DAY 22 UPDATE (04-10-19)

Hey Journal…

Another New York Close and here we are:

No of trades so far: 6

No of Active Trades : 4

Nothing spectacular to report today, no new trades based on the strategies I’m trading. Except that my EURAUD short doesn’t seem to be going my way:

We got a strong BEEB (Bearish Engulfing Bar) threatening breaking the support level and threatening my stop as you can see, looks like this trades lives to see another day though, will it live to see tomorrow?

I’m not bothered though, it’s just the first few of many trades I’ll be taking with this strategy and losses are expected to be part of the big profitable picture. Just today I was playing around with my trading result simulator and it turned out a healthy 100%+ profit after 100 trades with 11 ugly looking consecutive losses. If this trade goes south, it’s only going to be the first losing trade, Insignificant

USDCHF long trade finally decides to close higher above trade entry today. Hopefully it stays on this side of the fence.

Other trades aren’t stellar yet but aren’t too bad either, hopefully tomorrow will get us something to chew on with them.

So that’s it for today Journal… Hope tomorrow get’s better than today.

Lawal Hassan

NIgeria

1 Like

DAY 23 UPDATE (04-11-19)

Hey Journal…

No of trades so far: 6

No of Active Trades : 4

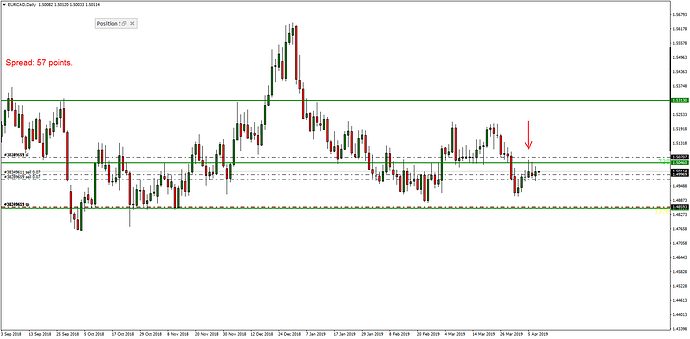

Day 23 and we got our first loss. Yesterday I talked about EURAUD short getting shaky. Well, turns out that things took a surprising turn, our loser is some other trade: EURCAD Pinbar short didn’t work out in the end:

Before

After

It’s the first of many Pinbar I’ll be taking so looking forward to the first winning Pinbar trade.

other trades still in play so keeping fingers crossed…

Catch you later Journ’

Lawal Hassan

NIgeria

1 Like

I would prefer a pin bar with very little or no body and an extremely long tail. However, my question is do you taken into consideration correlation of pairs before you enter a trade or dont you think it matters? I ask this because, If I took a long trade on the GBPUSD I would not be able to take a long trade on the USDCAD even if there formed a correct setup to enter long. I would always be comparing it with the other pair and thus I would remain a bundle of nerves.

1 Like

wow huge amount of work youre doing. Hope itll pay you interest.  Good luck.

Good luck.

1 Like

It will be tough for the first 3 years, wish you luck.

1 Like

Thanks for the link, I’ve watched the tutorial and now understand what the indicator is. However, its more like a referees whistle or the gun shot before the sprint. Many good trades are missed if this is the only entry signal used. I specifically liked the fundamental issues discussed in the tutorial. Also, how many pairs are you actually watching? or are you watching anything that offers a good opportunity?

1 Like

@momo3HC, @Tom_Hoang, @ria_rose, appreciate all the encouragements really… helps a lot at the Department of Motivation

@jairusmaloba, you’re very much welcome, you’re right about the indicator, it’s not a trade finder, it’s more of a trade filter for me really: I want to buy a pair but the SSI is at extreme levels of bullish sentiment, I’ll probable pass up the trade and find a less sticky one to trade.

I watch 36 pairs currently. Here are a couple of trades that may offer good trading opportunities this week, you can tell most yen pairs at currently at key levels:

USDJPY

USOIL

AUDJPY

CHFJPY

EURNZD

Hope that helps.

2 Likes

36 pairs??? That’s a lot, macilme.

I have been trading for 10 years: I trade only mainly 3 pairs. When there is no trading ideas, I find the best opportunity from 7 more.

And it is a lot of work.

If there is no ideas, Scalp may helps.

