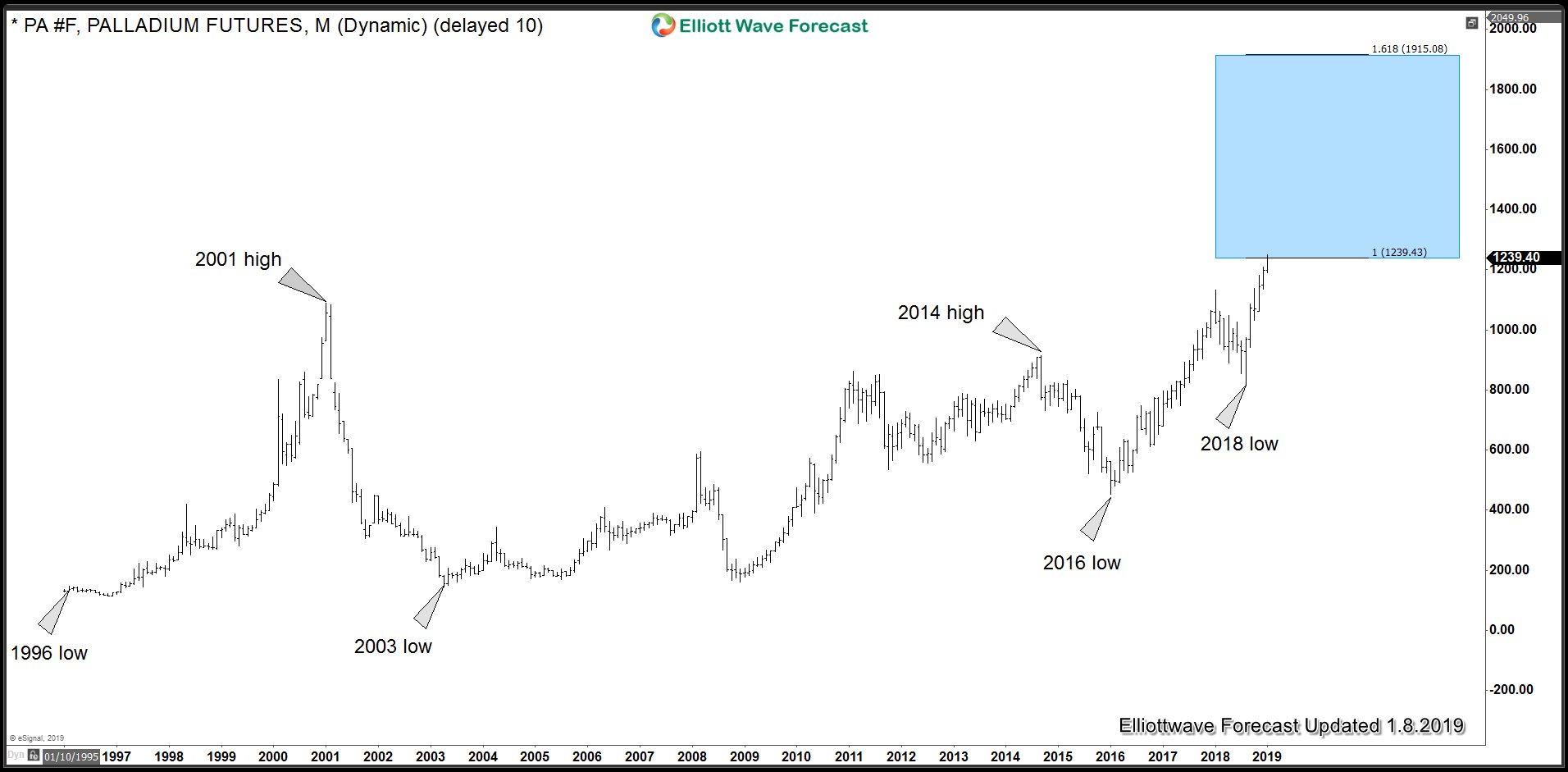

Palladium (PA_F) Buying Opportunity Ahead?

