Good work , if you were strongly bearish then on the EUR, then what’s the difference between EURGBP & EURAUD lol

Even i got the same doubt. Evermore, could you enlighten me on this ?

I think what he was trying to say is he seen EURAUD the better short opportunity, since he was already in EG and didn’t want to be in two trades at once, he exited EG and entered in on EURAUD.

How did I do Evermore?

Excellent! LOL.

I want to say, I’ve been trying to put it all together when it comes to PA, and this thread has proven very useful. Thanks again, DnB.

BTW, sorry for the dubious charts, will improve them for the next time.

I prefer the Inside bar on EURJPY for a breakout, rather than GBPJPY…

EURGBP looks like it wants to go down as well. Also Check out the Outside Bar on EURCAD!

EUR and GBP are correlated currencies, so if EUR is going down, also GBP is doomed to going down. But EUR and AUD are not correlated currencies, so EUR could be going down while AUD could be going up, making EURAUD a better choice for a short than EURGBP.

I find that EUR GBP & AUD are all relatively correlated with the Risk on/off vibes, occasionally they drift apart from one another creating good trading opportunities on the cross pairs…

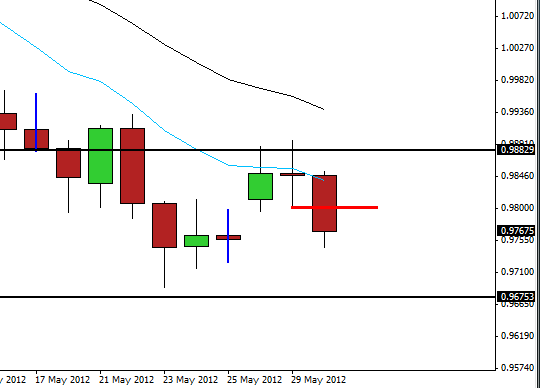

lucariga we will just have to wait and see how price reacts with that support level. If you want to play it safe you can just set your target there I guess.

As for your course I have to aim minimum at 1:2 RR. How can I achieve it? Even if I put my SL at 50% of the trigger candle I can’t reach 1:1 RR. Is it safe to place the SL below 50% level?

Sorry for my baaaaaad english…:8:

Another option is to place the stop loss above the high for the current day, But if you don’t see a trade setup there that you aren’t comfortable with don’t touch it! Wait for the next one!

Hey Evermore,

I like all the setups that you have posted. They are all in-line with the overall trend and close to the mean value. You’re not going to take every single one are you

I 've got nothing to post now, you’ve stolen my thunder

Hi Evermore. I jus had a look at AUD/JPY and AUD/USD. Aren’t you selling into support which are nearby ?

Seems like trasition from bullish to bearish is taking place in GBPAUD. Two indecisive candles in weekly chart at the resistance and price heading down in Daily. Formed a pinbar. Is it a reliable setup or should we wait for the crossover of MA ?

Seems like trasition from bullish to bearish is taking place in GBPAUD. Two indecisive candles in weekly chart at the resistance and price heading down in Daily. Formed a pinbar. Is it a reliable setup or should we wait for the crossover of MA ?

Price is resting right on resistance there, probably not a high probability setup to short into it. However looks like there is a double top pattern there

Hi Evermore. I jus had a look at AUD/JPY and AUD/USD. Aren’t you selling into support which are nearby ?

As long as the setup isn’t directly sitting on the S/R line or just shy of it, and you are trading with the trend momentum there is a better chance the S/R line won’t hold. You just have to wait until price reaches the line and see how it reacts. Worst case scenario you pull out with a small win.

Come back and check my charts and this AUDUSD & AUDJPY indecision breakouts are triggered, same with the Inside bar on the USD/JPY. Let’s see if the bears continue to rage through NY

Price resting on Resistance ? I dint get you here. Is it the Support you’re talkin about ?

I was actually looking at the Weekly TF, Price is far away from the MA’s, so it has to correct back according to your course. and also i was taking the support into consideration. though i don’t take the trade unless prices close above MA’s. I wasn’t sure about taking shorts atm where price is far from MA in weekly, so dropped a post on it.