Nasdaq 100 faces reversal risk if dovish rates narrative unravels

- The Fed cited tighter financial conditions as a factor likely to restrain inflation earlier this week

- Ever since financial conditions have been loosening rapidly

- If incoming data remains firm, it may force the Fed to rollback the less hawkish tone offered only a few days again, increasing reversal risk

Fed cedes power to markets to finish inflation fighting job

When Jerome Powell stunned markets with an eight-minute hawkish speech at Jackson Hole last year, he warned “the historical record cautions strongly against prematurely loosening policy” to defeat inflation, pledging the FOMC would “keep at it” until the job is done.

For the most part, Powell has stuck to his guns, tightening policy through pockets of market volatility, refusing to lose sight of the goal. Despite progress in bringing inflation back to acceptable levels, his job is not done yet. Just look at underlying price pressures in the CPI and PCE reports for September, coming in far stronger than what markets expected. It’s still far too hot for comfort when labour market conditions remain so tight.

Fed not “keeping at it”

That’s why I was stunned the Fed has decided now, having come so far in the inflation flight, to offload the responsibility of finishing the job to financial markets by introducing financial conditions as a key consideration for policy settings.

“Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” the November FOMC stated, adding “financial” to the sentence offered three months earlier. It implies that if markets are doing the work in taming inflation, then there’s no need to continue tightening official policy rates.

This is not “keeping at it”. This is a mistake. It’s allowing markets to dictate how the Fed should respond to the inflation challenge. Is it any wonder risk assets have been off to the races since the meeting concluded, loosening financial conditions dramatically? This creates a huge problem for the Fed the longer it persists, unless near-term economic data confirms the loosening in conditions is warranted.

Strong US data risks hawkish tone and reversal risk

It makes the October payrolls and ISM non-manufacturing PMIs releases later today even more important. If they continue to demonstrate strength, it means the Fed will likely have to rollback the dovish messaging as quick as it arrived. Otherwise, inflation may accelerate again, making the same mistakes of the past that Powell wanted to avoid.

That’s the risk.

Unless we see payrolls and services activity soften, the hawkish messaging will have to return, creating renewed downside risk for those markets that ran the hardest post the Fed meeting.

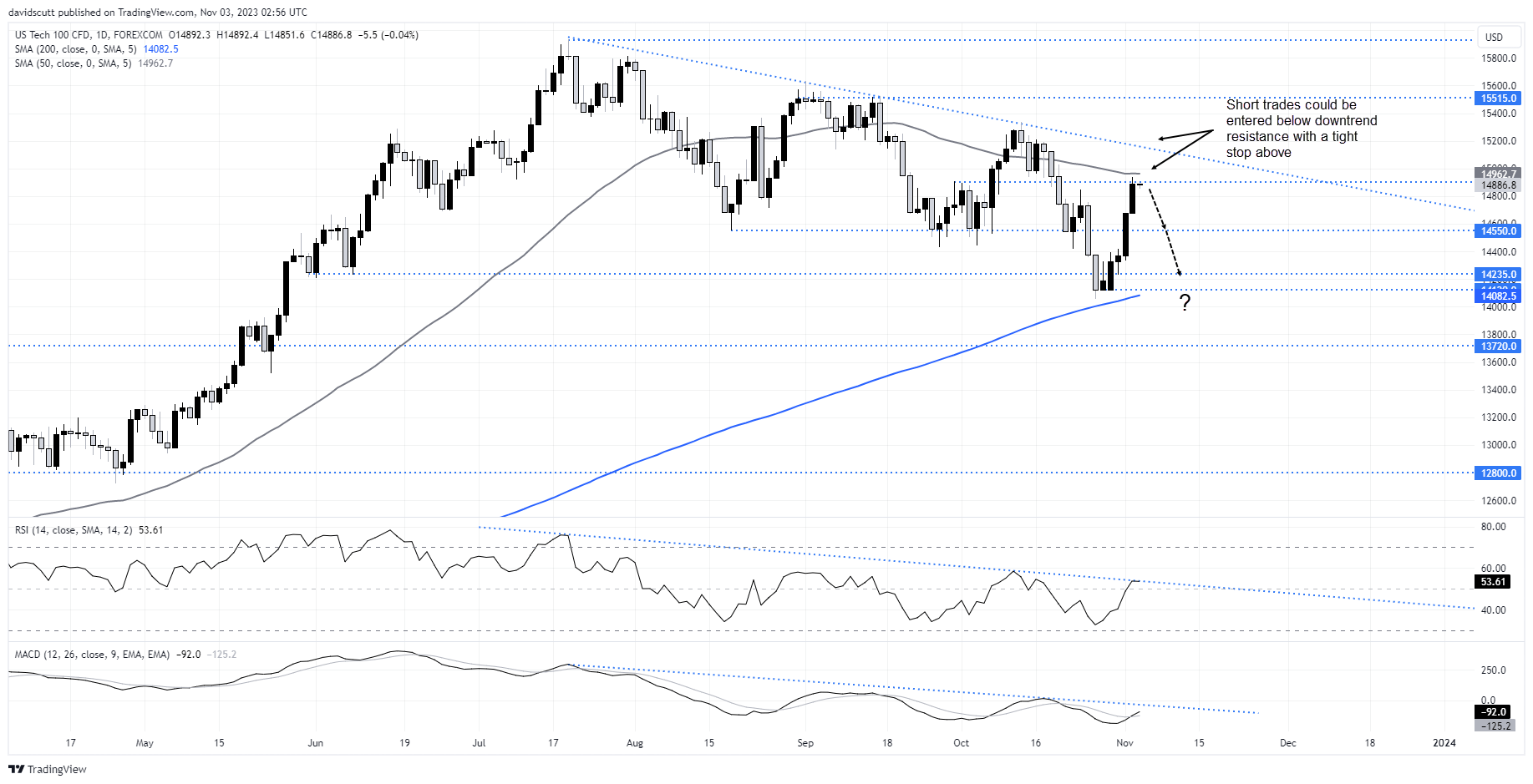

Nasdaq 100 vulnerable to shift in rates narrative

The Nasdaq is one market that comes to mind after surging around 6% from the recent lows, taking it back towards downtrend resistance around 15170. With Apple down heavily in afterhours trade and having stalled around minor resistance at 14900 on Thursday, any change of narrative around the rates outlook will make it vulnerable to a reversal. It’s obvious plenty of shorts have been squeezed in recent days, so positioning is likely to be a lot more balanced than the start of the week. Interestingly, despite the speed of the move, RSI and MACD are yet to confirm a shift in momentum.

For those who believe the market has run too hard too fast, a short around these levels, or even a little higher if optimism in early European trade spills over into US futures, could us the proximity of downtrend resistance, allowing a tight stop to be placed above. On the downside, 14550 is the first target with 14235 and 200-day moving average at 14082 further below.

If the trade goes wrong with a break of uptrend resistance, traders will no doubt be thinking about the test of the 2023 highs just below 16000. That could present other trade opportunities, should it occur.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.