Hey Babypips Family,

This is Market Structure from my point of view. Interpretations of Market Structure and opinions on the topic will vary and constructive discourse is always accepted but before you think about flaming me, keep in mind that I’m describing how my brain interprets Market Structure in order to make sense of the markets. I’m not claiming to be the supreme authority or a subject matter expert on Market Structure. I’m always open to learn more about this important aspect of analysis.

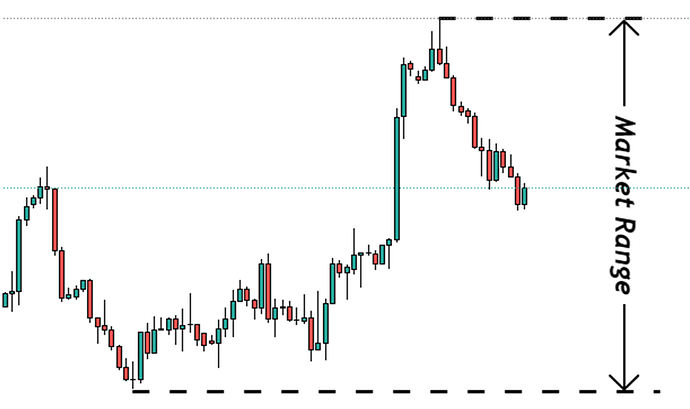

Please don’t blindly accept what you read in this thread. You need to verify everything against your own charts and in fact you should do that with all information that you receive online. You don’t need to trust what I show you, you need to trust your own eyes.

