Ammo Incorporated is an U.S. American defense company producing high-quality ammunition. The company owns STREAK (R), HyperClean and military ammunition technologies. Headquartered in Scottsdale, Arizona, USA, Ammo can be traded under the ticker $POWW at Nasdaq.

In the article from October 2021, we have expected a 3rd swing within a correction from June 2021 to see a reaction from 4.18-1.86 area. Indeed, the reaction has taken place in May 2022 from the blue box area. However, it has failed below June 2021 lows. Now, we see $POWW trading below May 2022. Here, we provide an update and discuss whether the bottom is near.

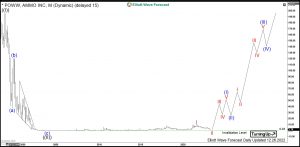

Ammo Monthly Elliott Wave Analysis 12.26.2022

The monthly chart below shows the Ammo stock $POWW traded at Nasdaq. From the all-time lows, the stock price has developed a cycle higher in black wave ((I)) of grand super cycle degree towards the all-time highs on February 1998 at 195.31. From the highs, a correction lower in black wave ((II)) has unfolded as an Elliott wave zigzag pattern. It has printed an important bottom in September 2003 at 0.03. Within 5 years and half, the stock price went almost to zero. From the lows, a new cycle in wave ((III)) has already started and should extend towards 195.31 highs and even higher.

Within wave ((III)), one can see the initial cycle in wave I. Hereby, red wave I of blue wave (I) has ended in June 2021 at 10.37 highs. From there, a consolidation in wave II should find support above 0.03 lows in 3, 7, 11 swings. Once ended, a new larger cycle in red wave III towards 10.37 highs and higher should take place.

Ammo Daily Elliott Wave Analysis 12.26.2022

The daily chart below shows in more detail the pullback in wave II which unfolds as a zigzag pattern being 5-3-5 structure. Firstly, from the June 2021, an impulse in black wave ((A)) has set a low at 3.52 in May 2022. Secondly, a bounce in black wave ((B)) has printed a connector high at 6.05 in August 2022. Thirdly, the price broke 3.52 lows opening up a bearish sequence. While below August 2022 highs, the price can still extend lower. However, it is impossible to reach the equal legs extension area being in the negative range. One should note that the stock price has erased already RSI divergence. That might be a hint that Ammo Inc. may truncate in black wave ((C)) at 0.618-0.786 extension range being 1.81-0.65 area.

Investors and traders can buy $POWW from 1.81-0.03 area targeting 10.37 highs and higher in medium term and 195.31 highs and beyond in the long run.

Source: https://elliottwave-forecast.com/stock-market/bottom-ammo-incorporated/