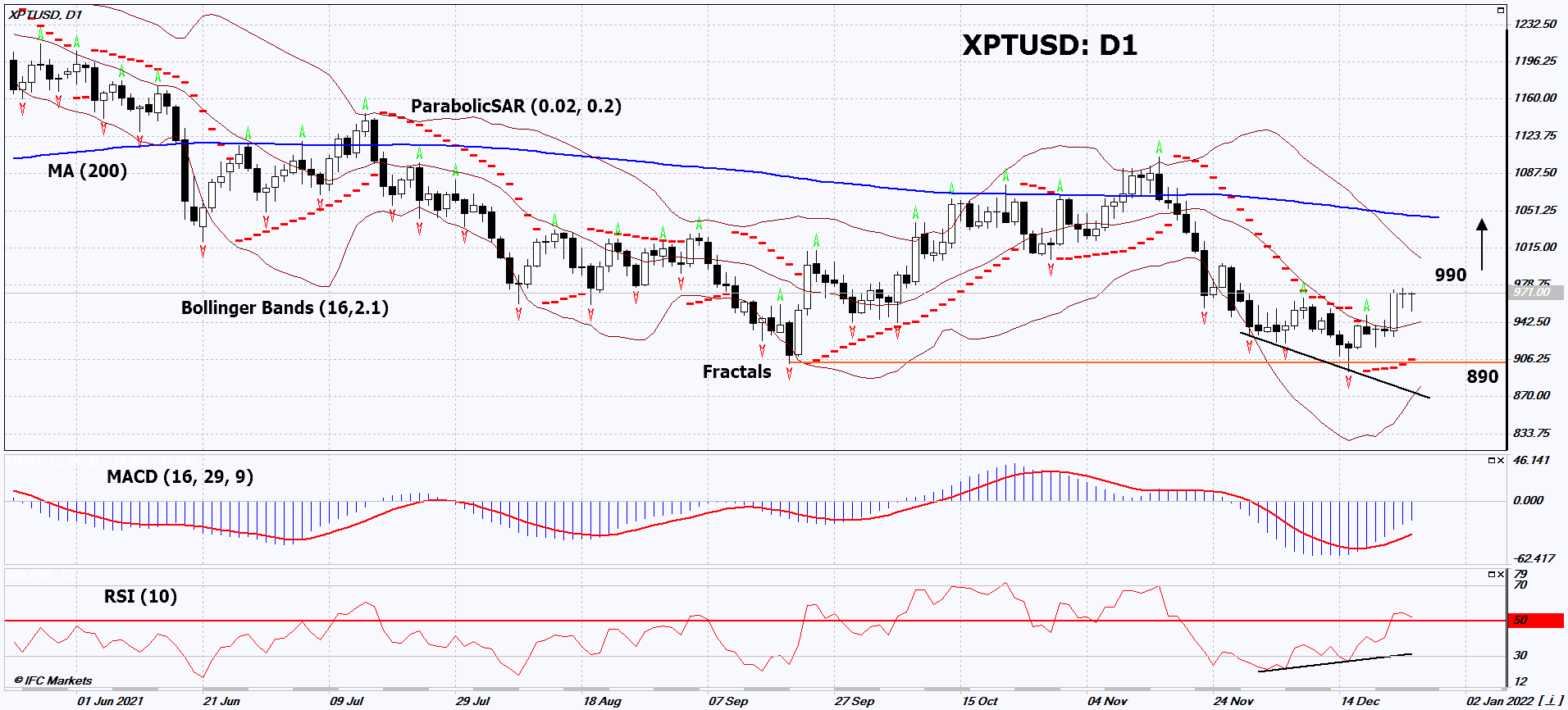

Platinum Technical Analysis Summary

Buy Stop: Above 990

Stop Loss:Below 890

| Indicator | Signal |

|---|---|

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

Platinum Chart Analysis

Platinum Technical Analysis

On the daily timeframe, XPTUSD: D1 was unable to update the previous minimum and is trying to rise. A number of technical analysis indicators have formed signals for further growth. We do not rule out a bullish movement if XPTUSD rises above the last high: 990. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the minimum since November 2020 and the last lower fractal: 890. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (890) without activating the order (990), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Precious Metals - Platinum

WPIC predicts an increase in global platinum demand in 2022. Will the XPTUSD quotes grow?

According to the WPIC, global demand for platinum in the automotive industry will grow by 14% this year and another 20% in 2022. This may be due to stricter environmental requirements, as well as the replacement of more expensive palladium with platinum. Total global industrial demand for platinum will increase by 26% in 2021, driven by a 65% increase in platinum consumption in the petrochemical industry and 72% in optical glass production. WPIC believes that global demand for investment platinum bars and coins in the 3rd quarter of 2021 has already increased by 25% and may grow by another 10% next year. Platinum is now the cheapest precious metal after silver.