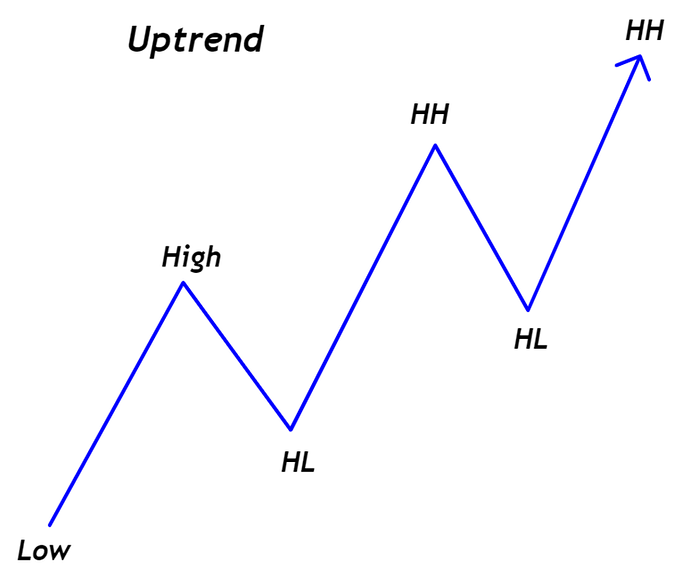

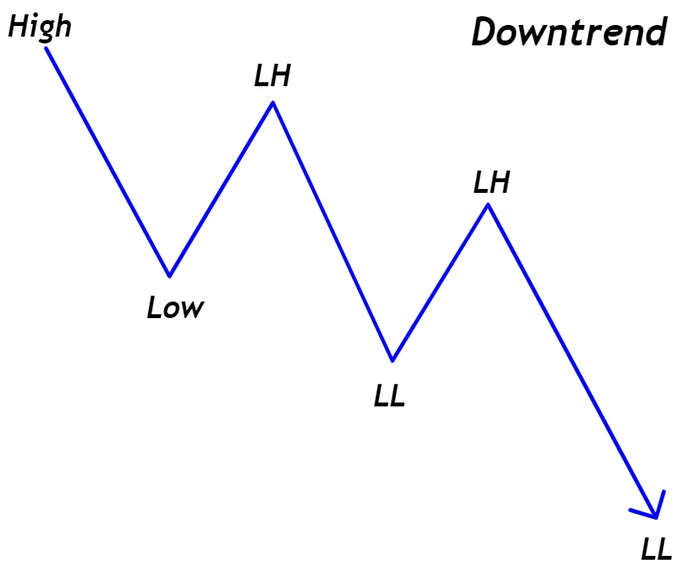

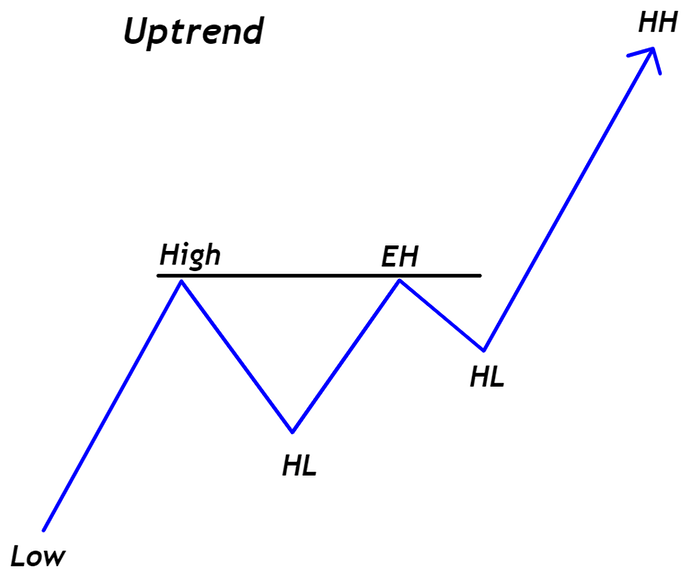

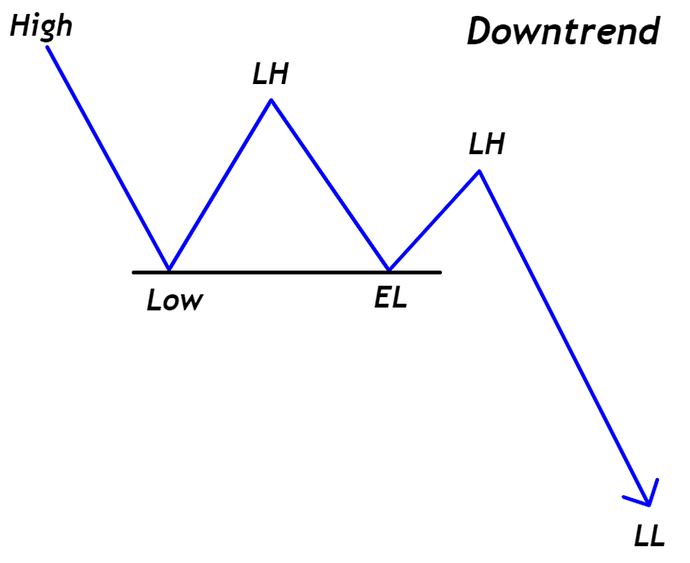

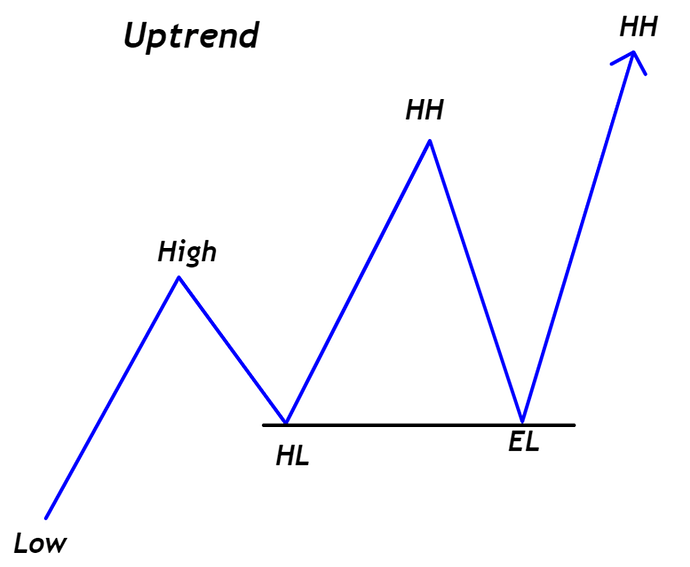

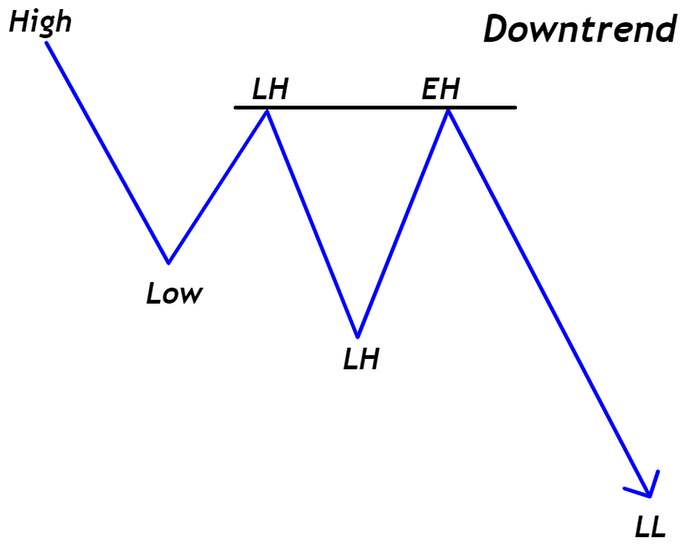

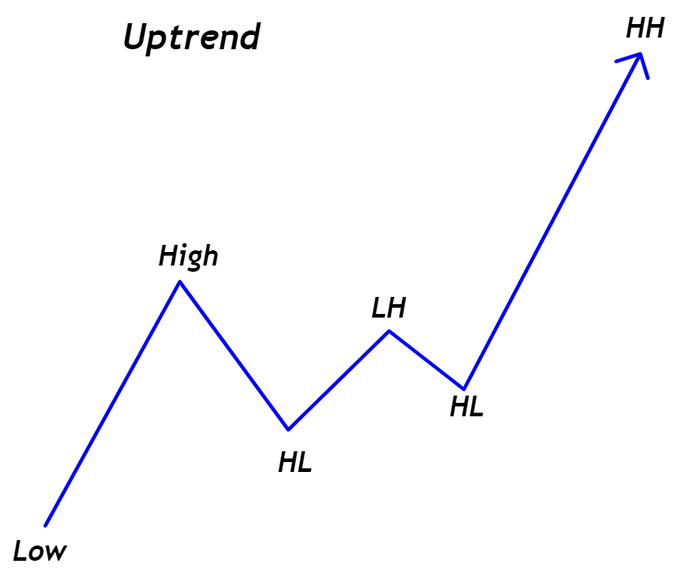

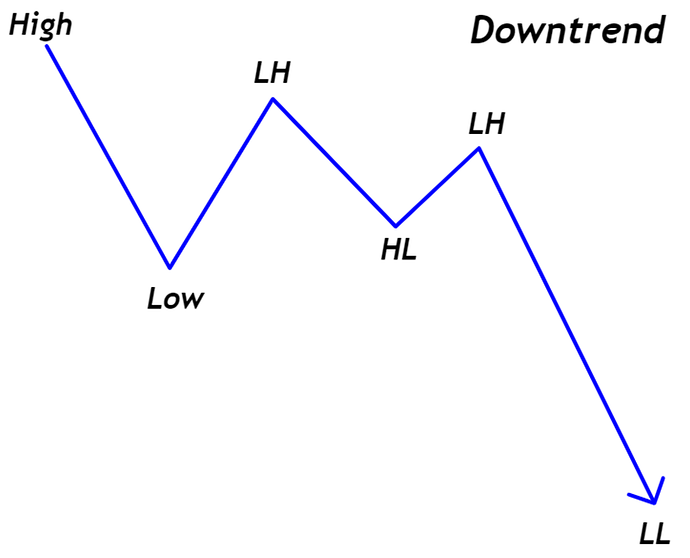

