Hey can someone explain the difference between price action and market structure and which one should I learn first

I like the question, some writers are imprecise using both terms.

For me price action is visible changes in price. This is happening constantly obviously so how do you know when price changes are significant?

This is when price action changes the current market structure. For example, when price breaches a previous candle’s or bar’s high, this is useful information and suggests that buyers control the market during the current bar. But that does not necessarily change the market structure from bearish to bullish: your personal technical analysis could tell you there is a change of market structure - for you - only when the current bar closes above that high.

So there is some room for subjectivity but that is TA, it’s not a science like DNA, it’s a tool which offers the trader options for trading. Which means two traders can look at the same chart and find opposite opportunities for a trade

I agree. For me, market structure refer to a bigger scale of perspective, and price action is more localized things I see myself on my normal single chart.

Here’s my take on this.

Market Structure is the structure of the market based on price either making higher lows and higher highs, making lower highs and lows, or making equal highs and equal lows. Market structure defines the condition of the market as trending, ranging or consolidating.

Price Action is the formation of candles on the chart and the way the candles are interacting with previous price action. Momentum, exhaustion, rejection, and indecision are price action characteristics.

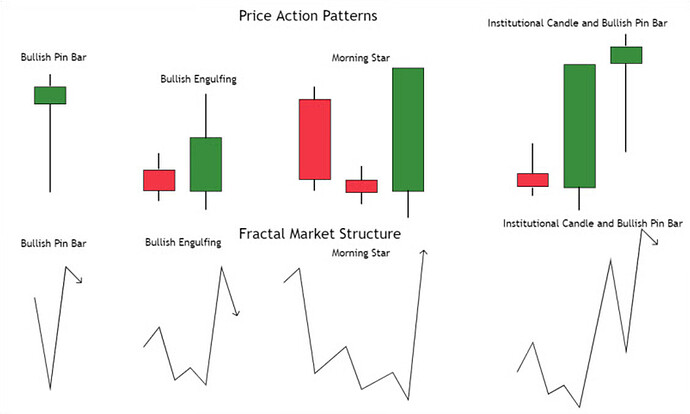

Price Action and Market Structure have a strong relationship to each other. Within market structure we witness price action and within price action there is market structure due to the fractal nature of price.

From the illustration above the market structure is in a downtrend since it is making lower highs and lower lows. The price action also tends to reflect this as the bearish candles show the most momentum downwards and the most rejection upwards. So within this market structure there is supporting price action and the sum of the price action creates market structure.

The illustration above shows the fractal nature of the market and the relationship between price action and market structure.

Within price action there is fractal market structure from a lower time frame. Inversely, market structure is the fractal market structure within a higher timeframe’s price action.

As far as which one to learn first? Learn both. Both are important but when compared to each other on the same timeframe, market structure is the king, price action is the prince.

Super reply.

Price action’s just watching how the price moves, like the candlesticks and patterns. Market structure’s the bigger picture, where the market’s heading, support, resistance, all that.

Market structure shows you the overall trend and key levels to watch. Price action is about reading the details in how the price behaves around those levels. Start with market structure to understand the setup, then learn price action to spot entry and exit points.

Very educational reply and I completely agree.

That’s a great image you shared. Thanks!

Now, where to learn about both?

The Babypips course doesn’t go as deep into market structure as I would like but it’s still a good place to start. Larry Williams’ book “Long-Term Secrets to Short-Term Trading” also includes a chapter on market structure. Check out Al Brooks for price action.

I’ve heard of this a lot, but not the others. Is one newer than the other?

I don’t have the dates of publishing but in general, there is nothing new under the sun.

So lots of renewing maybe, of old principles?

Interesting question ![]()

For me, Market Structure is the static “photo” and Price Action is the dynamic “video”.

Market Structure is the “past” when I am looking at the overall chart. It is static and historic. It is basically the left-hand side of current price and where one identifies significant points and events such as earlier highs, lows, ranges, congestions, gaps, etc. It is all formed from previous price action.

Price Action is the “now”. It is the current evolving movement of price. It is either rising, falling or standing still. But its movement is meaningless, and it’s almost impossible to extrapolate its possible forward movement, without a contextual background framework. And that background framework, for me, is that historic market structure “map”.

One can identify an aeroplane taking off, cruising, and landing. But one cannot anticipate which airports it might be flying from and to without a map. And, without the map how can one determine if and when that original assumption of direction was wrong and change it)?

Track the flight - plot the course on the map ![]()

Just my way, not necessarily the “right” way, of looking at the issue…

Both are equally important!

You need every advantage you can get, as long as it is a plus and going to add to you, learn both.

They shape your thinking.

Learn both for insight, and informed-decision making.