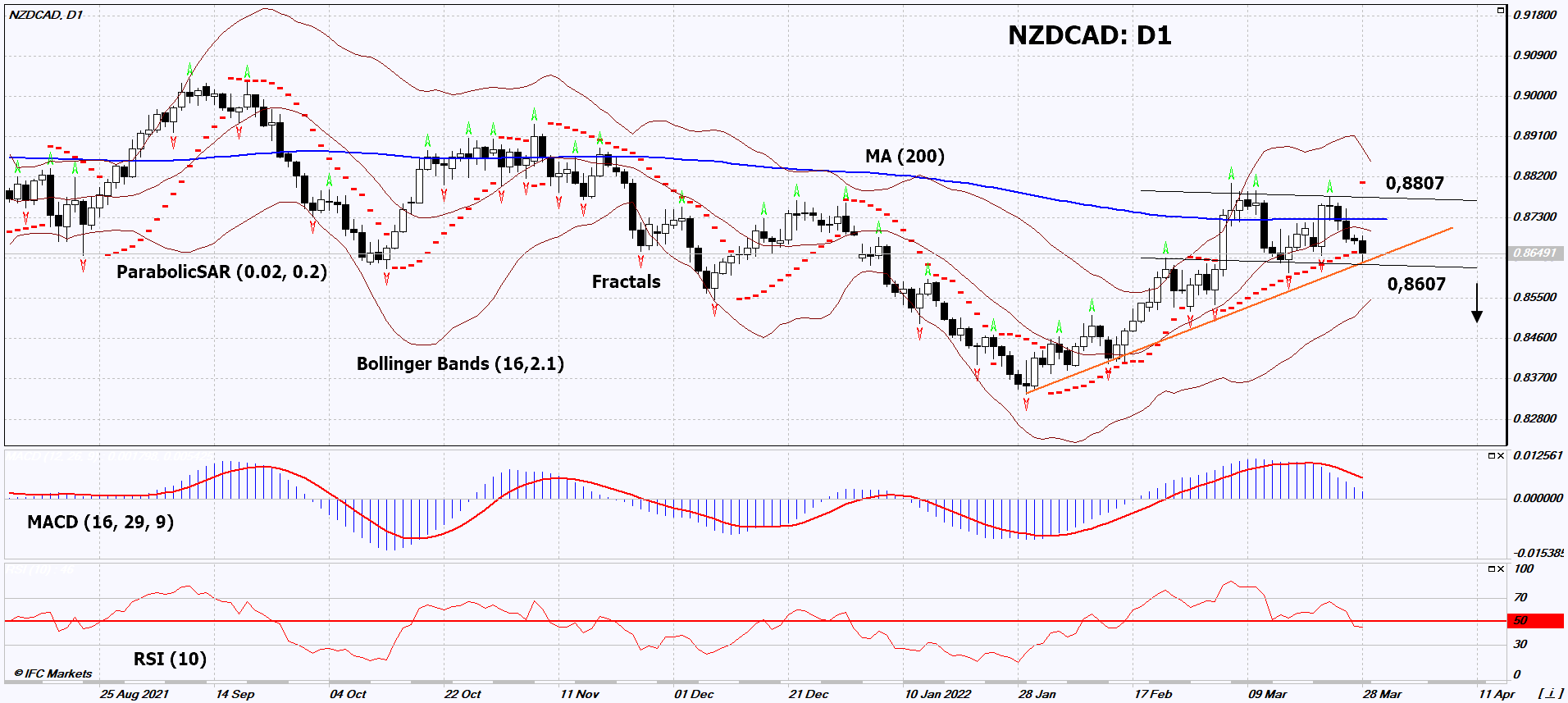

NZD/CAD Technical Analysis Summary

Sell Stop։ Below 0,8607

Stop Loss: Above 0,8807

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

NZD/CAD Chart Analysis

NZD/CAD Technical Analysis

On the daily timeframe, NZDCAD: D1 failed to exceed the 200-day moving average and started to decline. The chart approached the uptrend support line. It must be broken down before opening a position to sell. A number of indicators of technical analysis formed signals for further decline. We do not rule out a bearish move if NZDCAD: D1 falls below the last 2 down fractals: 0.8607. This level can be used as the entry point. Initial risk cap is possible above the last 3 upper fractals, the 200-day moving average and the Parabolic signal: 0.8807. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal high. Thus, we are changing the potential profit/loss ratio in our favor. The most cautious traders after making a trade can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (0.8807) without activating the order (0.8607), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - NZD/CAD

The Chinese authorities have announced a lockdown due to the novel coronavirus outbreak. Will the decline in NZDCAD quotes continue?

The downward movement means the New Zealand dollar is weaker against the Canadian dollar. According to Statistics New Zealand, China’s share of New Zealand’s exports has been about 50% over the past 12 months. The Chinese lockdown could further worsen New Zealand’s foreign trade performance. It should be noted that in February of this year, the New Zealand Trade Balance 12-Months (trade balance for 12 months with all countries) has already demonstrated a record deficit of -$8.37 billion. In turn, the Canadian dollar may strengthen due to high world oil prices and natural gas. Some investors are hoping for a Bank of Canada rate hike at the next April 13 meeting. Now it stands at 0.5% with inflation of 5.7% y/y in February. It should be noted that the meeting of the Reserve Bank of New Zealand will also be held on April 13. Its rate is now equal to 1% with inflation in the 4th quarter of 2021 5.9% y/y. The New Zealand Consumer Price Index for Q1 2022 will be released on April 20. According to forecasts, it can fly up to 6.4% y/y.