So I am starting this thread to keep track of my trades and to obtain a bit of help from other traders, should they stumble across my thread. I am a naked trader who has just started his forex career and trying to gain experience through trial and error on a demo trading system until I can prove myself slightly profitably at which point I will start injecting capital into my account. See you on the other side.

Okay, so I am currently in 3 trades.

- USDCAD SHORT : Got in on this yesterday as I seems to have broken through a long term trendline on the D1, retested and I believe, will continue lower. currently at -90.00

- CADCHF SHORT: although it may seem counterintuitive, I am in another (and opposite) CAD setup. This pair, like the UC has broken and retested a trendline in the H4 this time. Hoping for continuation lower again. currently +40.00

- EURAUD SHORT: This was a pretty dumb position taken as a naked trader but I got in because I accidentally had a 200 EMA crossover and had to do it. I understand that this is a stupid idea and will have more control in the future. -50.00

Note: I really need to get an account promotion so that I can start to post photos and stuff.

Thats all for today

Update: Closed USDCAD early as it broke well above the trendline and was most likely a fakeout. Will be looking for a retest to the trendline again to go long this time. -118

Update 2: Closed CADCHF shortly after with a profit of 91 euro as I feared that i would go against me which when waking up this morning, I discovered was right.

Update 3: EURAUD has actually spun around overnight and is moving in my favour. Currently at +15 euros ad will leave for a coupe of hours and see what happens.

Don’t be too hard on yourself, I’m short on EUR/AUD too. As long as this isn’t a fake-out then it should continue down. If it is then we’re both wrong.

Good luck!

Really good news to hear!! Thanks

Just realised that I actually can post photos so more will be added soon

Day 2 of new trading journal.

Still short on EURAUD and up 51euro so far. Hoping to return about 200 from it if all goes as planned.

Sell limit was triggered on EURGBP as I noticed a pretty strong supply zone that was created on the 5th. Up around 70euros right now and looking for around 170euros at TP.

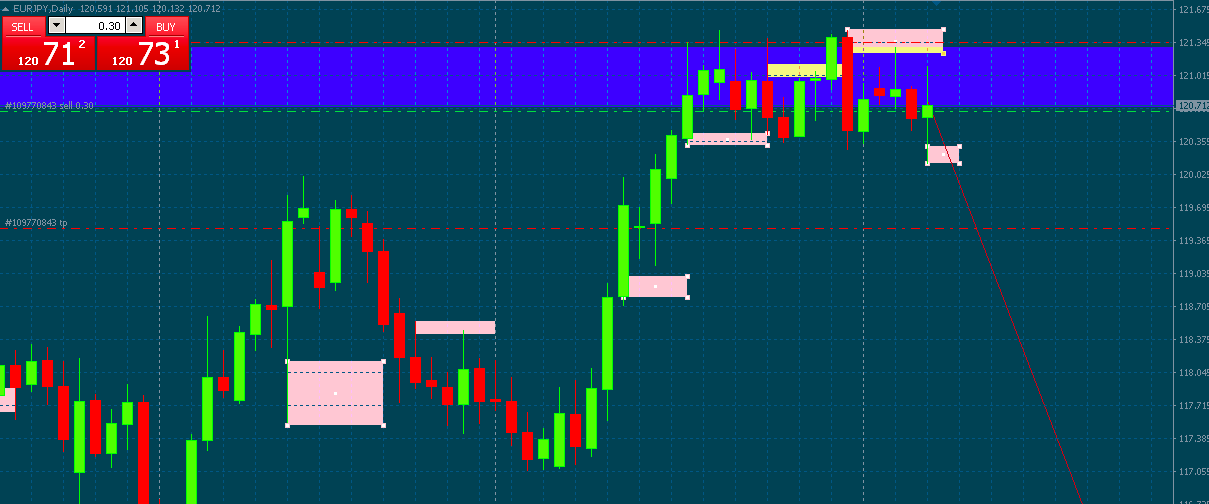

Lastly, I’ve just had a sell limit triggered on EURJPY as there was a long term supply zone on the D1 charts also seeing a triple-top-like formation coming to an end which I can hopefully ride out to about 300 euros profit if all goes well. Used a tighter stop loss as I’m just starting to use supply and demand zones and I am a bit wary of using the D1 charts as I have more to lose with a further SL.

currently -17 euros.

