Hello world, how are you today? The rain has poured quite heavily on the farmers’ fields, giving hope that the crops will produce an abundant harvest.

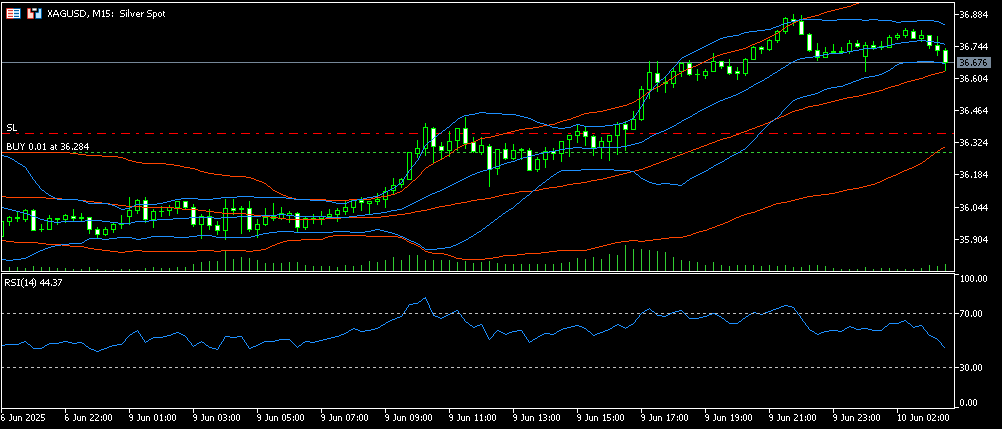

Back to my trading journal today, write again some words all about the ins and outs of forex trading activity with all the risks and gains involved.

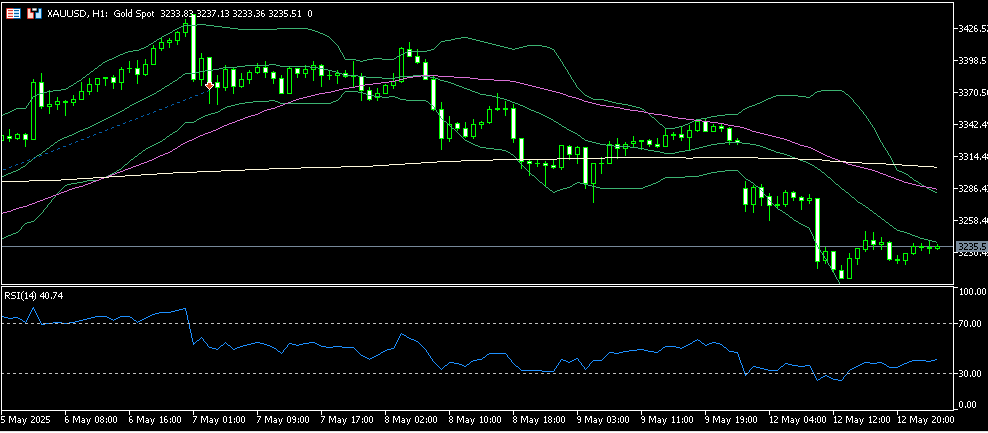

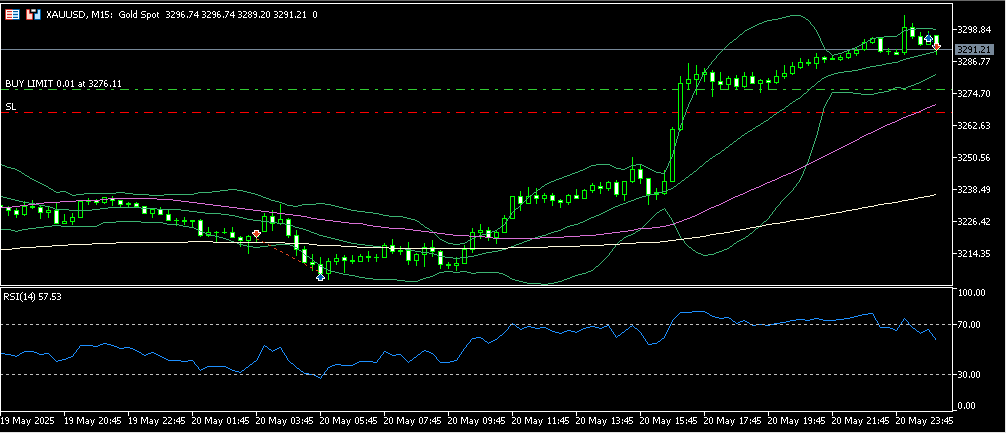

The market on Monday gapped in several currency pairs, including the precious metal gold, which experienced a wide bearish gap. Usually, the price then covers the gap, but yesterday the gold price extended its decline, and the gap has not recovered. The decline in gold was more due to the strengthening of the US dollar after the release of news of the China and US trade tariff cut agreement, which was delay for up to 90 days.

The US dollar index rose as seen from the DXY, which jumped to 101,977 from a low of 100,510. The strengthening USD weakens gold as an asset that does not provide a return. However, gold is still affected by the geopolitical risk of the India-Pakistan war and Netanyahu’s plan to eliminate the Palestinian population.

Meanwhile, Bitcoin yesterday fell slightly and hit the stop loss in profit at 101643, and now Bitcoin is at the 102k level near the lower band. RSI is at level 52 with an upward channel indicating bullish sentiment. Meanwhile, Coinmarketcap’s Fear and Greed index shows a level of 73, slightly down from 75, still indicating the market is in a greedy phase.

Meanwhile, in the oil market, WTI had risen to a high of 63.13, falling again at 61.50, drawing a long wick on the top candle.

Today, we are waiting for US CPI data, which may drive market volatility because it is the data used by the Fed regarding interest rate policy.