Hello world, how are you today? May all the people of the earth always be peaceful and prosperous, sharing kindness and avoiding greed.

Back to my trading journal today, I’m revisiting the forex market and writing a few words about trading activities with all their risks and potential gains.

Some positions ended with take profits in Silver, but there were also some losing positions.

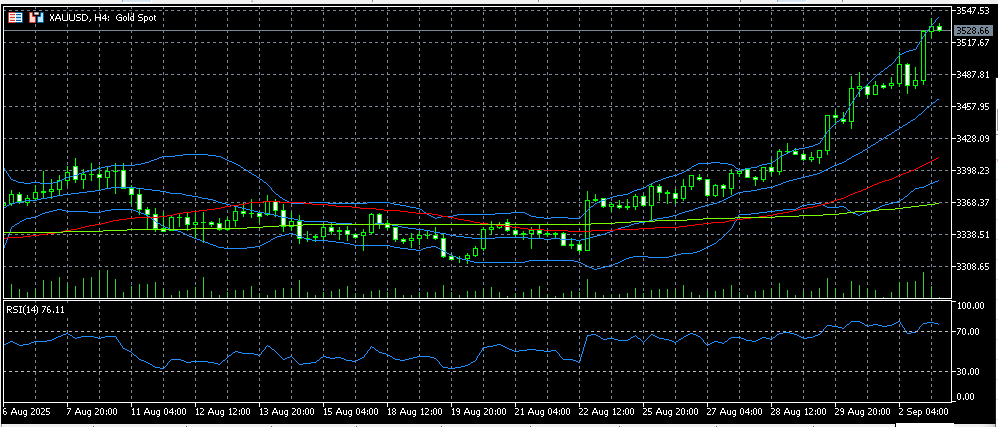

Gold prices are now soaring again, reaching around 3529, with pending orders far from being touched due to the strong bullish trend. This rise in gold prices appears to be fueled by expectations that the Fed will cut interest rates at its September meeting this month. A 25 basis point cut is expected. This policy move could support gold prices if they are actually decided. The rumors appear to have influenced gold’s rise even further.

On the other hand, Bitcoin, which some consider digital gold, is trending bearish. Although it rose to around $111,000 yesterday, the price is still below its 20-day moving average (MA20), reflecting a downtrend.

Meanwhile, WTI oil prices have risen, leaving the consolidation zone and breaking the upper band at around 65.25.

Today, JOLTS job opening data will be released, which may change the direction of the market.