In this technical blog we’re going to take a quick look at the Elliott Wave charts of NZDUSD pair published in members area of the Elliottwave-Forecast.com . As our members know, cycle from the 10/01 low is unfolding as 5 waves structure. Recently we got 3 waves pull back against the 0.6316 low. The pair found buyers at the Equal Legs, blue box area as we expected. We were calling for further rally within the October cycle. In further text we’re going to explain Elliott Wave Forecast.

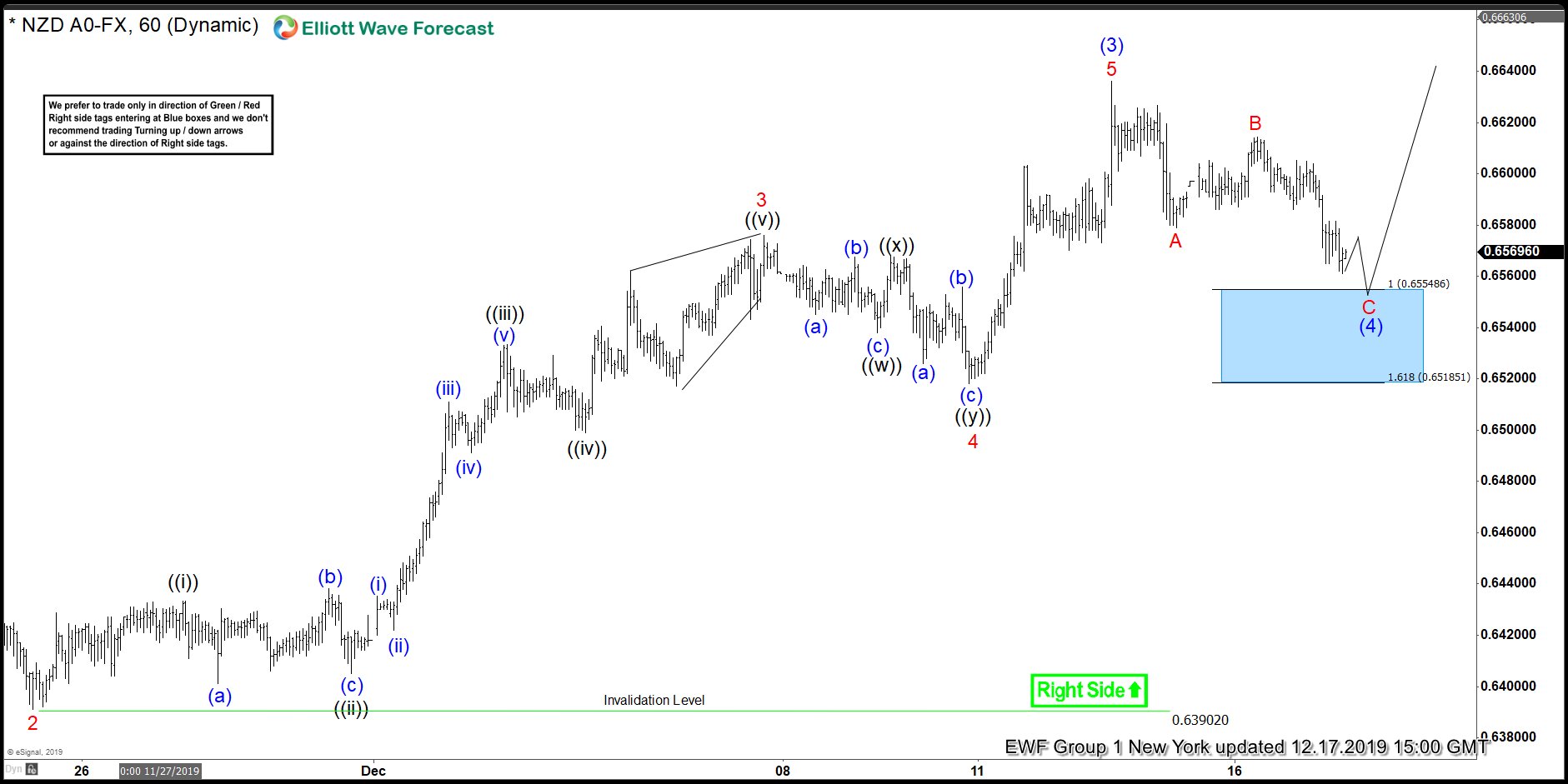

NZDUSD 1 Hour Elliott Wave Analysis 12.17.2019

NZDUSD ended short term cycle from the 0.6316 low as 5 waves rally, labeled as wave (3) blue. Now we are getting wave (4) blue pull back against the 0.6316 low. Current view suggests the pull back is unfolding as Elliott Wave Zig Zag Pattern. Correction looks incomplete at the moment. The price hasn’t reached equal legs/ blue box area yet. We expect to see another leg down toward Blue Box area: 0.65548-0.65185. At that area we expect buyers to appear for proposed rally or 3 waves bounce at least. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a bounce.

