Mattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide. The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq.

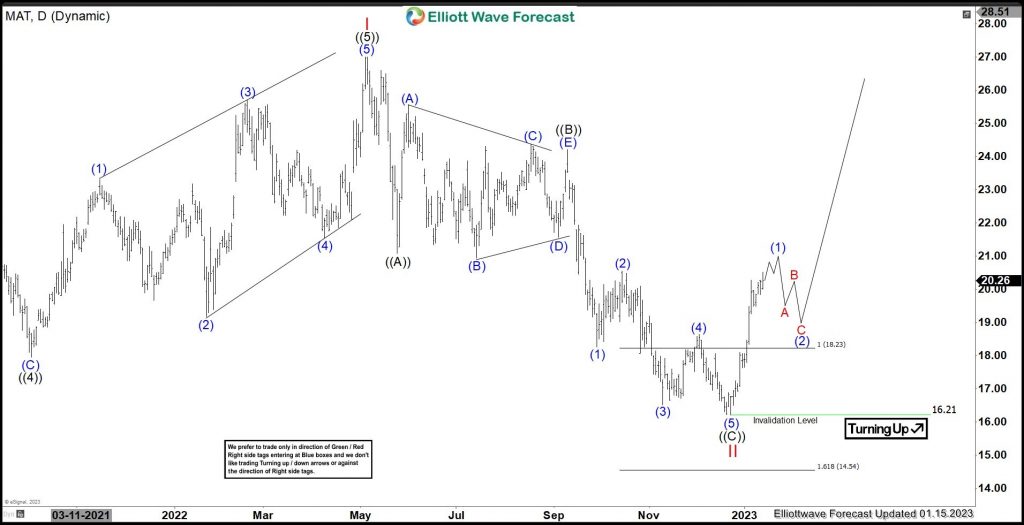

In the previous article, MAT ended wave I at $26.99 high as impulse sequence. Below there, it expected to correct lower in ((C)) of wave II between $18.23 - $14.54 area in zigzag correction before turning higher. It appears ended ((C)) leg at $16.21 low as II correction. Above there, it should either resumes higher in III red, which confirms above daily high or at least can see 3 swing bounce as the part of larger double correction.

MAT - Elliott Wave View from 9/27/2022 :

It placed ((1)) at $9.44 high & ((2)) at $7.54 low. ((2)) was a flat correction retraced 0.618 Fibonacci level against ((1)). While above there, it extended higher in third wave extension. It ended ((3)) at $23.31 high on 4/23/2021. Below there, it favored ended ((4)) at $17.95 low on 10/04/2021. ((4)) was ended slightly above 0.382 Fibonacci retracement of ((3)). Finally, it ended ((5)) at $26.99 high on 5/04/2022 as wave I red.

MAT - Elliott Wave Latest Weekly View :

Below wave I high, it placed ((A)) at $21.07 low on 5/24/2022 & ((B)) at $24.20 high as triangle on 9/12/2022. Finally, it ended ((C)) at $16.21 low as II as zigzag correction. Above there, it favors higher in (1) of ((1)) and expect short term upside before starts correcting in (2) 3, 7 or 11 swings. From $16.21 low, it either extend higher in III red or a connector higher in larger double correction in wave II.

MAT - Elliott Wave Latest Daily View :

Source: https://elliottwave-forecast.com/stock-market/mat-expect-upside-to-continue/