ArcelorMittal S.A., (MT) together with its subsidiaries, operates as integrated steel & mining companies in Europe, North & South America, Asia & Africa. Its principal steel products include semi-finished flat products, including slabs, finished flat products comprising plates, coils & sheets, bars, wire-rods, structural sections, rails, pipes & tubes. It is based in Luxembourg, comes under Basic Materials sector & trades as “MT” ticker at NYSE.

MT made a low of $6.64 in March-2020 against 2008 high. While above there, it started impulse up, which ended at $37.87 high finished as wave I. Below there, it proposed ended wave II at $19.25 low at blue box area. While above there, it started reacting higher. It expect to resume higher in wave III, which confirms above $37.87 high or at least can see larger 3 swing bounce in double correction in II.

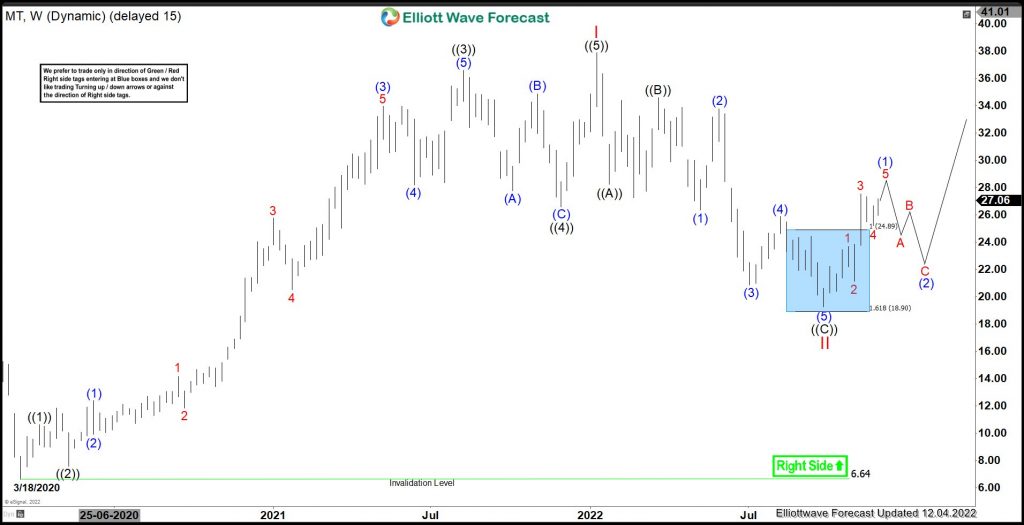

MT : Elliott Wave Latest Weekly View :

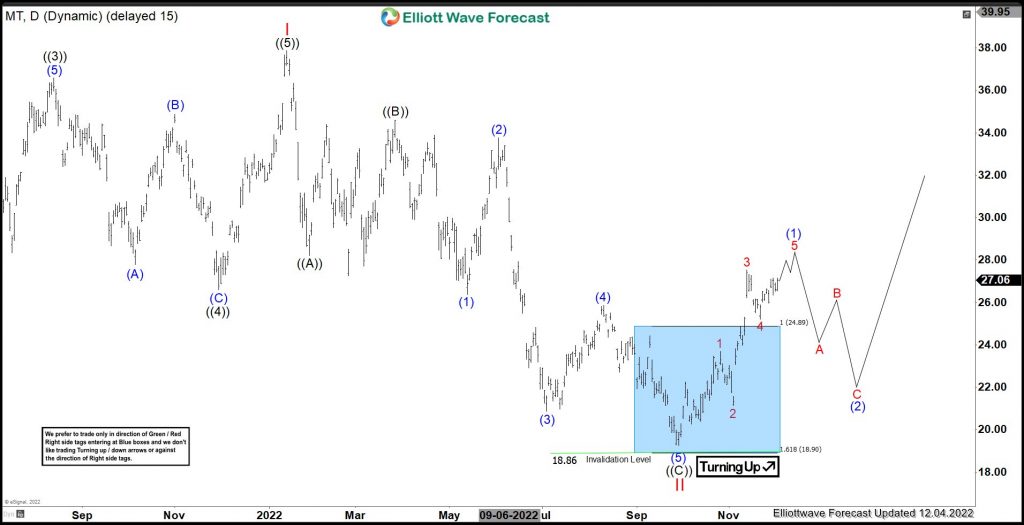

It placed ((1)) at $10.63 high on 4/09/2020 low and ((2)) at $7.58 low on 5/14/2020 as dip correction. Above there, it started third wave extension, which ended as ((3)) at $36.58 high. Below there, it favored ended ((4)) at $26.59 low, slightly higher than 0.382 Fibonacci retracement. Finally, it placed ((5)) at $37.87 high as wave I on 1/13/2022. Below there, it placed ((A)) at $28.22 low on 1/28/2022 & ((B)) at $34.59 high on 3/25/2022. It placed ((C)) at $19.25 low as the part of zigzag correction in wave II in blue box area. Currently, it favors higher in 5 of (1), while dips remain above $25.21 low of 4 red. It expects one more high before starts pulling back in (2) in 3 or 7 swings & expect to holds above II low to see at least one more leg higher. Buyers from the blue box area are already having risk free position.

MT : Elliott Wave Latest Daily View :

Source: https://elliottwave-forecast.com/stock-market/mt-ready-for-next-rally/