Update: Got spooked and closed EURAUD with 82 euro profit, price then reversed two hours later. happy with my decision.

EURGBP was also closed early which then reversed meaning I was correct again. Took 108 euro profit.

Today started poorly as a my buy stop on XAUUSD was triggered and reversed immediately hitting my SL. Im thinking that price might reverse again so there is a potential re-entry there. -139 on that one

Still looking at EURJPY, currently at -15 but not much happening at the moment.

I have re-entered a sell on EURAUD as price hit a trendine and looks as though it will reverse towards the support at 1.60213.

Update: EURJPY moved in my favour. Only managed to take +70 on this as price was weakening

EURAUD went against me and hit stop loss. SL was definitely too tight, I believe that price will continue to the downside tomorrow.

I’ve entered a short order on EUR/AUD also, I see it as bearish, more bearish than EUR/JPY, which is just confusing.

Just as a note - the AUD/CHF chart is virtually the inverse of EUR/AUD. But I feel I’d rather be short EUR/AUD than long AUD/CHF. I can’t say why exactly, but I would move towards pairs comprised of the larger currencies first, before I get down to the smaller currencies in the big 8.

OK, I took a few days away from posting on the thread as I am rewiring my brain and my trading strategy. After some advice from another trader and constant clues given to me by other traders on forums like these, I am moving to longer-term, HTF trading. No more scalping, no more looking for short term trading on any time-frame below 4H (possibly with the exception of the 1H from time to time. I will definitely be still using the 1H for entry points but no more soul trading from LTFs.

So by kicking off my new strategy. I moved up to the Daily and Weekly Time Frames and started mapping S/R levels, Support and Resistance, trendlines etc…

At the moment, I am in the following trades (all short).

CADCHF

EURJPY

AUDCAD

Using smaller lot sizes and wider stops for all of these. Won’t put up screenshots as it will take too much time but will begin posting them as I close them.

Peace

Took a sell last night (actually on my live account as I am trying to regain some of my original capital which I lost through stupid beginner decisions) on NZDJPY which turned against me almost immediately after taking it. Still looking positive in the long term though, I predict that we might get another bullish candle towards the trendline and hopefully followed by a reversal taking price down to the S1 line. Poor risk management being used here as I am risking about 6.5% but as there is so little left in my trading account, this is my last effort to regaining some capital. (65 euros left in account so by using a lot size of 0.01, I am already risking more than 3 percent by setting a decent SL)

Getting back to the demo trading where I use proper money management (which is ironic since I’m using fake money). As I mentioned in the last post, I am short CADCHF which made a nice turn last night. Currently entering most trades with two orders as MT4 does not allow you to set two targets for TP (for example does not allow you to close 50% of your trade once it hits a certain point). As far as I know, this is the case but if you happen to read this post and know differently please let me know.

So, by having two orders of the same amount. I was able to save some profits this morning (about 49 euros) and then moved the SL for the other order to Breakeven so now I am essentially risk-free.

Pretty much the same deal with AUDCAD at the moment. Using two orders, I set two separate take profit marks to preserve profits. First TP was hit about 2 minutes ago on AUDCAD and I will now move the SL for the remaining order to BEP so that I will be risk free on this trade also. I am also considering the advice given to me by another trader on another post of mine who advised me to forget about TP and essentially “let my winners run”. If I see a possibility of one of these Risk Free trades going further, I may move my SL a little more into profit and try to forget about it for a couple of days and come back.