The US Dollar bottomed last year as the Fed started cutting rates, and then rallied in Q4 even as the Fed continued to cut. Inflation is expected to increase again in tomorrow’s CPI report which could complicate expectations for more Fed softening.

By :James Stanley, Sr. Strategist

USD Talking Points:

- Tomorrow brings the release of US CPI and markets are highly expecting the Fed to soon move into rate cuts.

- The Fed cutting rates doesn’t necessarily ensure of USD-weakness, as we saw last year with the USD rally in Q4 which seemed to be more correlated to long-term rates at the time. And the FOMC rate cuts boosted inflation expectations which in-turn pushed long-term rates higher.

- I’ll be looking at the USD through several major pairs with updated charts after the CPI release. You’re welcome to join, click here to register.

Tomorrow brings an important US CPI report as evidence of rising inflation in the US has continued to stack up. This makes for a more difficult argument for the Fed to cut rates and, even if they did, there’s a very real question as to whether that would carry the impact that they would want.

Last year when they cut rates, inflation expectations jumped, as did longer-term rates in the U.S., as the 30-year climbed from a 3.9% low the week of the first rate cut to 5% in early-January. Mortgage rates in the US are more aligned with that rate and not the short-term rates that the Fed manage, and this proves that even if the Fed does cut – it doesn’t ensure that long-term rates and mortgage rates will tilt lower. Nonetheless, markets are aggressively pricing in rate cuts at the moment with an almost 90% probability of a cut in September to go along with an over 85% probability of two 25 bp cuts by the end of the year.

Tomorrow’s US CPI report will be key for that and last month when US CPI came out above expectations, the US Dollar broke out to a fresh high. I looked at this in a webinar and even opined that I wouldn’t be surprised to hear President Trump threaten to fire Jerome Powell. That happened less than 24 hours later and helped to bring a pullback to USD. But, a higher-low held and another higher-high printed into the end of the month.

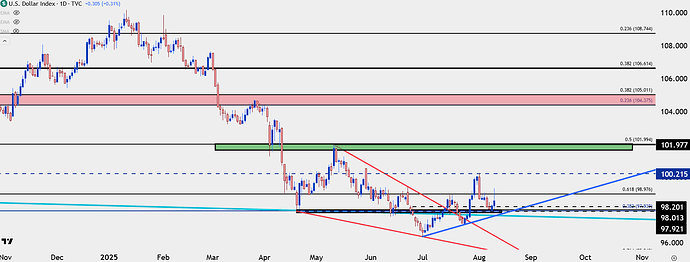

In the USD the higher-high and low sequencing has remained intact, even after the NFP-fueled sell-off.

US Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

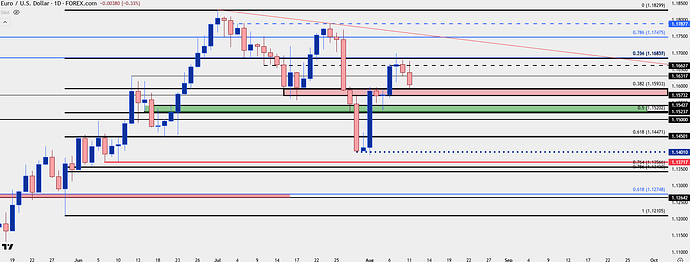

EUR/USD

I looked into EUR/USD in greater depth this morning and the lower-low and high sequencing has continued in the pair. This remains of interest for USD-strength scenarios, in my opinion.

Click the website link below to read our exclusive Guide to EUR/USD trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-eur-usd-outlook/

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

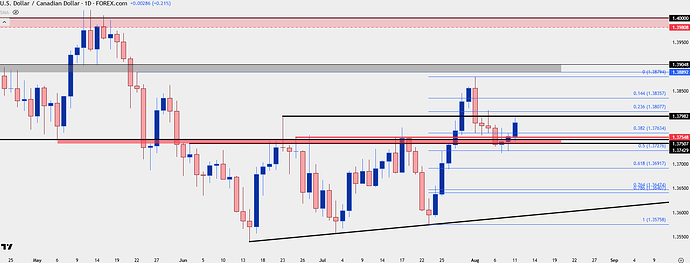

USD/CAD

I had written about USD/CAD on Friday and that setup remains in-play, following the pullback for a support test at prior resistance, from the ascending triangle formation that built from mid-June to mid-July.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

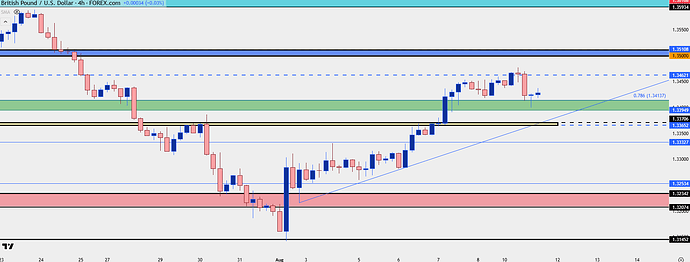

GBP/USD

I looked into Cable in the weekend forecasts, and I remain of the mind that GBP/USD is one of the more attractive backdrops for USD-weakness scenarios. Price is now testing a key zone as short-term support, spanning from a familiar area of 1.3395-1.3414.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

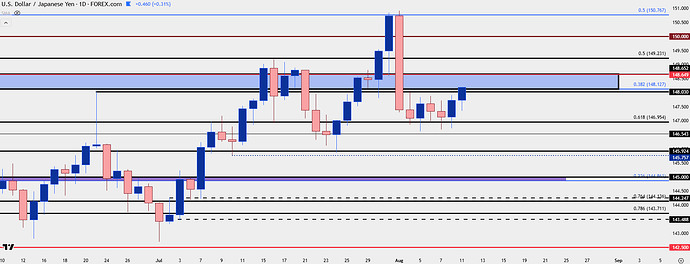

USD/JPY

Amongst major pairs USD/JPY is perhaps one of the more critical venues for USD scenarios. The long-term carry trade has kept the pair more than 40% above early-2021 lows and as I looked at ahead of last month’s US CPI print, those data releases have driven large moves in the pair.

For now, USD/JPY has held bullish structure following each day of last week showing support at the 146.95 Fibonacci level.

Click the website link below to read our exclusive Guide to USD/JPY trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-usd-jpy-outlook/

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.