I missed this !!

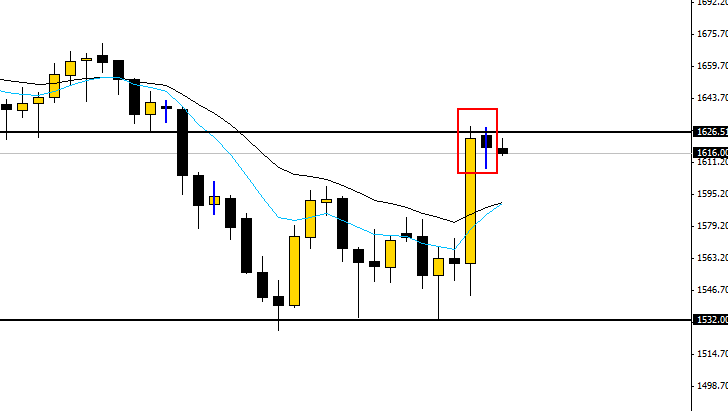

This Gold Inside Bar at resistance looks interesting…

Didn’t think too much of it when I first looked at it, I thought it would pop higher, now price is looking bearish as we move into London ( even though it isn’t open )

Not touching this one though, after that giant bull run. Ill just sit on the side and watch

Hi DnB, would you mind explaining your reasoning behind using 10 and 20 emas over any other?

Thanks a lot

The 20 EMA is the value I’ve used since I began trading, It’s a very popular value. Any higher and it would too slow and lower and it would be too fast. The 10 is just the halved value used for the “fast EMA”

Hi, Ben

I’d like to give my two cents regarding your question, if you mind.

If you care to analyze what is an EMA, you’d see that the 10 is equal to a week and the 20 is equal to a month. This is the reason why the 10 and the 20 EMA are so popular.

What do you think DnB?

I’ve never really put that much thought into why the 20 is so popular, what you are saying does make sense.

30 days in a month on average, minus weekends and trading holidays is around 20 trading days per month.

I use a 8 EMA and 21 EMA as a base for my trading. The 8 EMA equals a week -including weekends plus a day more for average with holidays- and a 21 EMA for a monthly average. Im not saying one is better than other, the are almost the same for didactical matters. I guess it’s just that I’m used to them.

Btw, have you read Trading in the zone by Mark Douglas? Just started reading it and find it amazing.

How do you cope with the fact that there is no wrong or right trade?

How do you cope with the fact that there is no wrong or right trade?

When I enter a trade I assume the money already lost, and knowing I aim for about 3-6 times what I risk, the losing trades don’t really bother me that much. When I am right I jump ahead much more than I do step back when I am wrong. That’s how I look at it anyway.

Check this IB setup on the EURCAD. I think this one has potential to break down…

Hey DnB and Evermore,

EUR/CAD looks interesting to me too, but I always have troubles dealing with support/resistance to obtain a good R:R. How do you manage those 2 major supports on the way down?

Can someone explain me once and for all?

Ciao…

I’ll put it as simple as I can: Let the price guide you.

So as DnB does generally, you still set your take profit around 3x your risk. But regarding S&R levels i guess you just keep an eye on them, be conscious of where they are and watch out for reversal signals around that area?

These guys are right,

I generally play it candle by candle, focusing on how the Daily candle closed. If the daily candle closes rejecting support then Ill have to consider exiting, if the daily candle closes under support then I know I am good…

Hey, DnB

Nothing going on really on the markets, I think that if someone is not already on a trade then is late, LOL.

Several momentum candles -AUD/USD, NZD/USD, GBP/AUD- to watch out.

Here are other things I’ve found on the charts. Comments always welcome.

EUR / GBP Long

Spot Gold Short??

hehe

Would be great but waiting for good PA

I think not worth read my post here, please: http://forums.babypips.com/free-forex-trading-systems/42378-forex-price-action-154.html#post358463

Cheers

So if I’m understanding right, in your choice to enter or not on a trade, you don’t care about support/resistance, even if they are placed only few pips above/below your entry point, right?

You just place your R:R to minimum 1:3 and use support/resistance just to exit your trades in case of contary price action signals in those areas, right?

As usual sorry for my english… hope to be clear:33:

Your trades look good. I’m planning to go long on EUR/GPB but only if price retraces back to the 8 EMA.

Congrats and good luck.

Hey, DnB

Nothing going on really on the markets, I think that if someone is not already on a trade then is late, LOL.

Several momentum candles -AUD/USD, NZD/USD, GBP/AUD- to watch out.

Wow I woke up really late,

Yeah Looking at the EURGBP, looks like a nice trade.

Rejection Candle + Support + Dynamic Support

EUR/NZD Momentum Candle

This one looks good to me, because the trend momentum is already down.

USDCHF Momentum Candle

This one looks alright, if it breaks the low. The thing is we are moving into the EMA support here so EURNZD feels like a better trade to me because we are working with the trend. The momentum candles on AU, NU etc are still against the over all trend, although a correction is due in them markets my momentum candle pick of the day is EURNZD

I have been reading this thread for a while plus some others, and I have gotten confused with this trade. You have spoken in the past about waiting for price to retrace for a trading oppurtuniuty but on the EURGBP there is no retrace but you are trading it. This looks to be buying from a high and not a low. Does this not matter in this case?

Also would way say this is against the trend or counter trend trading?

Thank you and sorry for newb questions.

Sorry for the newb questions