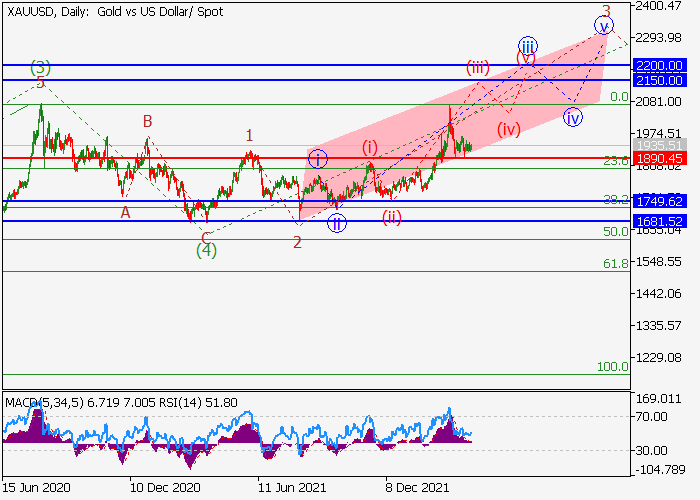

Gold, prices are approaching $2,000 again

XAUUSD shows moderate growth during the morning session, updating local highs from March 14. The “thin” market encourages the purchase of safe assets, so the US dollar and gold strengthen their positions. The precious metal is moving higher for the second week in a row, as statistics on consumer prices in the US, where inflation in March reached 8.5% on an annualized basis, which is the highest since 1981, increases the attractiveness of XAUUSD for hedging risks in anticipation of the next financial crisis. The situation on the market changes little, as the news background after the Easter week remains quite calm.

