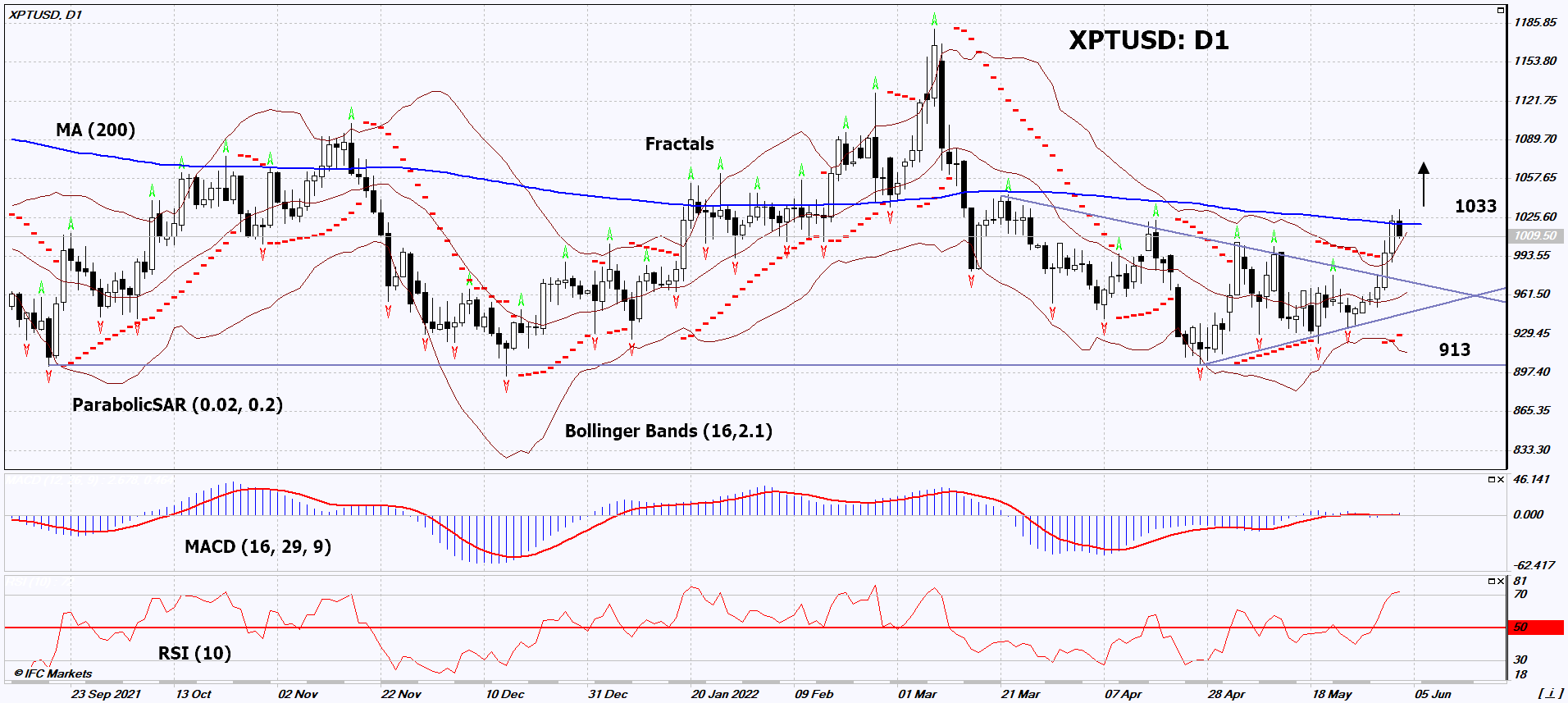

Platinum Technical Analysis Summary

Buy Stop։ Above 1033

Stop Loss: Below 913

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Platinum Chart Analysis

Platinum Technical Analysis

On the daily timeframe, XPTUSD: D1 went up from the triangle. Some indicators of technical analysis have formed signals for a further increase. We do not rule out a bullish movement if XPTUSD rises above the last high and the 200-day moving average line: 1033. This level can be used as an entry point. The initial risk limit is possible below the Parabolic signal, the last three lower fractals and the lower Bollinger line: 913. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (913) without activating the order (1033), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Precious Metals - Platinum

The World Platinum Investment Council (WPIC) has lowered its global surplus forecast for 2022. Will the XPTUSD quotes continue to rise?

WPIC has updated its forecast for the global platinum market for the 1st quarter of 2022. He now expects a 5% decline in global supply (-332 thousand ounces) and a 2% increase in demand (+126 thousand ounces) for the full 2022 compared to 2021. Because of this, the global surplus of platinum at the end of the current year may be reduced by almost 2 times compared to 2021, to +627 thousand ounces. The main reason for the decrease in global supply may be accidents at fields in South Africa and Zimbabwe, as well as anti-Russian sanctions. Russia produces 10% of the world’s platinum, while African countries produce 80%. The rest of the production is concentrated mainly in Canada and the USA. The increase in demand, according to WPIC, may occur due to the replacement of expensive palladium in automotive catalysts with cheaper platinum. There may also be an increase in the production of diesel trucks and an increase in freight traffic after the coronavirus epidemic. In addition, demand in the petrochemical and medical industries may increase. Theoretically, it is possible to increase the purchase of physical platinum in coins and bars, for investment purposes, since it is much cheaper than gold.