I am new to trying to use PA, candlesticks, and support/resistance in my trading. I would like to use candlestick patterns near support/resistance levels, but am unsure if I am reading the candlestick patterns right.

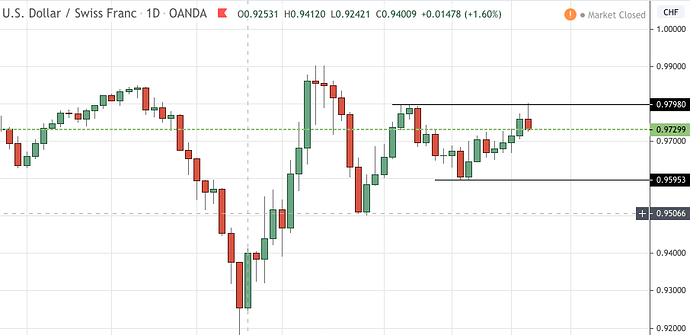

For instance, USDCHF chart looks to have a reversal candle at a resistance level. Am I reading this correctly? Any thoughts or help appreciated.

You have a series of lower lows You also have a series of higher highs. I say it is about a 51% chance that the next candle will be down. How far? The last candle could be a reversal sign, but it is not definite. It is more likely that price will stay within the range lines you have drawn. Possible it will sell down to the low of 4 days previous. When price works an inside range like this, trading loses volitility; meaning reduce price motion. I would look at this on the 1H chart and if trends align, there may be some pips profit in it.

thx for helping me out. I would like to make most my trades near support/resistance, but need to learn how to read the candlestick patterns better. I have been trying to study the different formations, but there is a lot there.

Do you perform top down analysis, looking at your highest timeframes and working your way down? Identifying the overall trend you have greater success trading with the trend. Also have you considered changing your view from candlesticks to lines, renkos or heiken ashi ? This sometimes helps to cut down a lot of the noise that candles create

Yep you’ve read the candlestick right here. It is a bearish pin bar at previous resistance. Notice the lower highs and higher lows showing that price is tightening up into a range likely before it breaks out. Ofcourse nothing is definite but in this case you have a few clear reasons to sell.

thx. I realize this prob. isn’t the best set up, but I am just trying to make sure I am reading the candlesticks somewhat correctly.

thx. I will check that out. I have been using that patternsite.com bc they list all the candle patterns and their success rates in %. There is a lot to take in. I am trying to narrow it down to looking for 2 or 3 setups, and playing those over and over.

The question has to ask is did you follow through with your analysis and how did that go??

At the present moment price looks like it is entering into a trading range. If you are a price action trader then what you are seeing is a bull leg in a trading range that is possibly going to see a reversal and become a bear leg in a trading range. The only way you can make money in that situation is sell high buy low and scalp.

That one bear candle that touches reistance and then pulls back is not enough price action for me to say that it is the start of a bear trend. It certainly has created a double top which is a definate signal that indicates that there could be a trend reversal however I personally would like to see further price action before I committed any of my hard earned $$$ taking the trade.

Cheers

Blackduck

What else would you like to see? I dont use price action so am interested.

I notice in your bio you are a full time day trader so I am curious on what interests you.

The chart in question has just one bear candle after 4 bull candles. So if I was going to short that setup off resistance I would like to see a big bear bar. A big bear bar would tell me that the bulls have given up and the bears are in control. That would be the trade with the highest probability.

As I am sure you are aware of that without further information it is hard to speculate on exactly what happened on that chart.

Blackduck

This is so really good input. I have not entered a trade yet. I would have to enter today when markets open back up. I will probably just watch and learn. I definitely wouldn’t predict a long term trend reversal. I see the trading range, so I wouldn’t expect this trade to move more than 200 pips down to that little support. And I am so new using PA, I don’t have any confidence in my accessments. Why I like to hear all your opinions. I am just soaking up the other angles.

I day trade with indicators only. It’s a mechanical system so I dont use price action or market structure. Always interested in other methods, just helps when people post questions.

How big would you want a ‘big bear bar’ to be? Because the range is about 200 pips in total and it’s already down by about 50 on the recent pin bar. So by the time you get another bar your risk to reward might not even be 1:1.

I did wonder he same. Small TP here in this tight range. I am assuming he wouldn’t even consider this trade bc risk/reward not too good if you waited one more bar down.

Also, how is the indicator approach working you? I just never found a system that was consistent. Why I am learning PA.

It’s working fine for me. Took a bit of time. I cant use PA, I find it’s too discretionary. Which is why I was asking the questions. . In this trade I wouldve said the sell looks good. We’re looking at the same chart but we’re seeing different things

oh, i see sell. But I am so new at PA, I was seeing what others thought. We’ll find out in 2 or 3 days I guess.

When you say you day trade do you use daily charts to enter and exit trades or do you analyis on a daily chart and take entries on a smaller timeframe?? I consider myself a day trader and never trade daily charts unless I am position trading using Options.

I trade on a 5 min chart and use an hourly chart to find support and resistance levels and market direction. With this in mind and in answer to the last part of your question, price action on a big bear bar on a 5 min chart, maybe only 10 to 20 pips.

There is nothing wrong with using price action on a daily chart but you are right a big bear bar maybe 200 pips but the subsequent down trend that start as a result of that move maybe 1000 pips. It’s all relevant. However a lot of traders don’t have sufficient capital to use the necessary wide stop loss placement to successfully trade on a daily chart.

I have used mechanical systems and there is nothing wrong with that if they work for you.

Here is an example:

Cheers

Blackduck

I trade off of smaller timeframes mainly 5, 10, 15 sometimes 30 min, so analysis and entry is off them. Ah I see what you mean. Yeah on a smaller timeframe the bars are not as large.

Looks like the sell worked out. Took a few days but thanks for pointing out the analysis.