains below the 20 level. Such low numbers on the VIX do imply markets are somewhat ‘okay’ with taking on risk despite inflation remaining high in most of the major countries, borrowing costs also remaining high, and layoffs from big companies such as Meta. Such a scenario can be quite concerning as recession concerns are still present, so this does raise questions about the bull rally of the SPX and high risk appetite readings from the VIX. But at the moment, the VIX gives out a risk-on sentiment.

INTEREST RATE

Taking a look at market expectations for the upcoming FOMC meeting The market is expecting an 83.4% chance of a 25 basis point rate hike in the upcoming FOMC meeting on May 3, 2023. The market is also expecting this to be the last of the FED’s tightening cycle, and after the rate hike, the FED will continue holding rates until September. With the scenario presented from market expectations regarding interest rates, it can be negative for businesses and consumers as the high cost of borrowing and high cost of living still remain. For currency, the upcoming rate hike can boost the US dollar; however, comments from the FED can be as crucial as the previous FED dovish hike back in March.

Source: CMEgroup

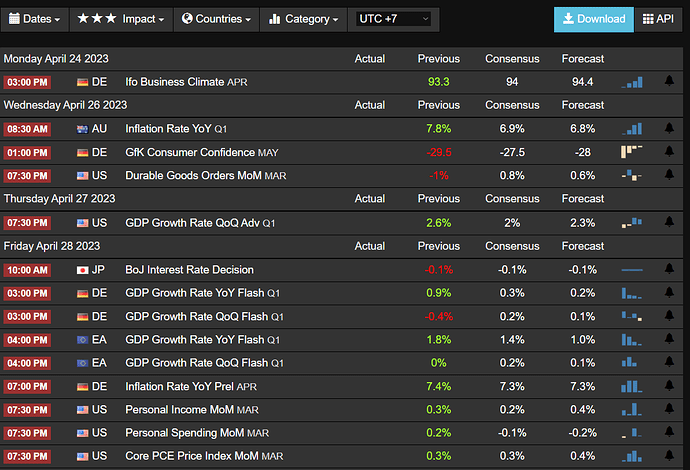

ECONOMIC CALENDAR

For this week’s economic calendar, we will have the inflation numbers from Australia, the BoJ rate decision, and the US core PCE price index as the main headlights. But with the upcoming FOMC meeting next week, volatility can be rather limited as the market awaits the FED rate decision and comments.

Source: Tradingeconomics