You can learn more about Elliott Wave Zig Zag Patterns at our Free Elliott Wave Educational Web Page.

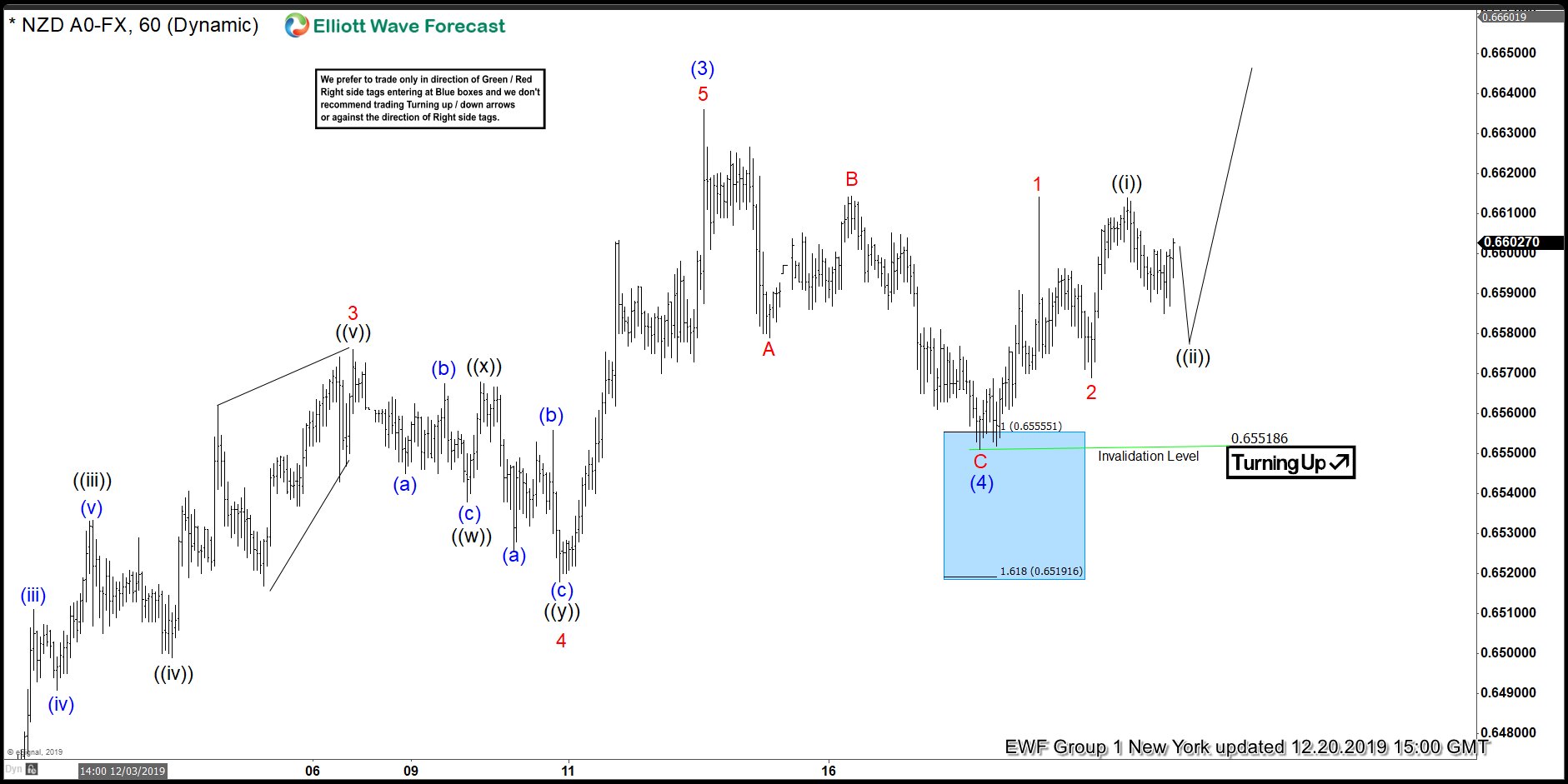

NZDUSD 1 Hour Elliott Wave Analysis 12.20.2019

NZDUSD found buyers at 0.65548-0.65185 , the Blue Box area. We got nice reaction from there so far. At this stage we are calling wave (4) blue pull back completed at 0.65518 low. We would like to see further extension higher and break above 12/13 high to confirm next leg up is in progress. Otherwise break below current short term low : 0.65518 would open possibility for a deeper correction in 7 swings.

