Hello world, how are you today, the clouds are still covering the sky, and a thin mist is obscuring my view from a distance.

Back to my trading journal today, write down some words all about forex trading activity in financial markets with potential gain and risk.

The forex market is very highly volatile, every second, minute, and hour, changes in value always occur, and possible the market trends that previously rose can suddenly fall beyond traders’ predictions. Risk management is important to deal with uncertainty in addition to portfolio diversification strategies to maintain capital balance and increase exposure.

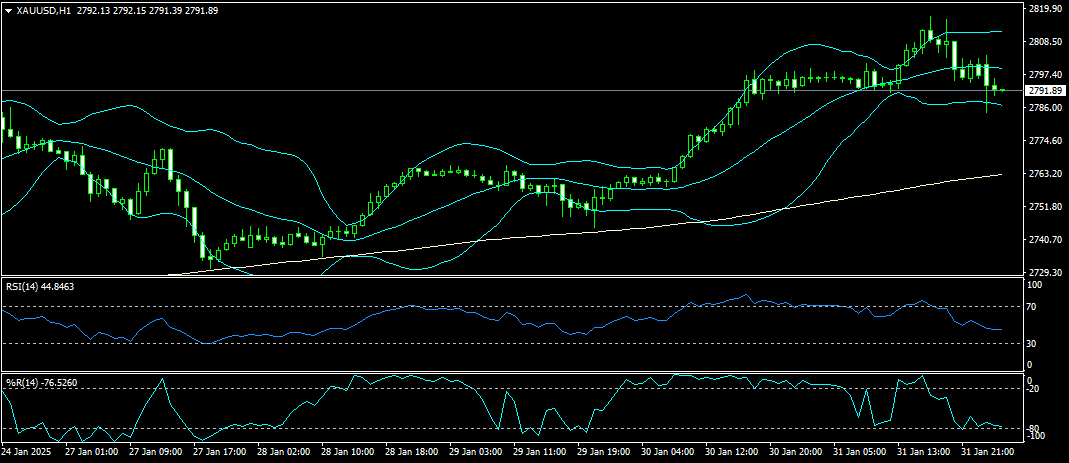

At today’s market opening, the US dollar seemed to be strengthening. Gold, which previously reached an all-time high, seemed to be down slightly at around 2791. Gold had reached a high of $2817 at the end of trading. The impact of Trump’s tariff policy seems to be the reason gold is still a safe-haven asset choice amidst economic uncertainty.

There is a gap in the EURUSD pair, the Euro is also weakening against the US dollar as a result of Trump’s policy and the ECB’s reduction in interest rates. Gaps also occur in GBPUSD, USDNH, and other USD pairs which reflect the strengthening of the US dollar.

WTI oil also gapped, with the open price much higher than the previous close. WTI oil price is now around 73.34.

In the crypto market, Bitcoin plummeted, at around $96k and there was a wide gap down.