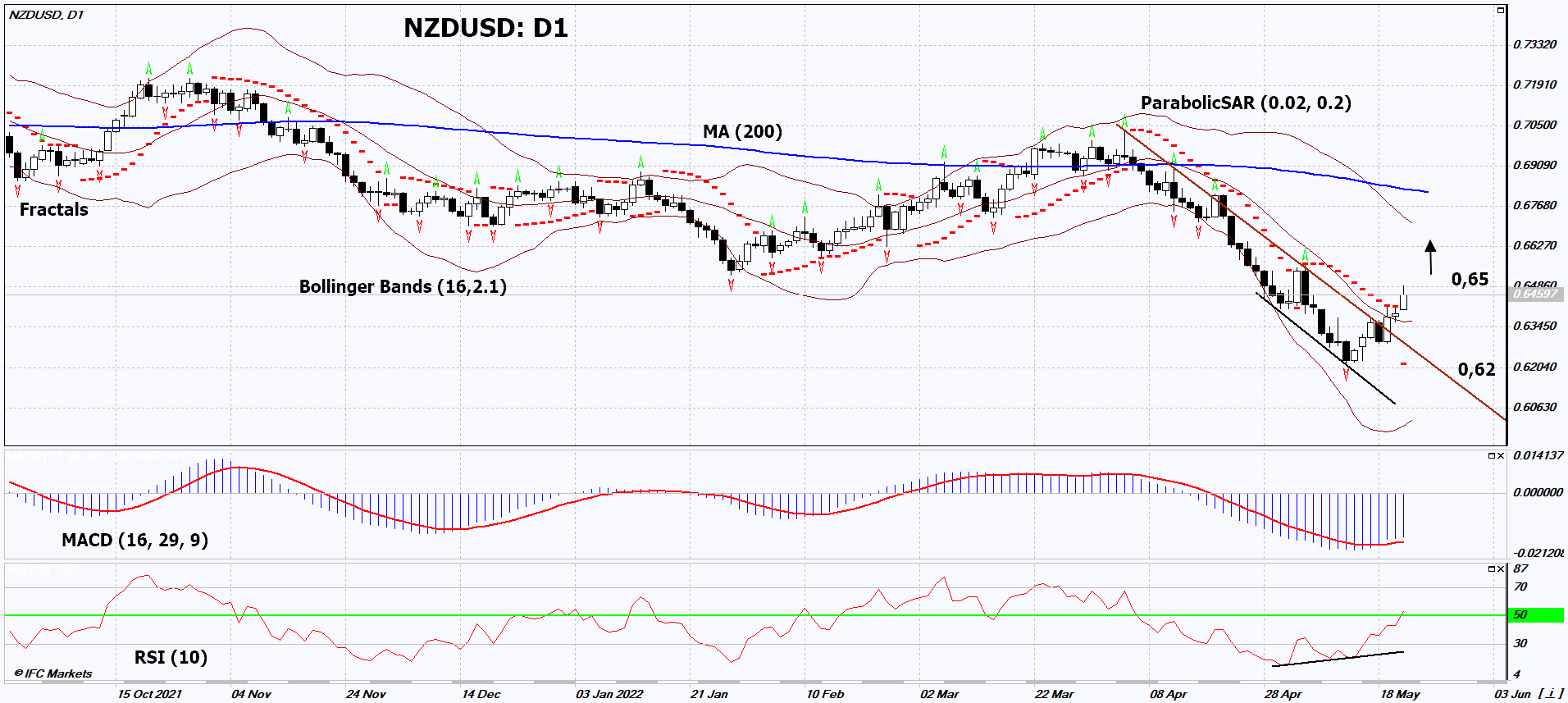

NZD/USD Technical Analysis Summary

Buy Stop։ Above 0,65

Stop Loss: Below 0,62

| Indicator | Signal |

|---|---|

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

NZD/USD Chart Analysis

NZD/USD Technical Analysis

On the daily timeframe, NZDUSD: D1 came out of the downtrend up. Some indicators of technical analysis have formed signals for a further increase. We do not rule out a bullish movement if NZDUSD rises above the last high of 0.65. This level can be used as an entry point. The initial risk cap is possible below the Parabolic signal and the last down fractal: 0.62. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thereby, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (0.62) without activating the order (0.65), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - NZD/USD

Investors do not rule out an increase in the rate of the Reserve Bank of New Zealand. Will the NZDUSD quotes continue to rise?

The next meeting of the Reserve Bank of New Zealand (RBNZ) will be held on Wednesday, May 25. Investors do not rule out that bank will immediately raise the rate by 0.5% to 2% from the current level of 1.5%. Prior to this, RBNZ raised the rate 4 times in a row. However, it is still well below inflation, which hit +6.9% y/y in Q1 2022. This is the highest since the 2nd quarter of 1990. The forecast for New Zealand consumer price growth in the 2nd quarter of 2022 is +8% y/y. However, the data will not be released soon - July 17th. However, inflationary expectations may make the RBNZ more determined to continue tightening its monetary policy. Note that on May 24 in New Zealand will be published significant statistics on retail sales for the 1st quarter of this year. A positive factor for the New Zealand dollar may be the plans of the Chinese authorities to lift the coronavirus lockdown in Shanghai from June 1st. China is New Zealand’s main trading partner, accounting for almost 30% of its exports.