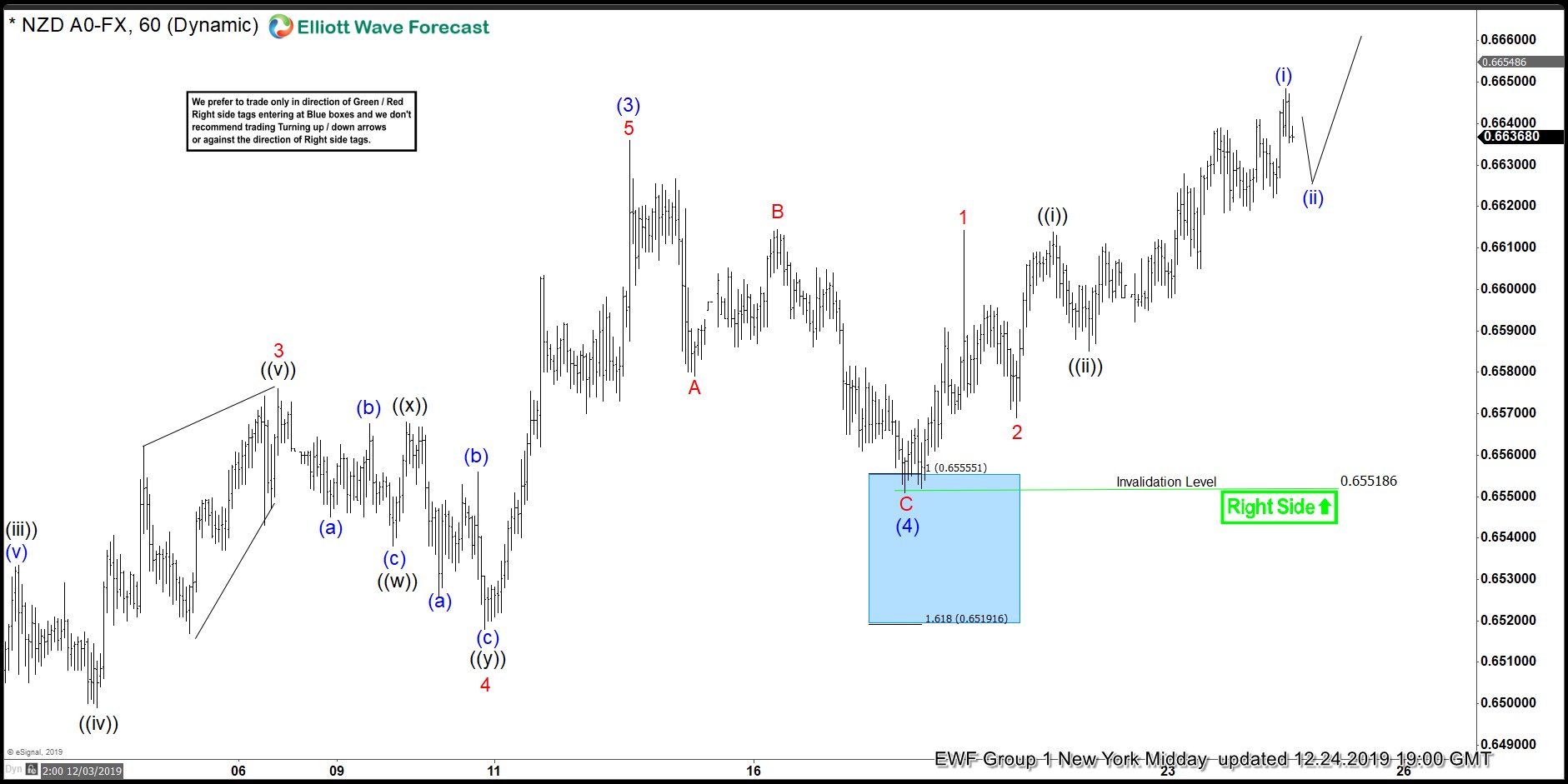

NZDUSD 1 Hour Elliott Wave Analysis 12.24.2019

Eventually we got further separation higher and the pair broke 12/13 high as we expected. Current view suggests further extension higher within wave (5) as far as pivot at 0.65518 low stays intact.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences.We put them in Sequence Report and best among them are shown in the Live Trading Room.