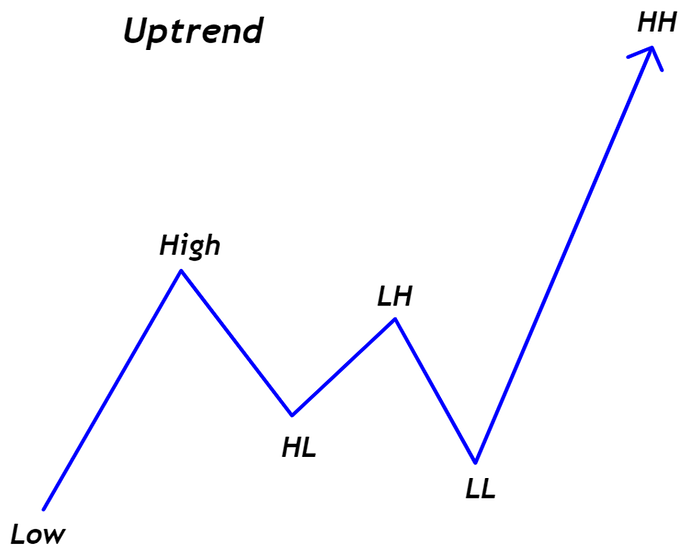

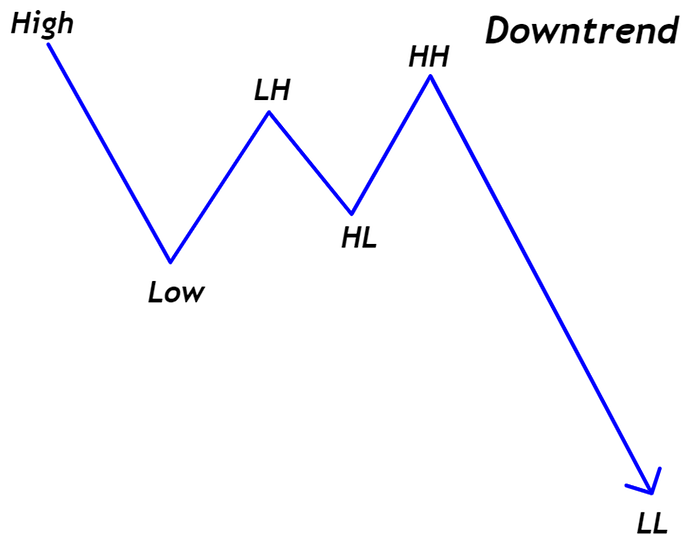

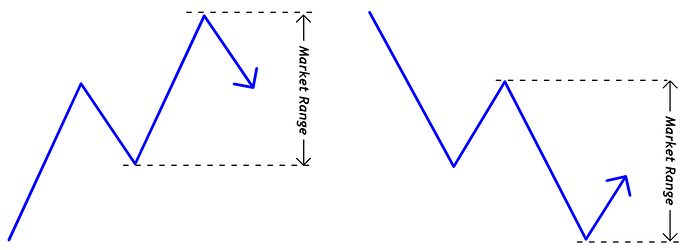

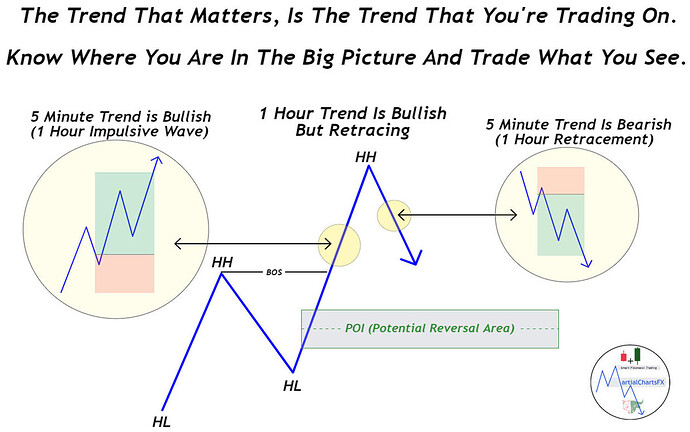

I’m not intending for this to be a strategy thread, but you can use Market Structure to create or refine your own trading strategy. I believe that Market Structure can improve almost any strategy, after all there is a reason that Market Structure is King.

The reasons for this thread:

- In response to questions I see regarding Market Structure. Particularly when someone asks about a trade that didn’t work out as planned and misreading Market Structure was the culprit.