2 Likes

DAY 27 UPDATE (04-15-19)

Hey Journal…

And so Monday ends…

No of trades so far: 6

No of Active Trades : 3

No new trades today, things started of slow as it often happens on mondays. I did however place a limit order on for Dollar Yen at market open today:

levels are as seen on chart. that’ll be trade no 7 if it triggers (6 actually, if I ignore the accidental trade opened with a $2 loss at close ). We’ll see how this breakout trade works out. I’ll prefer to see green figures though hehe

@Tom_Hoang, I suppose you might be right , just not in my case. Watching 30+ pairs is expected to get me 3 to 8 trades on average monthly, can you guess how many trades I’ll be hitting watching just 3 pairs?

So it’s all relative you see, that many pairs is going to be overwhelming for day traders but it’s best for me to have as many possible on my radar. As long as they’re tradeable.

Yeah that is a lot! But would be a real feat if you can make it work.  It’s nice to see another female trader in here. I wish you success and unlimited amounts of persevarance and patience!

It’s nice to see another female trader in here. I wish you success and unlimited amounts of persevarance and patience!

1 Like

At this particular point in your chart what indicators make you feel that the price will go up (breakout) and not down, as the level seems to be holding? Yes it has closed above the previous high point where price is at right now, but not the furthest high point. Or are you looking at it as an inverted head and shoulders?

1 Like

Price as seen on the chart has clearly closed above the horizontal level and stayed above it (green horizontal line). It may not look as obvious looking at it as the close above that line isn’t a huge one, but sentiment suggests further moves up. Does that mean that price will definitely go in my preferred direction? Nope. But I know it will over time generate more accurate directional bias than false ones. If I took twenty trades this way and 12 works out in my favor, then I’m well in the green.

I wouldn’t consider that a valid inverted H & S though as they are better taken form established downtrends and not this clear bullish left to right trends as seen on the chart.

On indicators I do not use any, except that I sometimes consider retail market sentiment when I’m taking these types of trades is all.

1 Like

lol… thanks buddy. Most of the information I base my trading on I got for free right here on Babypips. You can check out this old but gold thread on Forex_School_online if you have the time, you’ll understand what I try to replicate better then.

And no I’m not a girl haha  , that’s my girlriend, her picture’s up here so it reminds me every waking day on why I gotta succeed with this lol.

, that’s my girlriend, her picture’s up here so it reminds me every waking day on why I gotta succeed with this lol.

3 Likes

I would feel safer if I let price close above your buy stop order, then I would be able to put in an order to buy. As it stands right now, price may spike and trigger your order and then move downwards. However, I respect and understand your conclusion on the matter. (don’t forget I’m learning).

1 Like

Correct my friend, there’s no hard and fast rule on trading, as long as you know what you’re doing and how to measure it’s performance so you can make changes if it turns out as poor strategy and keep at it if it’s a good one. I’m not risk averse on trading breakouts that’s my way, you prefer playing breakouts safer and that’s your way… we could both do our thing and be profitable in the long run…it’s all about creating your own level of order within the randomness of the market. So good luck to us both my friend…

Might I ask though, are you on demo or live?

1 Like

I traded demo for over a year and discovered that 95% of trades on demo are successful as it lacked the psychological stress, so I changed over to Live with a tiny amount. This way I triple check my decisions and feel like my learning journey is actually moving in the right direction. Also when I make a mistake I definitely remember, not to mention that I’m very particular where I place my stop loss and whether a trade is worth it depending on how large a stop loss is required.

I agree, 36 pairs is way too many to focus on. all you really need is 3, 4 at the max honestly and just compound them

1 Like

DAY 29 UPDATE (04-17-19)

Hey Journal

So another day in in the markets…

No of Trades so far: 7

No of Active trades: 3

So what’s happened since the last time?

The short trade on EURAUD finally hit my stop, 2% loss that one.

I took the trade off of the BUEB to the left of the chart, it didn’t work out in the end.  , hopefully the next engulfing bar trade I take returns something better.

, hopefully the next engulfing bar trade I take returns something better.

next up…

USDJPY long

Price breaks out of resistance and has managed to barely stay above it the past day or so… I had a limit order triggered above the resistance, we’ll see how this one goes.

Hopefully at the end of the trading month I’ll be doing a review of the trades in the last 30+ days.

wish me luck guys

2 Likes

Good luck.

Good luck.

I’m sure that with your hard work and determination, you’ll get to make your dreams a reality!

I’m sure that with your hard work and determination, you’ll get to make your dreams a reality!

It’s nice to see another female trader in here. I wish you success and unlimited amounts of persevarance and patience!

It’s nice to see another female trader in here. I wish you success and unlimited amounts of persevarance and patience! , that’s my girlriend, her picture’s up here so it reminds me every waking day on why I gotta succeed with this lol.

, that’s my girlriend, her picture’s up here so it reminds me every waking day on why I gotta succeed with this lol.