DAY 14 UPDATE (04-02-19)

Hey Journal…

So I thought I’ll post some charts on some of the trades I missed and the ones I’m currently looking at:

First up is USOIL:

On the zoomed in chart you can see price clearly in a consolidation phase within the pretty green box…

my trade idea was to enter long on breakout of the candle. Now the breakout occurred but in a way i disliked: and that is it broke out so strongly that it affected my R:R considering the closest resistance above it… I set a limit order a little below the breakout candle close, unfortunately price never reversed as it often happens…

Next up is UK100

Price broke out of above resistance on a Friday and I should’ve really had my limit entry order on the charts immediately the markets opened on Monday… If i had, I could have had an entry as price reversed back to cover the gap over the weekend, I didn’t…

@jairusmaloba, I’ll only be watching for PA at the next resistance to see any suggestion of a reversal.

So two things going into my Morning routine based on these two errors become obvious:

NEVER EVER DELAY SETTING MY ORDERS EVER EVER AGAIN

IGNORE

There, that’s clear enough… It’ll be on my routine for 20 trading days, if i stick with it all through then I can remove it, else it stays for double the time.

EURUSD UPDATE

I finally closed out the trade manually as it approached the lower end of the swing low to the left:

Got out with a decent 1.2% profit on this trade in total so no complaints. Pin bar formed at the low but we won’t be trading against an obvious trend as a rule, so no trade there.

TRADES WITH ACTIVE LIMIT ORDERS

I currently have limit orders set for a couple of pairs that fit with my trading plan:

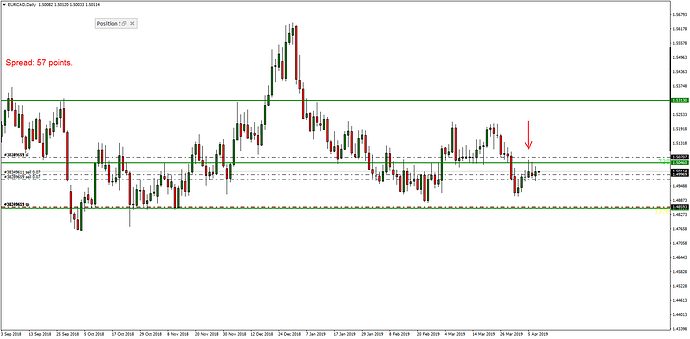

first up is EURAUD

Price has formed a really nice looking Bullish Engulfing Candle pattern at the lower support of the current range playing out on the pair. I have my limit entry order set above the BUEB candle wick and my SL and TP as you can see on the chart. wish me luck on this one.

US500

price broke out of former resistance… I have limit order set above the breakout candle on this one.

thanks @baemax023 really appreciate.

.

.