NextEra Energy Inc (NEE) generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity through wind, solar, coal, nuclear & natural gas. It is based in Juno Beach, Florida, comes under Utility sector & trades as “NEE” ticker at NYSE.

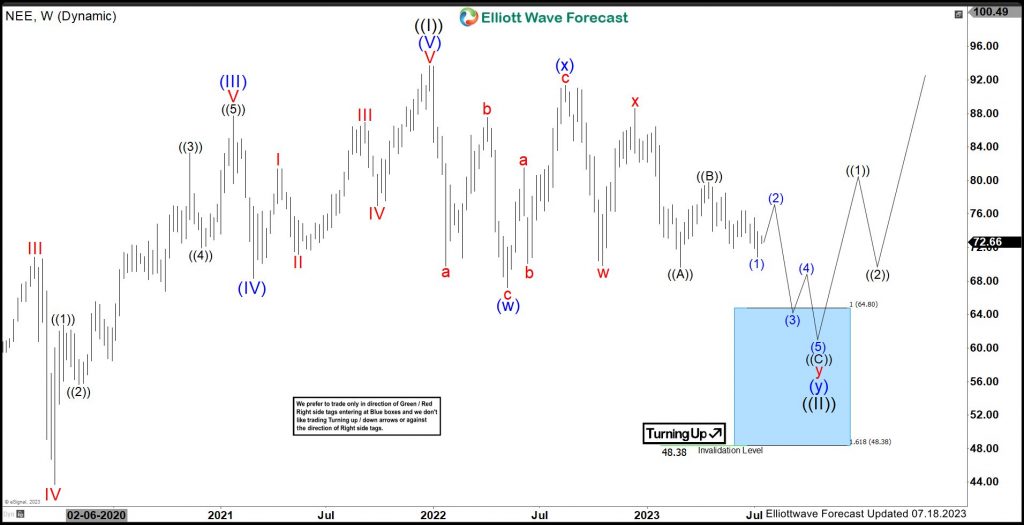

NEE made an all time high of $93.73 as impulse sequence as ((I)) & favors lower in ((II)) as double correction. It expects to remain sideways to lower & find the next support between $64.80 - $48.38 area before rally resumes.

NEE - Elliott Wave Weekly Latest View:

In weekly impulse sequence higher, it placed (III) at $87.69 high & (IV) at $68.33 low. Above there, it finished (V) as diagonal at $93.73 high as ((I)) in December-2021. Below there, it favors pullback in double correction in ((II)). It placed (w) at $67.22 low in 3 swing pullbacks. In (w), it ended a at $69.79 low, b at $87.52 high & c at $67.22 low. It bounced off in (x), ended at $91.35 high. In (x) connector, it placed a at $81.49 high, b at $75.77 low & c at $91.35 high as 3 swing sequence.

Below (x) high, it placed w of (y) at $69.81 low & x at $88.61 high. It favors lower in y of (y) in 3 swing sequence & expect to remain sideways to lower. It favors lower in ((C)) of y of (y), while bounce fail below ((B)) high of $79.78, which confirms below ((A)) low of $69.64 and extend towards $64.80 - $48.38 area to finish ((II)) correction. We like to buy from the blue box area for next sequence higher or at least 3 swing reaction higher. Alternatively, if it breaks above $79.78 high, it can either extend ((B)) leg before turning lower or can be x connector, while placed w at last low in (y) leg.