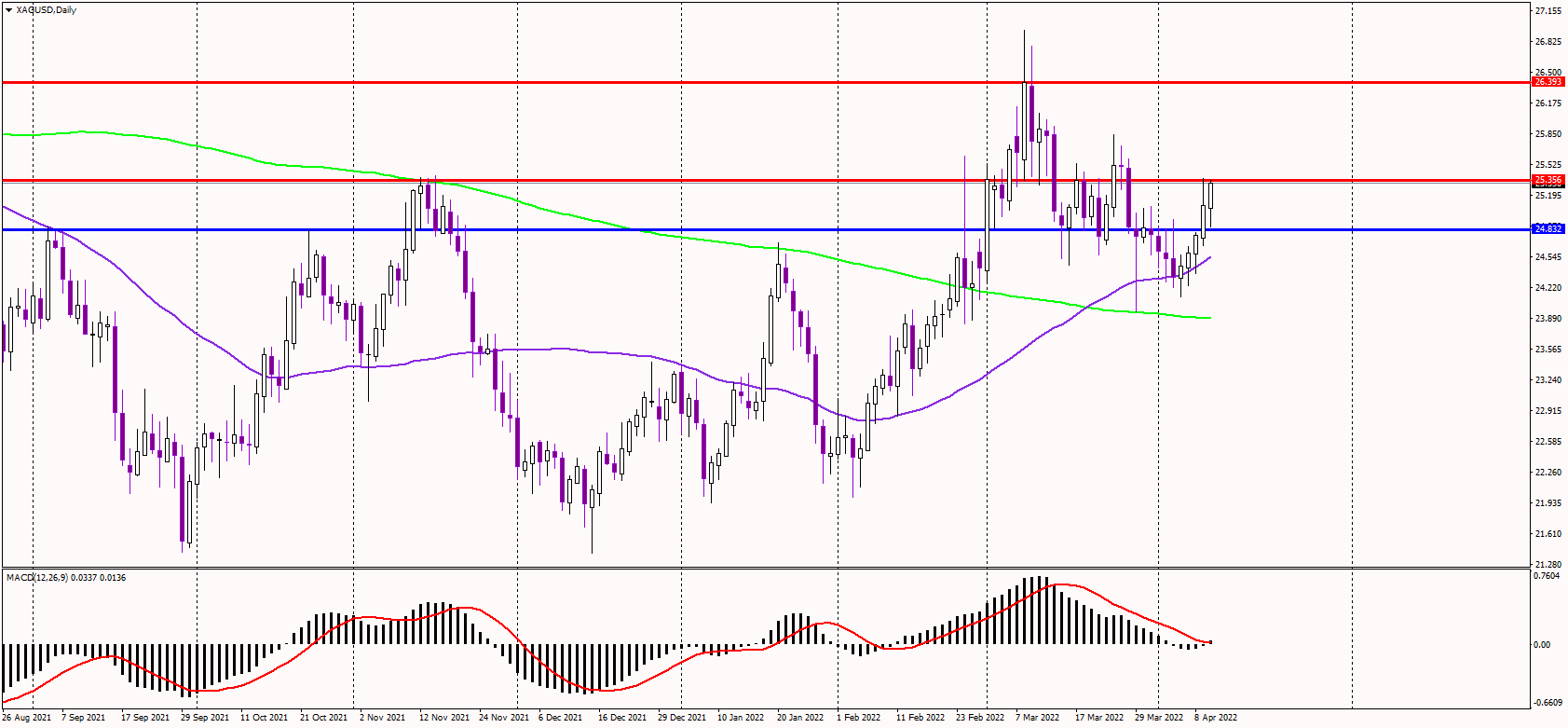

Demand for the metal is supported by general tension, which is expressed primarily by investors’ concern about global inflation rates. Due to the military conflict in Ukraine and subsequent sanctions against the Russian economy, energy quotes rushed up sharply, which provoked an increase in consumer and production prices in the global economy, which had just begun to recover from the period of the coronavirus pandemic. Under these conditions, gold actively added in price. In turn, an increase in the yield of treasury bonds, as well as expectations of further tightening of monetary policy by the US Federal Reserve, is holding back “bullish” sentiment on the instrument. Monthly bonds showed the maximum increase, having added 8.68% and amounted to 0.4108%, while the yield on 10-year bonds increased by 2.01% to 2.864%.

Today’s macroeconomic statistics from China did not support the instrument significantly. GDP in Q1 2022 showed a slowdown from 1.5% to 1.3%, which, however, turned out to be noticeably better than the expected 0.6%, while in annual terms, the Chinese economy accelerated from 4.0% to 4.8%, ahead of analysts’ forecasts at 4.4%.

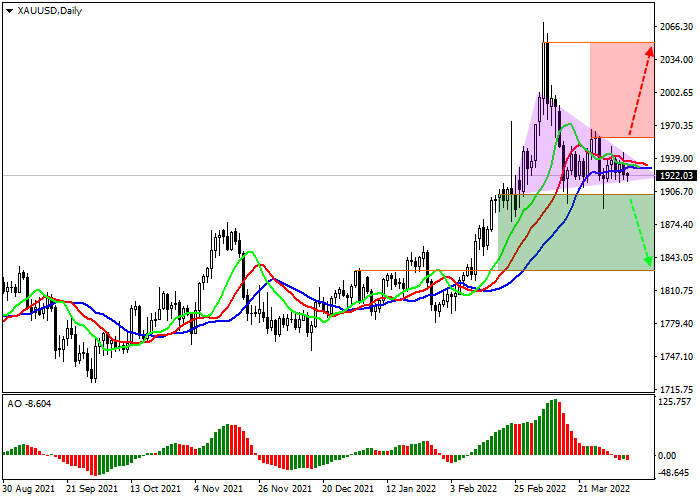

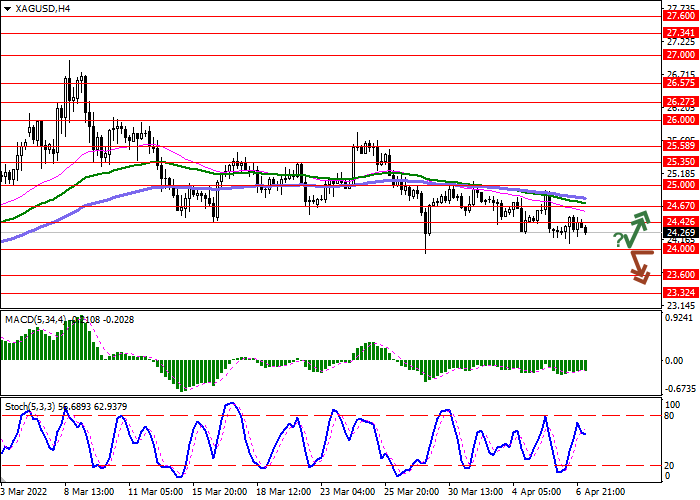

Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the surge of “bullish” sentiments at the moment. MACD indicator is growing keeping a buy signal (located above the signal line). Stochastic retains an upward direction but is located in close proximity to its highs, which indicates the overbought instrument in the ultra-short term.

Resistance levels: 2000, 2015.3, 2030, 2050 | Support levels: 1974.22, 1952.53, 1930, 1900

Trade with a True ECN Broker

Solid ECN Securities