Hi, I have read your thread and find it interesting. We share some background. I graduated and worked as a Schlumberger field engineer (oil exploration offshore) then moved into management and nearly 30 years ago became self employed (I declared myself unemployable coz I couldn’t do the corporate ladder thing).

On and off, I have been involved in leveraged trading since 1988 (USD/GBP by phone call to Swiss bank from Middle East using BBC World service as the information source). Scary days. Made $8K in 3 days, missed a trade and felt lucky coz I didn’t lose $24K in the next 5 days. We stopped doing that. I started again around 2005, then again 2010/11, and again 2015/16 and now 2019 to now. So I have put on over 1,000 trades. Until the last year I had never been able to demonstrate an edge, but persevered. Strangely, I have found recent comfort in Crypto - no leverage to date - just a combination of a longer term investment plan supported by a shorter term (weekly time horizon) trading plan. We started with 1% of our assets, and it now consumes 3% of our assets, and will go to 5% mid year.

About targets, for the past 20 years I have made investment and trading plans with three targets. I define a “standard target” which I expect to be able to achieve, a minimum target which will not disappoint me, and a “stretch target” which is what I really want to achieve.

That approach may accommodate both your desire to achieve double digit monthly gains (stretch target) whilst being realistic and perhaps setting a minimum target of 10% to 20% per year. We set those targets only every five years, for the past 30 years, and have exceeded standard target in five out of six of the five year plan periods.

3 Likes

Cheers for taking the time to read my ramblings, and to share your experience.

I work alongside the Schlum boys regularly when we have the cementers and Geo onboard.

I like your approach to targets, I think I’m going to remove targets for FX until the end of 2021 when I have an idea of expectations, then will start looking at establishing something to work for.

2 Likes

So week two done, nothing dramatic this week.

Mid week we had a little turn on a few of the open trades as money went flooding back to the equities market, all in all not a big deal as for as many of the trades we had to close in a small loss, we had a few closed in profit to compensate.

This resulted in a fairly flat Realised PNL over the week, but still up overall.

Open PNL took a bit of a dip over the week, however as of close we’re now at a all time (2 week) high running PNL.

There’s 3 trades in particular are running away slowly, nice long trends. The rest is a mixed bag of small losses and small gains. Monday will most liklely be a little clear out of them.

One thing I need to do soon is update the TSL on most of the open pairs. The ATR has dropped a fair bit since opening the longer running ones, so the TSL being 1.5x ATR is alot wider than when they opened. I’ll tighten this up on Monday… I may be able to do this while the market is closed with Oanda, yet to try.

Overall I’ve stuck to my rules, that was 100% the main objective. So I see this as a MASSIVE win.

Have a great weekend everyone.

1 Like

David Paul - trade psychology

Brilliant video from David Paul above! Thanks to Ben. Takes all the fluff out of the psychology, form the habit from 5 -13 trades then you don’t need discipline anymore, it will be wired in! Can it really be that simple? Worth reviewing regularly

Happy to be of help. Keep asking the questions, and keep recording your journal

So nothing exciting to report at the moment.

Got a few trades that are running away and making a good bit.

Stopped a few trades early as they went south, so taken a little drawdown.

Nothing exciting and nothing really interesting to report.

I do have a little update to make regards volume, I will go into that a little more later.

All in all looking good, my process is really easy to stick to so far.

One thing I still need to get better at is looking periodically through the day to see if there are any changes in the % etc.

I will not be acting on anything unless my indicators tell me to in the last hour before NY close, so why do i need to look at all inbetween? I’ve moved the icons from my homescreen on my phone into folders so wandering hands are less likely to click the icon.

1 Like

So that’s me settled into my onshore life again ( been home a little over 24 hours) and just sat down to my second trading session.

So today saw a turn around on quite a few positions, a good few trades closed by TSL either in small loss, or in profit.

Tonight’s trading saw me close a host more of trades due to Exit Indicators signalling. Some of these trades were the opened in the first couple of days of the month, I’m hoping the next couple of days may bring a continuation of them.

At a guess there’s been a bit of a dump in the Equities markets again today, I’ve got plans tomorrow and over the weekend so I’ll take some time on Monday to examine what currencies saw the biggest swings, and what it correlates to.

Overall at nearly 8% in gains in just under 3 weeks closed profit things are looking ok.

I’ve opened a good few new trades tonight. A few positions of Major Currencies against the HUF and PLN mainly.

1 Like

Looks very good! Do you prefer to do your research/trading at home, or it doesn’t matter to you?

I prefer everything at home!

Not one thing I can honestly say I prefer there.

1 Like

So today took a little turn to the downside, with a fair amount of the new trades pulling back from the entry points.

The positive being 2 of the trades so the first half position hit TP, pushing out Realised PNL to over 8%

On checking tonight NONE of the open positions have an Exit indicator, which I’ll be honest was a surprise.

I believe some of the positions are starting to push back towards the entry so they may turn out alright after all.

Definitely some interesting figures, from a peak unrealised position of nearly 15% to about 6% in only a few days, certainly could be a rollercoaster if I don’t focus on the process.

There may be scope to improve the figures over time, maybe having more TP positions etc.

Time and Data will reveal all.

Still in a good place all said and done, and happy to continue the ride.

