Hello Traders, in this article we will analyze our forecast of the Nasdaq Futures in the short term cycle. Since the short term peak of NQ_F from 05.01.2023 to end wave (i) we have been expecting a pullback within wave (ii) to take place. Here at Elliott Wave Forecast we have in place a system that allows us to measure an area in which we can expect a react to take place.

We call it equal legs area or blue box area as you might have seen within our charts. These areas provide us with at least an 85% chance of a minimum of 3 waves bounce or reaction to take place. We can use these areas to enter in the market with a defined entry, Stop Loss and exit strategy.

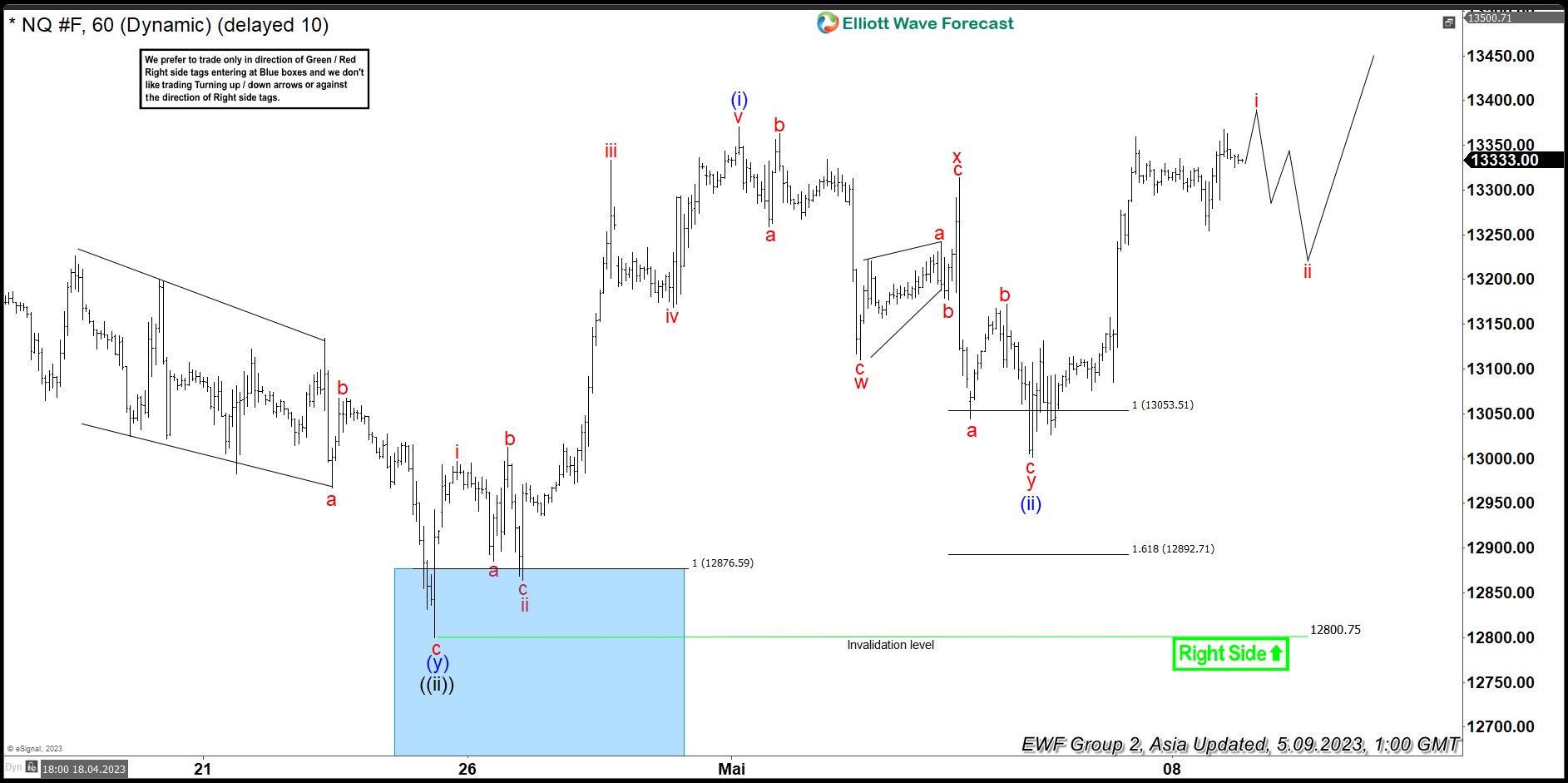

Let’s have a look now on the 1 hour chart of Nasdaq futures as provided to members from 05.04.2023. We have been within the equal legs area within a swing lower missing to end the cycle.

NQ_F 1 Hour Asia update 05.04.2023

As we can see the market has bounced within wave (x) of ((iv)) and we have been forecasting little more downside within wave c of (y) of ((iv)) to end within equal legs area of 13053.51 - 12892.71. Fast forward, towards the latest update now from 05.09.2023 Asia update we will see that the market has already reacted higher and what we expect next.

NQ_F 1 Hour Asia update 05.09.2023

A very clear reaction higher started taking place from 05.04.2023 within the equal legs area 13053.51 - 12892.71. Reaction higher as an impulse within wave i of (iii) of ((iii)) expecting a ii pullback. Afterwards a wave iii of (iii) higher is expected to take place. We have switched the view to a more aggressive one.

[Edited for Forums Policy violation]