In Jackson Hole speech last Friday, Fed’s governor Jerome Powell indicated that the Fed is serious in fighting inflation and will not pivot early. He also suggested that further hikes are likely as inflation rate continues to be elevated. The pace of change in inflation has started to slow down after a series of hikes this year. US Dollar responded by rallying, dragging down commodities such as Platinum. In the charts below, we will look at the Elliott Wave technical outlook for the metal.

Platinum Monthly Elliott Wave Chart

Monthly chart shows that Platinum has ended larger degree Grand Super Cycle wave ((II)) at $846.2. The metal has resumed higher in wave ((III)) and wave (I) of ((III)) ended at $1348.2. Pullback in wave (II) of ((III)) is in progress to correct wave (I) before the metal resumes higher again.

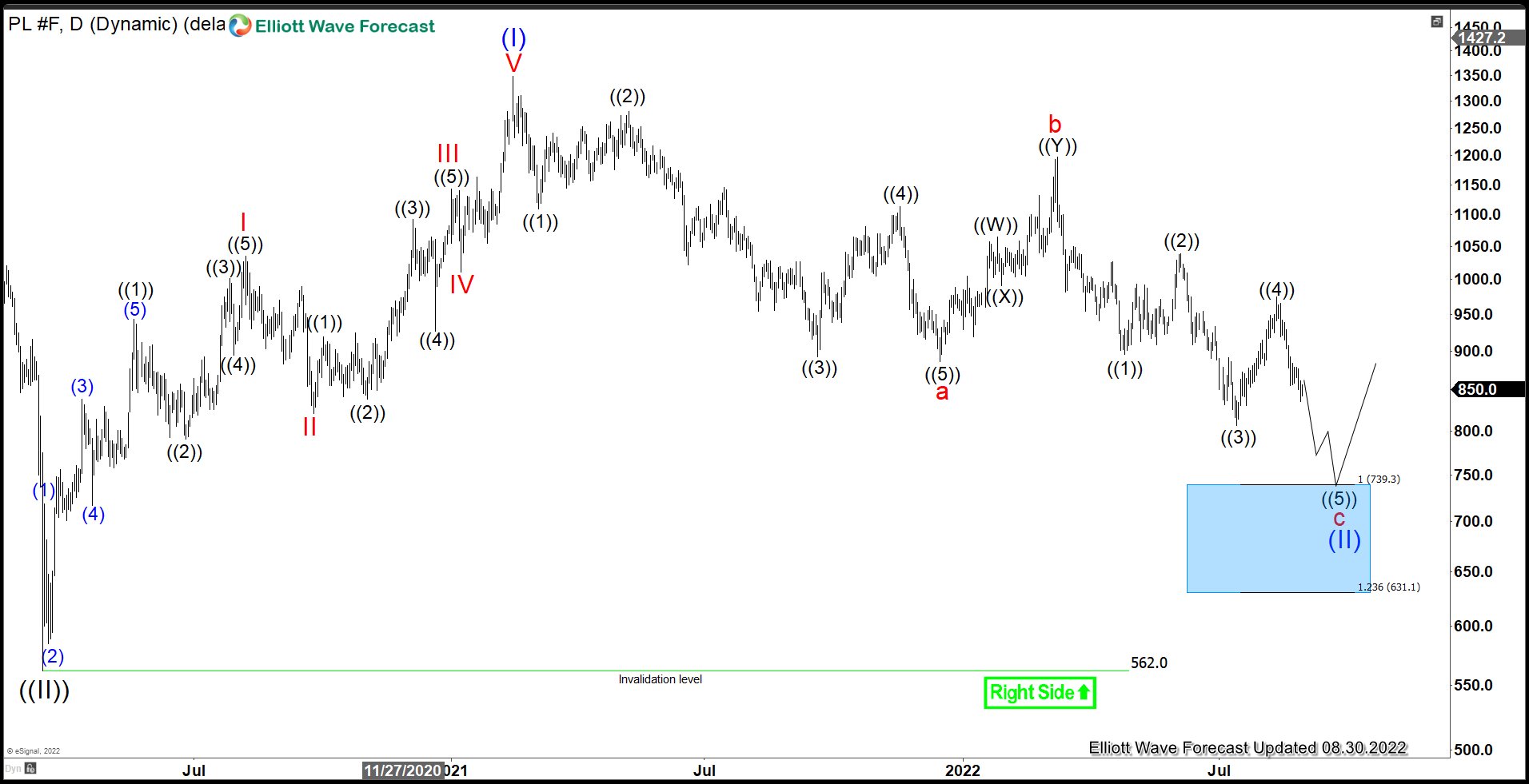

Platinum Daily Elliott Wave Chart

Daily Elliott Wave Chart of Platinum suggests wave (II) has scope to extend lower. The ideal target is 100% - 123.6% Fibonacci extension at $631 - $739. From there, the metal finds strong support and do at least larger 3 waves rally. Wave ((4)) of c is proposed complete at $974.6 even though it still needs to break below wave ((3)) low at $806.7. Expect the metal to extend lower in wave ((5)) of c towards the blue box area before strong rally can be seen.

Daily Elliott Wave Chart of Platinum suggests wave (II) has scope to extend lower. The ideal target is 100% - 123.6% Fibonacci extension at $631 - $739. From there, the metal finds strong support and do at least larger 3 waves rally. Wave ((4)) of c is proposed complete at $974.6 even though it still needs to break below wave ((3)) low at $806.7. Expect the metal to extend lower in wave ((5)) of c towards the blue box area before strong rally can be seen.

Source: Platinum (PL) Has Resumed Lower