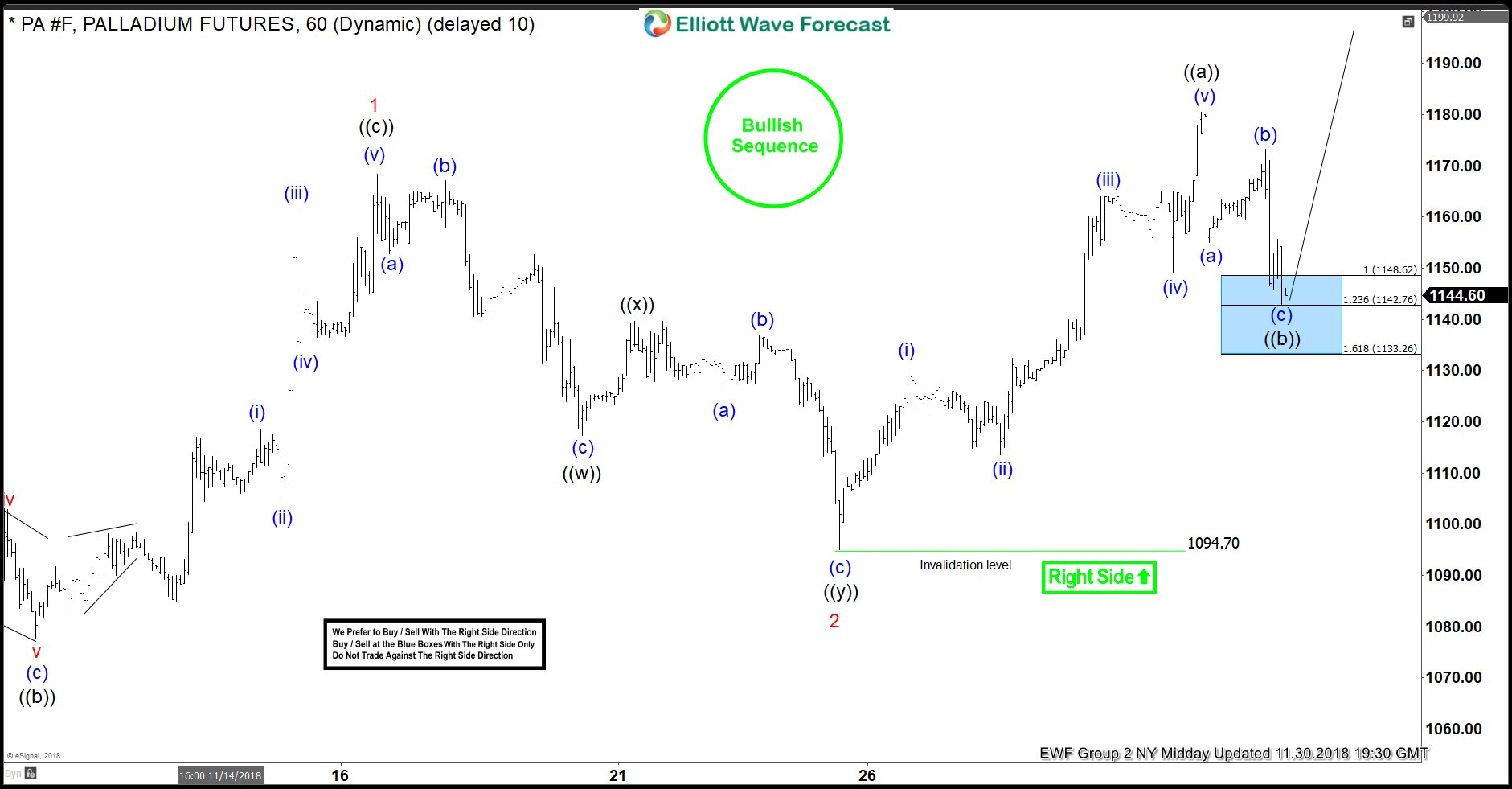

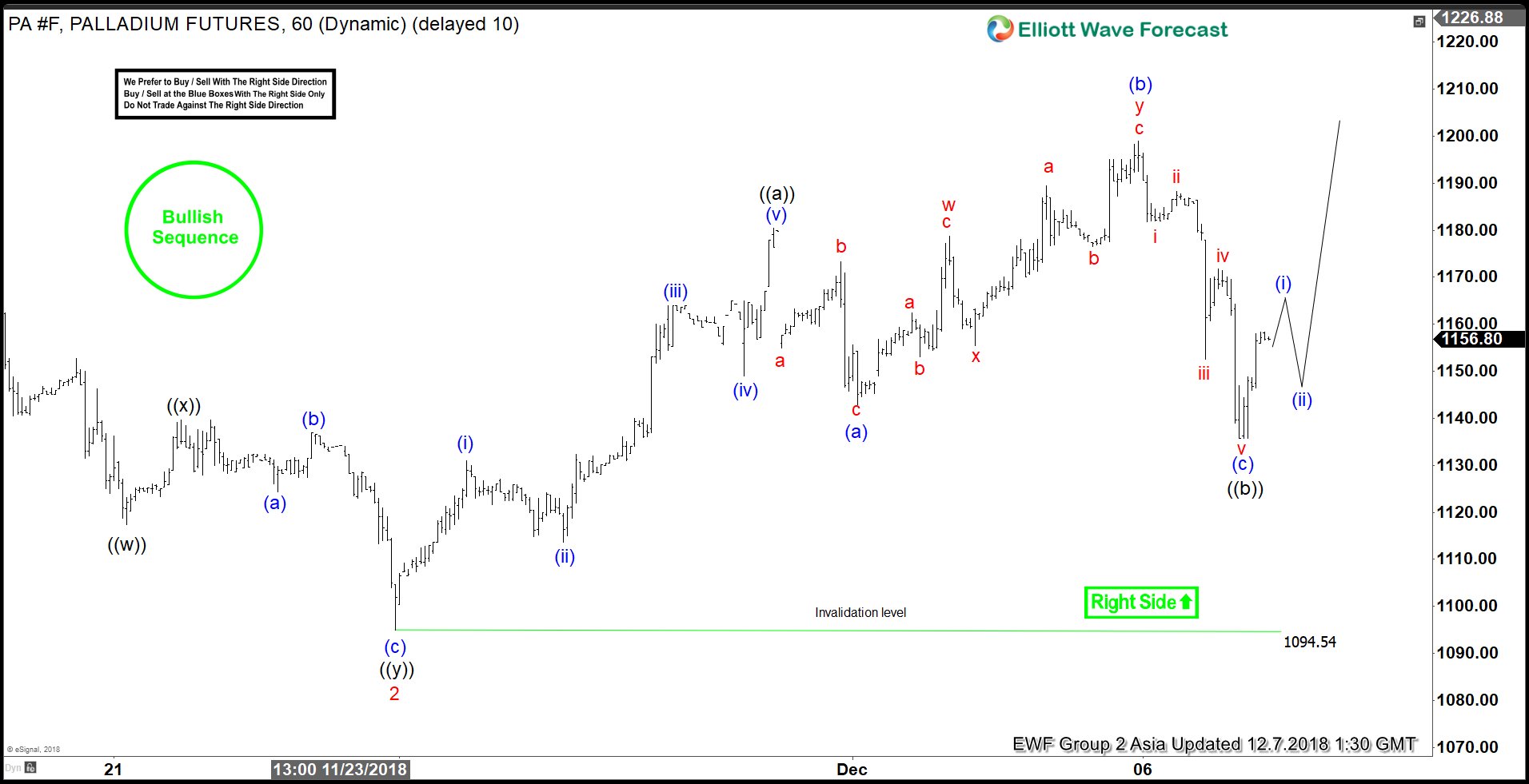

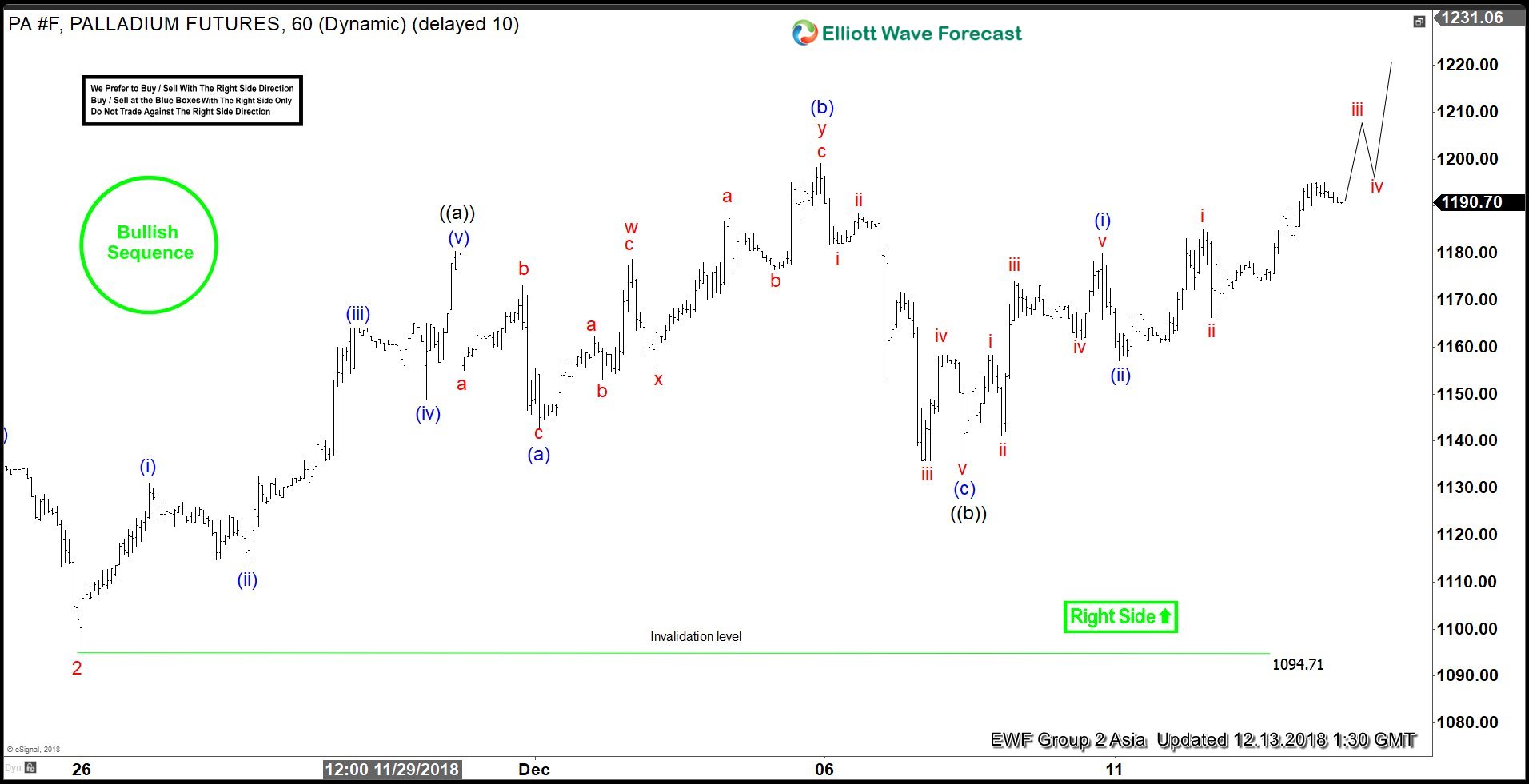

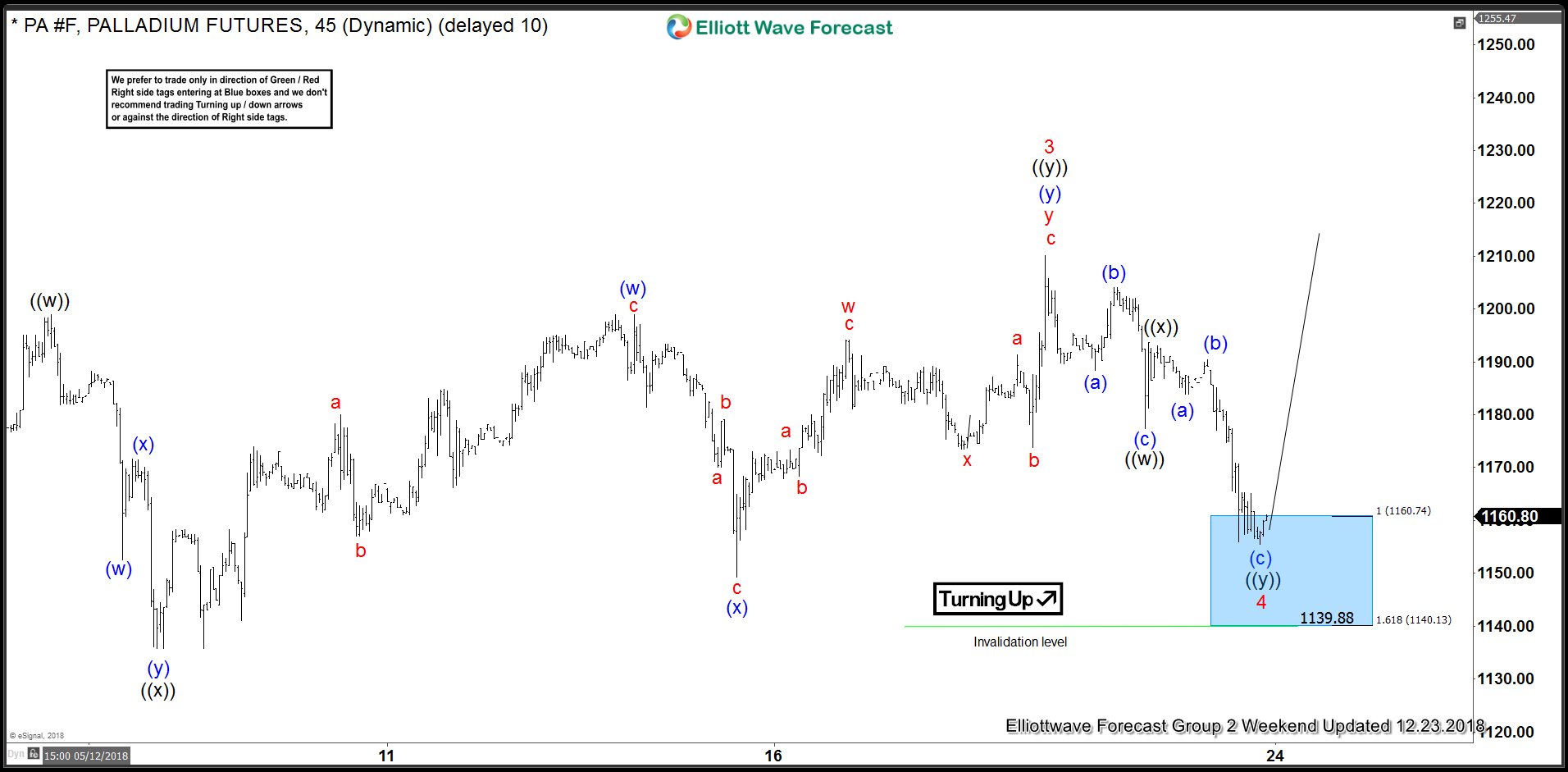

Palladium ended a cycle from January 2016 low (452.63) and the pull back should be a Palladium Buying Opportunity. Rally from January 2016 low can be counted as an Elliott Wave Impulse when rally to 776 completed wave ((1)), dip to 652.15 low completed wave ((2)), rally to 1023.95)completed wave ((3)), dip to 973.60 low complete wave ((4)) and rally to 1133 completed wave ((5)) which we have labelled as wave “a” of (III) of a diagonal higher.

Palladium Buying Opportunity – Weekly Elliott Wave Analysis

Chart above shows the Impulse rally up from 452.63 low which has completed and we are now in a pull back to correct the cycle from 452.63 low. So far we have seen 3 swings lower to 890.85 which was followed by a bounce which has so far failed below 1133 peak. As bounces fail below 1047.75 ((X)) high and more importantly below 1133 peak, Palladium has scope to trade lower into 806.98 – 749.94 area to complete a 7 swings corrective decline. Due to 5 waves rally from 452.63 low, we expect to see buyers appearing in 806.98 – 749.94 area and then the rally can resume for new highs above 1133 peak or we should get a larger 3 waves bounce at least. Once ((W)) low at 890.85 is broken, we will have 5 swings incomplete sequence down from 1133 peak and then wave (X) bounce could offer a selling opportunity for a move lower into 806.98 – 749.94 area which is where we believe we should get another Palladium buying opportunity.