- I’m fascinated by Market Structure, which is why when Market Structure related questions come up in the forum, I’m all in.

- Instead of having this information spread across the forum in random replies, I figured having it organized and in one place would make it easier to follow.

- Market Structure is probably one of the most important concepts in chart analysis but it is also one of the concepts that is most glossed over and taught at a superficial level. I’m hoping this thread will be a resource to fill the information gap. That is not a jab at the excellent Babypips’ School of Pipsology.

Disclaimer: The content of this thread should not be considered as financial advice. DYODD.

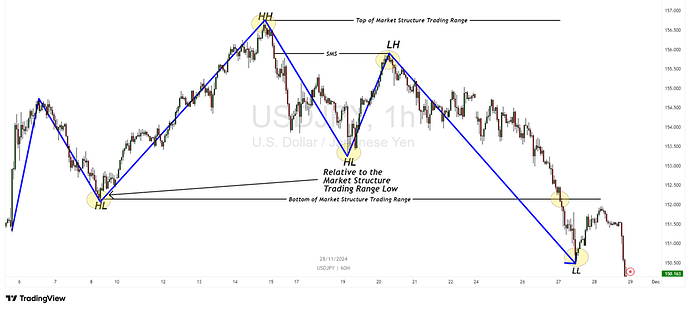

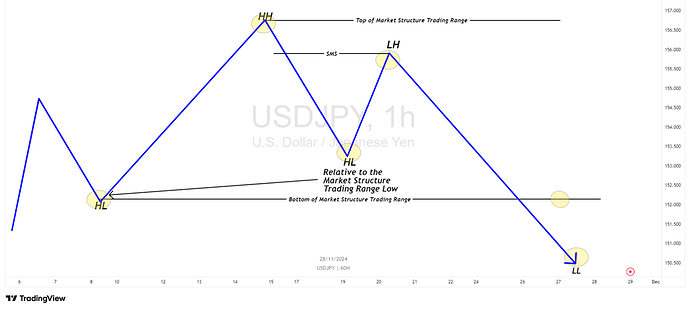

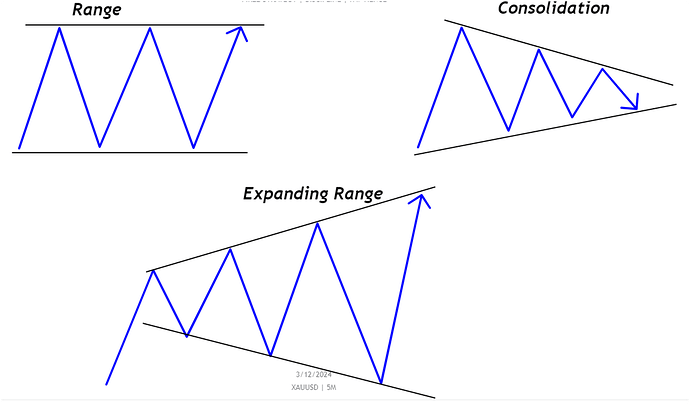

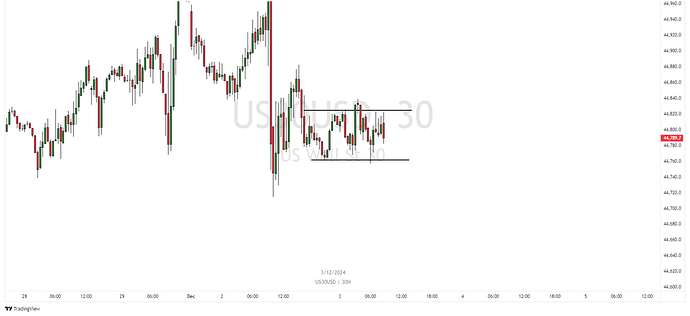

I want to discuss Market Structure thoroughly, so I’m going to start from the very basic beginning. The beginning part of this may be a review for some of you but it will ramp up as we go along. If you’re wondering about the difference between Market Structure and Price Action, you can read my response to that question here: Market structure vs price action - #4 by MartialChartsFX.

This thread may end up being quite long but I’ll try to make it a worthwhile read (no promises ![]() ).

).