In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of NASDAQ ticker symbol: $NQ_F. In which, the decline from 13 December 2022 high ended 5 waves in an impulse sequence and showed a lower low sequence in a lower time frame charts. Therefore, we knew that the structure in NASDAQ is incomplete to the downside & should see more weakness. So, we advised members to sell the bounces in 3, 7, or 11 swings at the extreme areas. We will explain the structure & forecast below:

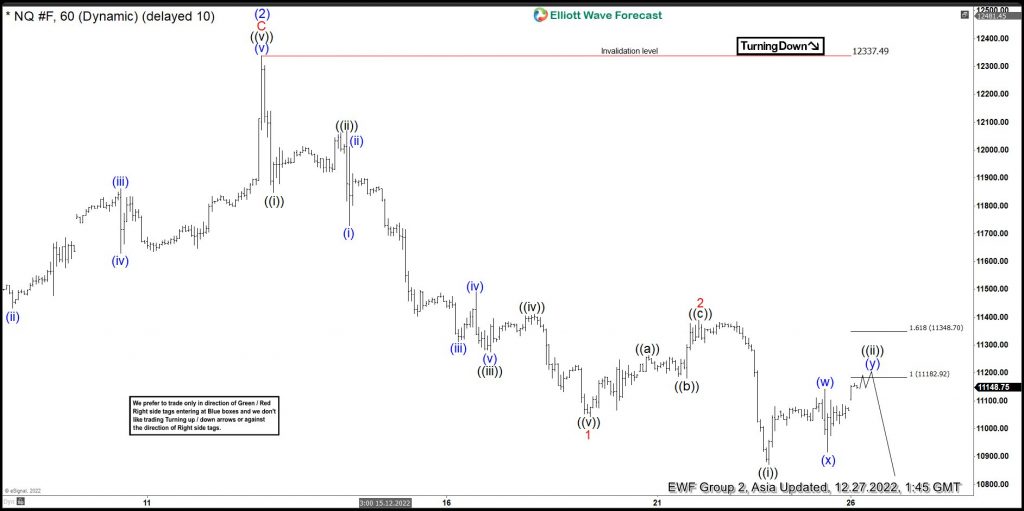

NASDAQ 1-Hour Elliott Wave Chart

Above is the 1hr Elliott wave Chart from the 12/27/2022 Asia update. In which, the decline from 13 December unfolded in an impulse sequence & showed a lower sequence where the index made a short-term bounce in wave ((ii)). The internals of that bounce unfolded as an Elliott wave double correction where wave (w) ended at $11143 high. Then a decline to $10916 low ended wave (x) pullback and started the (y) leg higher towards $11182- $11348 equal legs area from where sellers were expected to appear looking for more downside or for a 3 wave reaction lower at least.

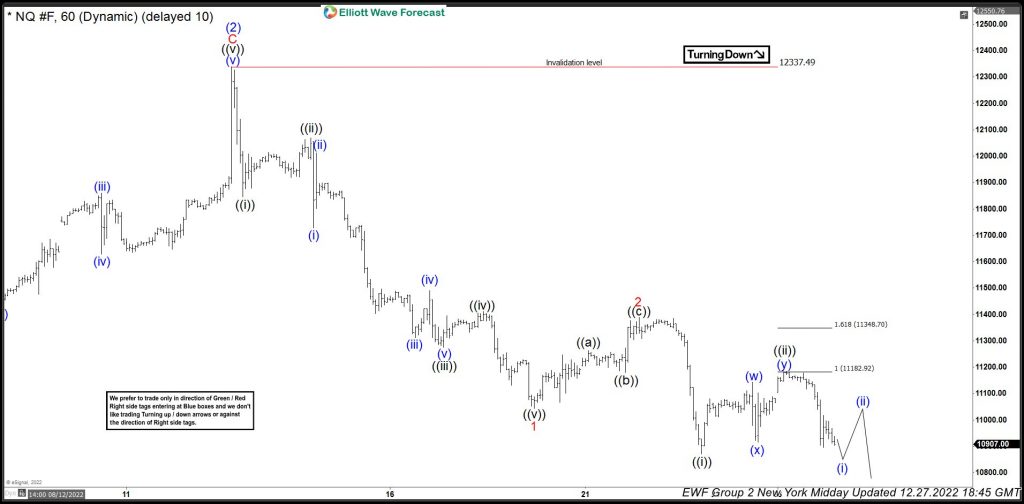

NASDAQ Latest 1-Hour Elliott Wave Chart

This is the Latest 1hr view from the 12/27/2022 Midday update. In which the index is showing a strong reaction lower taking place from the equal legs area allowing shorts to get into a risk-free position shortly after taking the position.

Source: https://elliottwave-forecast.com/stock-market/nasdaq-reacting-lower-equal-legs-area/