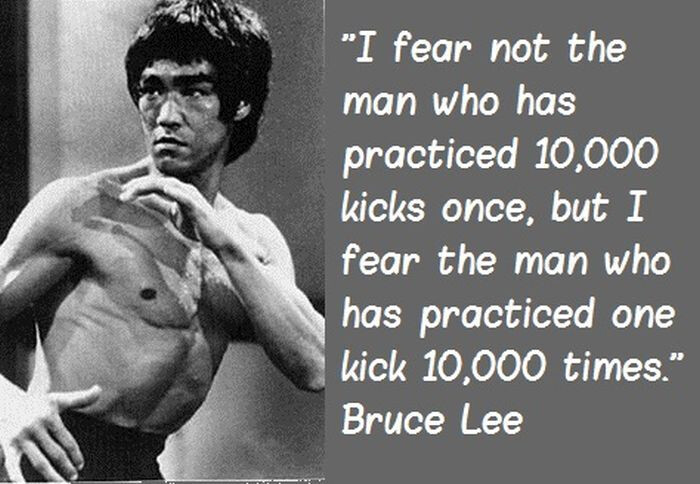

Most rooky traders are very confused in mastering one strategy, they don’t have the IQ on how the market operates, they just want to make use of any strategy they see online, resulting them to loss money.

As a trader you were not meant to loss money more that 5 time in a week,that depends on your limit for the week. That is why you should be able in mastering your edge in the forex community, so as to strive higher than you were yesterday.

It is a shame that most of those professionals traders out there can not defferenciat there weakness from there strength, because they also have no master there edge.

Taking people signal will only make you as same level as that person you are relying on for signal, the best way to trade is by analyzing your chat by yourself and journaling were you took loss or were you won.

Yeah lots of newbies just copy stuff without really getting the market. Finding your own edge and learning from your trades is the real way to get better not just following signals.

You know for newbie, they believe if they follow the way there mentor’s trade they are likely to be successful, but that’s all a lie trading only work for you the way your mind see fits, you copying trading signals only make you a student of the game.

A good trader must at least learn if not master all the main strategies. I met a trader that has been trading for a year. I asked what strategy is he using. He says he dunno. He showed me his setup which was a simple trend following. These are the traders that will be lost without his setup.

Mastering one strategy is far more effective than chasing dozens of random setups. Consistency comes from repetition, testing, and knowing exactly how a method performs under different conditions. Losses are inevitable, but journaling every trade provides clarity on strengths and weaknesses, which is the real edge. Relying on signals from others can limit growth, while personal analysis builds independence and confidence. The more a trader understands their own process, the less confusion and emotional pressure there will be in the market.

Yeah, if you want to get anywhere here you need to master your own edge not copy other people.

So which approach should I take? ![]()

You absolutely do not need to learn or master every strategy. Focus on one strategy and become the master of that. Otherwise you become a jack of all trades and a master of none.

What is a strategy? You will get the answer when you know it

Perhaps you could kindly tell me?

You must know, if you’re advising me that I “must at least learn if not master all the main strategies,” to become a good trader.

Sorry for my confusion! ![]()

I will answer clearly and specifically without any “you should understand for yourself”… A beginner cannot understand their mistakes on their own, because if they could, they would correct them themselves… The same applies to strategy. If there were worthwhile strategies on YouTube, then people would be making money, but as we can see, they mainly teach technical analysis and psychology there, and we know that 99% of traders lose their money. Therefore, connecting the two, we get that psychology and technical analysis do not work because they do not give you any advantage over the market and other professionals. Therefore, the only right option for you would be to focus on studying fundamental or quantitative analysis (I recommend starting with fundamental analysis) because that way you will understand how the market works as a whole. Still, my recommendation is to find a good teacher, not an amateur who thinks that fundamental analysis is an economic calendar with green and red colors…

You are correct that beginners cant understand their mistakes, most of them. So good basics are key in building a foundation. Keeping a journal. Log every trade. Spot the reason for wins and losses. Recognize the fact that there will be losers. As long as the process is followed, the statistics can be collected and from that, the strategy being used can be validated. A well defined strategy helps reduce emotional decision making, maintain discipline and create consistency. There are online tools that help with that.

And a strategy is a systematic approach to trading, and most of it is catered to a certain market condition. When using it, a certain set of tools is needed. Say for example, trend following. The indicators used for this strategy will not be suitable for trading S&R. If only one strategy is mastered. Then you can only hope to trade a certain market condition successfully. The common solution is universal strategy, But then again, you need to be able to recognize the market condition, have the required indicators to assist in trading it. No single strategy works for all conditions. So if one single strategy is mastered, you will only specialize in that specific market condition or you can learn and maintain a multiple approach in your arsenal.

Imagine trading is treasure chest. that requires a key. Only you can find the key to unlock it. Gaining knowledge, knowing yourself, know the market.

Trade safe.