1 Like

So just getting into my new home routine.

Kids are now back in school now the lockdowns are lifting.

My plan was 09:00 to 10:30 would be exercise then 10:30 to 12:30 trading related activities.

Due to the car getting collected for a service this morning I’ve shifted it to trading first then exercise.

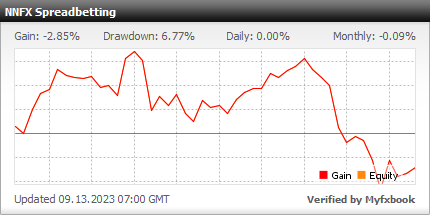

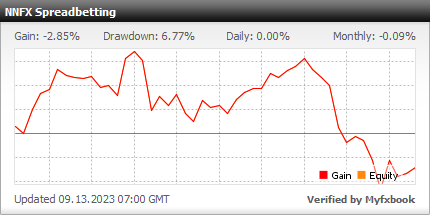

I had a little look at my trades, and I’ll be honest it’s brutal! Drawdown has pretty much swallowed all my gains.

I’ll have to take a really good look at the data and see what’s happened when there is enough to see.

With December, Jan and Feb in Demo being such high finishes, my gut says I’ve hit the DD period just as I’ve gone live, but I don’t have enough info to say for sure at this point.

Plan is to keep going and see where we end up.

So anyway, what are my plans for my mornings?

I’ve decided to work on my TradingView indicators and also to convert them into a Strategy to enable easy backtesting.

I go through my settings, and do paper trades for all my changes, it takes time.

If I am able to convert it to a strategy which takes the trades on paper and gives me results fast, I can save huge amounts of time going forward.

So spend the time learning TradingView pine coding now, to save time testing later.

1 Like

Haha. You’re doing the backbone of your strategy?

It’s funny to me because I was doing something very similar over the weekend.

I was working on the foundation of my strategy, as well. Looking for new set-ups is cool, but sometimes working on strategy is good.

Keep doing your thing!!! Keep up the good work!

1 Like

Thank you so much for making this post. It is possible to learn some important lessons from this post.

I think it is possible to move easily in trading if you can keep yourself away from emotions. I always trade with a target that can bring me 10% profit per month. So it is better to maintain a journal and trade.

So today I made alot of progress integrating my indicators together.

I’ve made some nice tweaks to the code, so instead of my confirmation indicators being below and directional, it’s greying out the candle body when there is no confirmed trend.

I’ve also added a label for the ATR value as this is the main thing I use ATR for when working out my SL and TP values.

The Red banded areas are low volume (data taken from the 4hr chart).

Unfortunately the trades I put on the other day all very quickly turned around and went to Stop losses or close to, so we’ve had a quick turn around in fortunes.

Will have to keep working to get my Backtestable TV strategy ready so I can backtest a load more settings and see if there’s anything I can use to improve the system long term.

For now, my previous backtesting and Demo showed real promise, so I’ll continue and see where it goes.

Doesn’t look the prettiest at all right now!

1 Like

For anyone interested in the updated combined indicator it’s here;

I’ll work on turning the same into a strategy from here on

So things still going quite well.

I’m enjoying the routine, exercise first thing after dropping the kids at school, spending a couple of hours on trading related activities, couple of hours after lunch doing housework, projects, hobbies etc, then a couple of hours with the kids after school before bed.

Trading at 8 PM for 15/20 mins (will be back to 9PM after the UK Clocks change this weekend).

So trades wise, just plugging on at the moment, not making any changes at the moment but simply following the process and seeing where it takes us. Gathering data, dealing with the emotions, getting used to the process and making it routine at the goals at the moment, and that is successful so far.

With regards tradingview algo, I’ve been making some really good progress combining all my indicators and tidying up the code. I believe I’m ALMOST happy that it’s got all the functions I need.

Once this is ready, I’ll start working converting it to a backtestable strategy. As my combined indicator has lots of selectable options, for the baseline, exit, confirmation, volume and ATR’s including Type and lengths I can use it to optimize the strategy own timebases and pairs with tens of thousands of combinations.

I do believe the strategy has an edge, I’ve just got to prep things to make life easy to improve it!!!

2 Likes

So little bit of chillout time this evening as the boys were being good.

Decided to do a little more coding after sorting out my new home made fermenting chiller/warmer for my homemade wines.

I tidied up some code, and then added actual Takeprofit and Stoploss Prices calculated and displayed on the chart, so when my indicator shows an Entry it’s an even quicker process to setup the positions.

Also things are going my direction again with the Equity, so it’s feeling good…

AND… I never checked the account balance deliberately once between trading last night and today.

So all in all 110% at the moment.

I might not be that much closer to my Aston Martin, maybe just closer to a Big Mac meal, but I’m definitely working on becoming a trader.

1 Like

Don’t get me Started on my wines… the thread isn’t big enough

1 Like

I’m not very knowledgeable about wine, but I do like it. I like malbec and sweet wine. What is that a rosé?

I’m not trying to digress for too long, but do you have a vineyard? Do you buy your grapes from a vineyard? Do different corks affect the fermentation? How long do you keep the bottles sealed for? How important is humidity?

Uh oh. I may have just opened Pandora’s box…