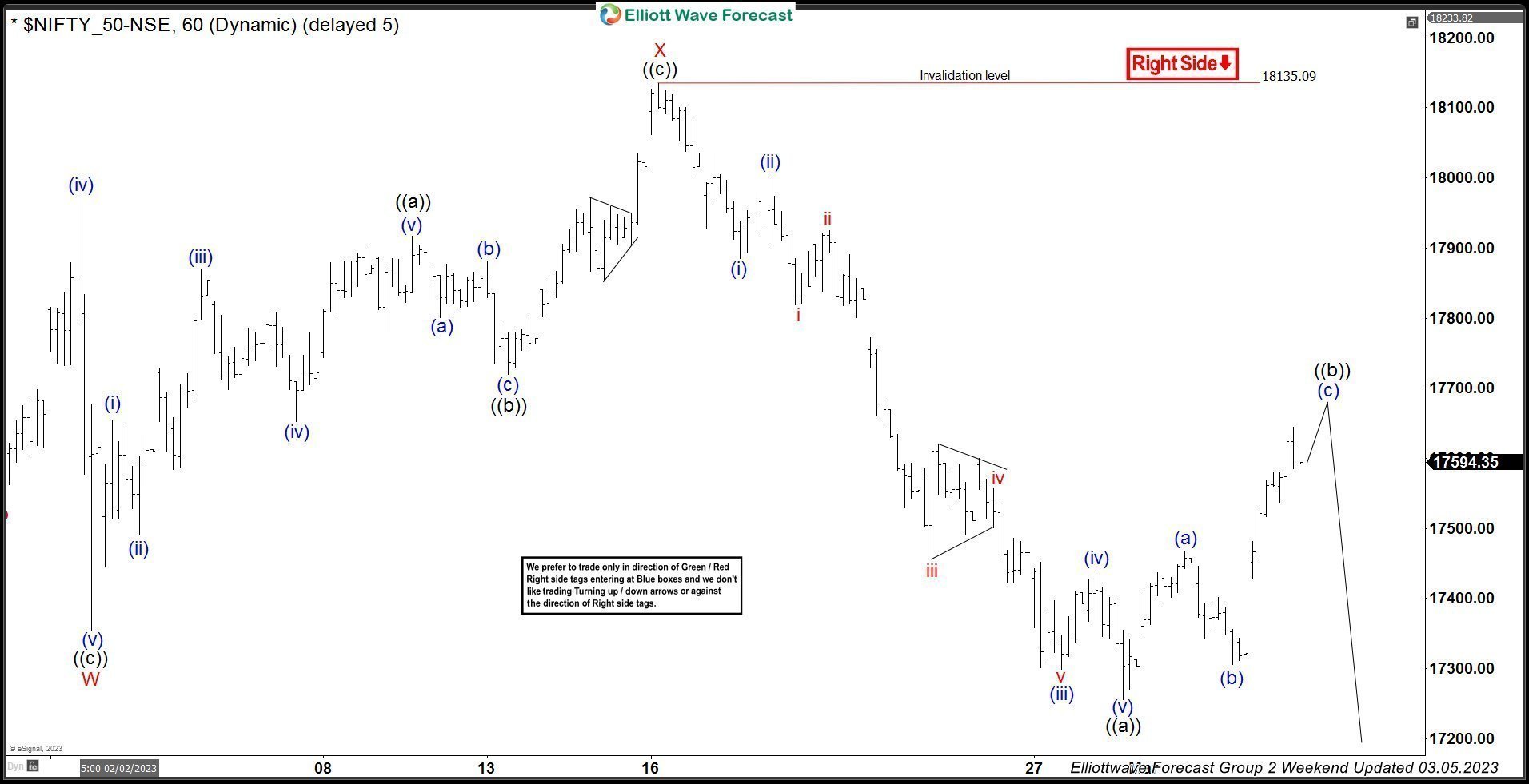

Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of NIFTY Index published in members area of the website. As our members know NIFTY is showing incomplete sequences from the 18887.6 peak. Recently the index made short term recovery against the 18135 high. It made clear 3 waves up from the lows and found sellers as were expecting. In further text we’re going to explain the Elliott Wave pattern and forecast.

NIFTY 1h Hour Elliott Wave Analysis 03**.05.2023**

Current view suggests cycle from the 18887.6 peak peak is still in progress as potential Double Three Structure. The price is showing incomplete lower low sequences, which suggests further weakness as far as 18135.09 pivot holds. At the moment NIFTY is giving us 3 waves recovery in wave ((b)). Once recovery completes we expect to see further downside toward new lows.

You can learn more about Elliott WaveDouble Three and Zig Zag Patterns at our Free Elliott Wave Educational Web Page.

NIFTY 1h Hour Elliott Wave Analysis 03**.10.2023**

NIFTY found sellers as expected and made nice turn down, approaching previous low. At this moment we count (b) recovery completed at the 17794 high. However, we would still need to see break below 17262 low to confirm next leg down is in progress. Once we get that break that will be confirmation (c) blue is in progress toward 16622 area ideally.

Keep in mind not every chart is trading recommendation. You can check most recent charts and new trading setups in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Source: https://elliottwave-forecast.com/stock-market/nifty-elliott-wave-calling-decline/