In our last article on Pan American Silver Corporation (ticker: PAAS) dated November 25 last year, we suggest that the stock is about to end correction and resumes higher. This is the chart we provided last November looking for buyers at the blue box.

Fast forward to the new year, the stock failed to reach the blue box and has started to turn higher. With the new second round stimulus check approved by congress as a bipartisan bill, and Georgia Senate election possibly tilting towards the Democrats, market is preparing for even further stimulus and money spending by government.

This article today gives an Elliott Wave update on PAAS

PAAS Monthly Elliott Wave Chart

The monthly chart of PAAS above shows the rally from January 2016 low is in progress as a 5 waves impulsive Elliott Wave structure. Wave ((4)) of III has ended at $28.33 and the stock has started to resume higher again. Expect more upside to end wave ((5)) of III, then it should pullback in wave IV before turning higher again. The stock is still in very early stage of a wave ((III)) move in Grand Super Cycle degree to the upside.

PAAS Daily Elliott Wave Chart

Daily Elliott Wave chart above shows the stock has broken above the descending bearish trend line from August 2020 peak, suggesting the cycle is over. The stock still needs to break above that peak to signal the correction is complete and rule out a double correction. However, a look of the rally from wave ((4)) low suggests the structure of the rally is a nesting impulse, favoring the idea that the correction is completed.

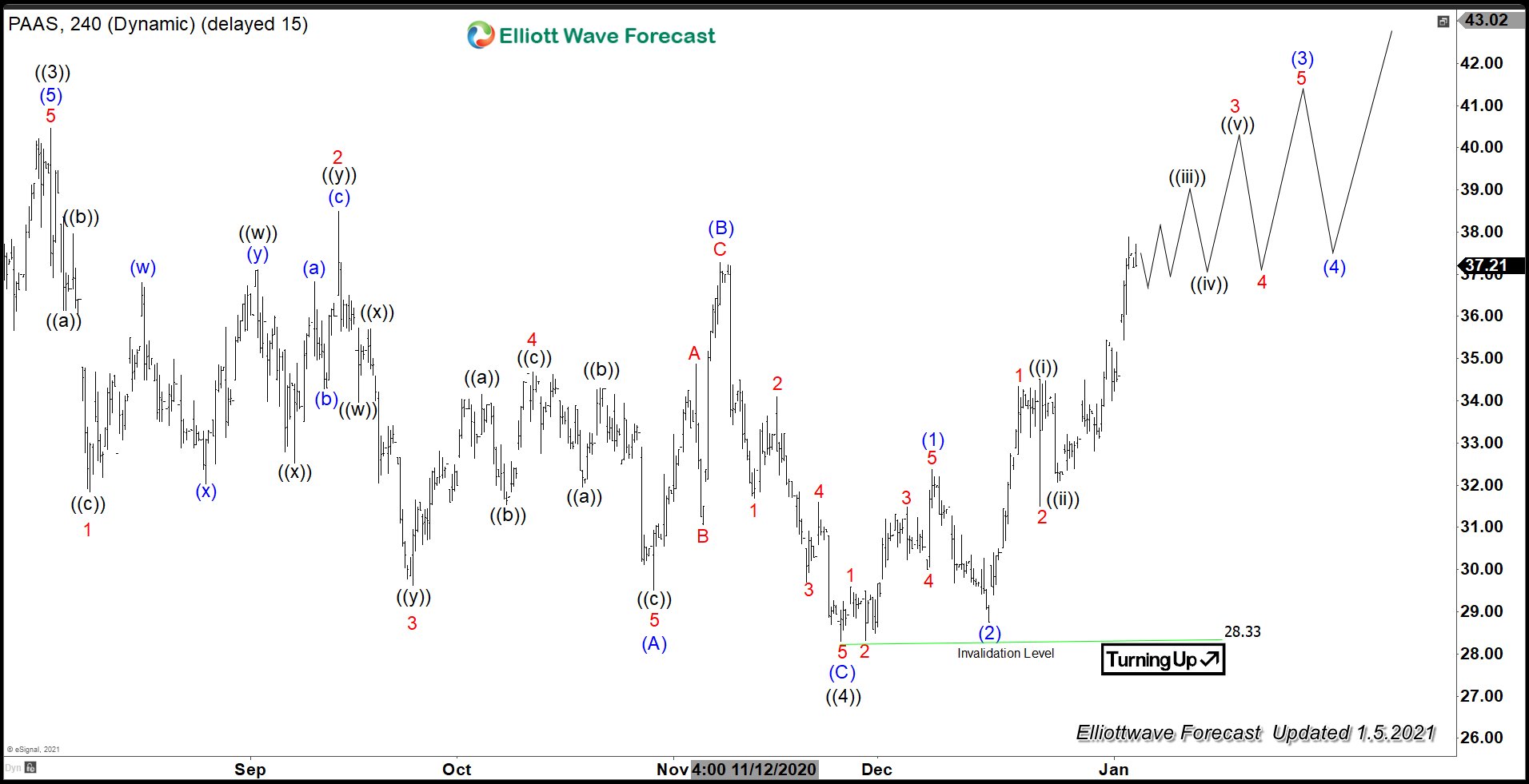

PAAS 4 Hour Elliott Wave Chart

The 4 hour chart of PAAS above shows the rally from November 24 low (28.33) unfolding as a nested impulsive Elliott Wave structure. Expect the stock to continue moving higher in coming days / weeks to end wave ((5)) of 3 in 5 waves before a pullback happens and stock resumes higher again.