Hello traders ! here again to share my personal weekly sentiment analysis to get the overall feel of the market and what to expect in the upcoming week.

SPX

Starting with the stock market S&P 500 (SPX), last week we had quite a busy week with several economic data releases, with FED Powell and the NFP as the main spotlight. From the last trading sessions, the SPX fell quite sharply, starting with the hawkish comment from Powell and continuing with the last sell-off on Friday with strong NFP numbers as concerns of a tight labor market justified a further rate hike from the FED in the upcoming meeting.

On the technical side, the SPX is currently trading below the 20-day moving average, which also serves as a short-term trendline. The SPX also had broken previous resistance at 3927, which was acting as a support level, and seems to target 3783 as the next key area. With the strong sell-off from last week in the SPX, it does show bearish sentiment, or rather a “risk-off” market environment, in the stock market.

BONDS

Next, we take a look at bond yields, and they are not performing well either; from late February until the early part of March, they managed to stay above 4%, but yields were unable to hold or push higher and instead made a strong drop back below 3.9%, which can be negative for the US dollar basket. Also, the falling yield correlates with rising bond prices, which should reaffirm the “risk-off” sentiment in the market and indicate that investors are shifting to bonds in the mean time.

VIX

Then we look at the fear index, or VIX, and from the last trading session we have a huge spike in the VIX, which was previously below the 20-value and spiked up to 28.97 by the time I was writing this forum. Hence, the VIX also aligns with the SPX and bond yields, which tell us about a rising level of fear or stress in the financial market.

INTEREST RATE

After the late NFP numbers, as we look into what the market expects of future interest rate changes from the FED, markets are starting to anticipate rate cuts starting in Q4 of 2023 and a peak interest rate of 5% to 5.25%, which aligns with the FED interest rate forecast, which could be negative for the US dollar, but the US inflation reading this week could be a strong factor in regard to this matter.

DATA RELEASES

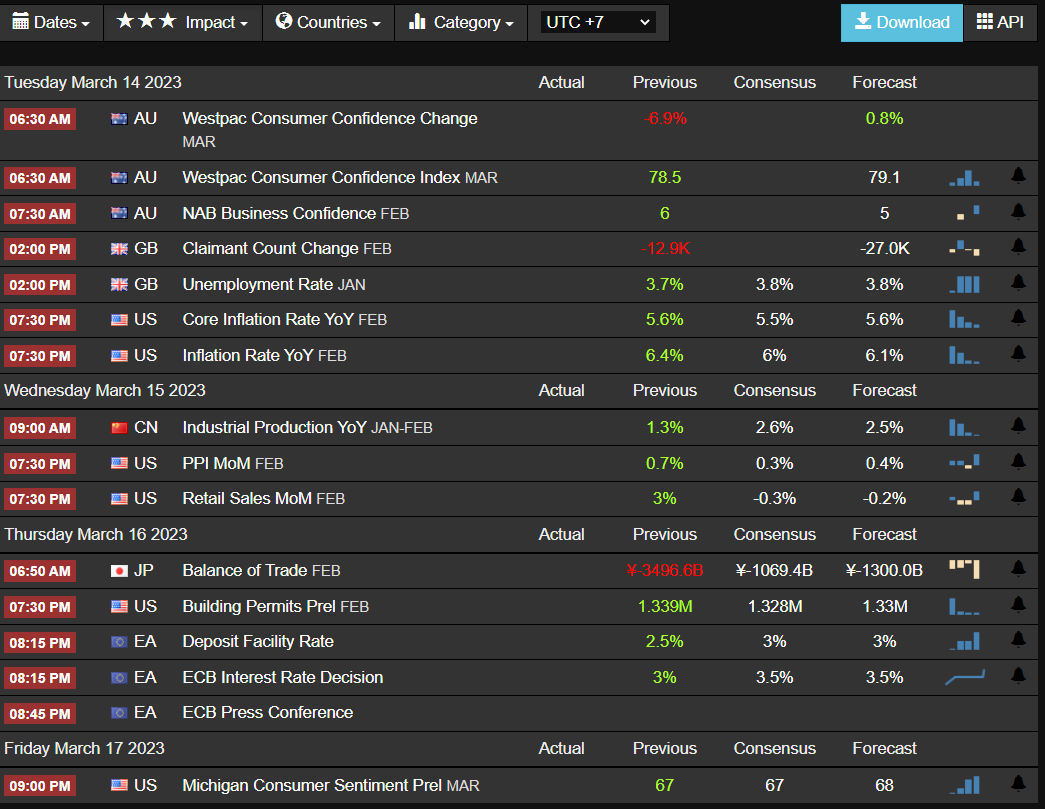

This week, economic data that are to be release are not quite as hectic as last week data release, but all eyes on the US inflation data, PPI, and the ECB Interest rate decision which can spark volatility in the market. The upmost importance however, can be put into the US inflation data as we did have a deceleration in the inflation readings. A re-accelerating inflation could force the FED for even stronger rate hikes and could be negative for risk-asset such as equities.

source: tradingeconomics

source: tradingeconomics

CONCLUSION

The global markets are currently showing signs of a “risk-off” market environment, as evidenced by the strong sell-off in the stock market, dropping bond yields, rising bond prices, and surging VIX readings. Also this week we have several key economic data points that could spark volatility, but all eyes are on the US inflation readings. A further decelerating inflation would favor risk assets, but the opposite is true if inflation is back on the rise, which could justify further FED hikes and be negative for risk assets.