I’m going to journal my manual trades in the hope that it forces me to maintain my rules at all times. I’ll describe the trades with screenshots each time. Due to time restraints, it won’t be every day or as I call them, but a review afterwards. Hopefully it helps some people and me learn from my mistakes and when I get it right how I make money.

When I’m in work, I trade from my phone, which means my entries aren’t sharp or necessarily exactly where I want them, but they’re based on the principles I want to exploit. I’ll try to explain what this is and what I’m doing with screenshots.

7 Likes

28/4/2025

The overnight range is an important factor in my manual trading. Breaking out above or below it gives me an indication of a trend day in a direction. Other times I use it as a range or retracement target. Typically the start of the session is used to determine what to expect.

This trade broke above the overnight range early on, retraced inside and broke out again. I tried to trade the break above the 2nd breakout retracement on the 1M chart. This is not a good entry technique, I prefer waiting for pullbacks but the bullish start made me think it would run further before retracing. My stoploss was also rubbish, so it was a bad trade. The entry was probably ill disciplined, but trading breakouts is something I often do so I won’t be overly critical here

Next bunch of trades is essentially trading one move whilst trying to avoid being stopped out for nothing. Adding to winners, closing as the move looks to retrace and trying to add back in again as it moves back up.

29/4/2025

Similar setup to yesterday. Price breaks high almost immediately, expecting price to break out above here for a while. Price doesn’t really move for quite a while here. I thought I’d mess up not moving the stop loss to break even when it retraced back inside the box, but it looked like a large trading range so I held on thinking it’ll go back up somewhere near where it dropped from. Sharp drop after I exit makes me think this is probably a range type day just above the overnight range. But it’s late in the session so wait until NY opens to see what sentiment looks like then.

1 Like

29/04/2025 US Session

This chart has some tiny swing trades that mess it up, so ignore the ones that project from off the screen. I closed them all at the end because they were summed in profit and I don’t like the current price action.

This chart has a dark blue box showing the latest overnight range that I made. This is the only indicator I use, and only when on my PC which I am today.

Feel free to chime in with criticism or questions. I’m trying to explain the charts as I read them and why I’m trading, but alternative views are welcome.

1 Like

There’s no mention of position sizes here and what I’m risking. The idea is to start off with a risk of about 1%. If price goes in my favour, I will move stops up to a swing low, break even or some other place that I think will save me if the move reverses. If I read the market correctly, my stop isn’t at 1% for long.

If the market looks good for a move up, I want to add. I’ll add to losers if I think it makes sense, but not always adding to either. It’s discretionary and based on what the chart is telling me about today’s sentiment. The most important thing is not risking too much, and not holding on to losers when you get it wrong. The market can always go much further than you think and one day it will.

Here are the results from these 2 days as a percentage of the current account balance.

Good luck with this Chester!  I’ll be cheering for you here.

I’ll be cheering for you here.

1 Like

29/04/2025 Bonus Trade

After writing that up on here, I looked at the chart and saw very tempting price action. A bounce off the previous day close says up to the top of the range.

Unfortunately my kids are little a’holes so I had to intervene in a fight and closed where I wanted to add a 3rd position.

Now I’m definitely done for the day. The next few hours tend to be good for catching retracements but we haven’t really moved outside the range today.

2 Likes

01/05/2025

No morning trades because it was a holiday in Europe and not expecting anything to move.

NY open was a winner, but bad entry. I wasn’t patient and should have waited for the gap to be nearly closed before entering.

02/05/2025 Europe Open

NFP day today, so not expecting much movement. Got a couple of trades in on DAX and FTSE.

Seems I’m getting really bad fills. I thought it was because I mostly use my phone when in my real job, but it’s doing it from home with a good internet connection. Seems they’ve connected me to a NY proxy and my latency time is 10 times what it used to be. I’ll be complaining to Pepperstone if that’s not fixed next week, I’ve been confused why my fills were so bad all week.

Weekly Review

Profit wise a very good week, entries weren’t as controlled as they should be, but an element of FOMO has been on my mind as we recover from the tariff fallout. This has been profitable and could have been much more so if I had more time to spend trading.

DAX and FTSE have all but reached recovery point (gap fill) and the American markets are getting close. This gives a new perspective to trading, long isn’t a given and patience will be important to make the right decision at the right time.

Not going to bother with working out P/L for this week because it includes other stuff not related to what I’m trying so will do that going forwards if I have time. I’ll probably be back in work next week too, so less active in trading and posting.

If anybody is reading, do you have any idea how myfxbook calculates monthly gain/loss? January, February and May are about right, March was a losing month but it was about 5% and April was a winning month with a 24% gain but it says I basically wiped out… I assume it’s to do with making withdrawals but it seems wrong.

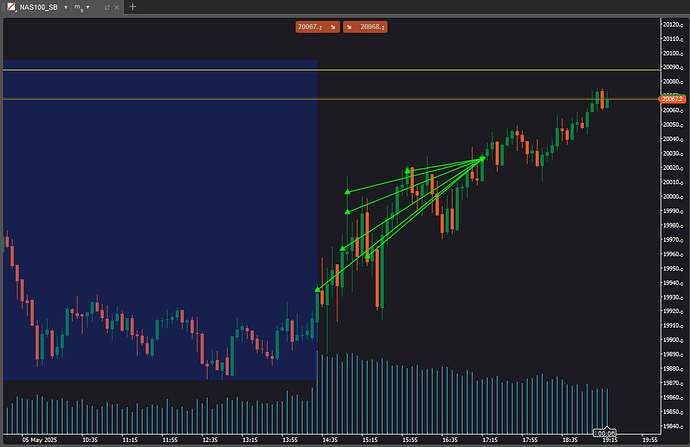

**05/05/2025 US **

Bank holiday in the UK so no trades this morning. DAX would have been good, but I didn’t expect it and took the family out.

Nice big winner to start the week. Suspect I could double it if I had time, but kids need feeding.

2 Likes

Gap almost filled now. The old me would have left that trade open with a TP at 20080 and SL below the blue box (if at all). And whilst that seems like the old me was right, that’s only true with hindsight and I’m happy that I closed the trade up over 3% whilst I was in control of the situation.

That sounds wise, to me! I guess when we ‘change our ways’ sometimes it will seem like ‘the old me’ would have done better with hindsight, but hindsight doesn’t pay the bills, does it?

I’m posting partly to subscribe to the thread and wish you good luck with it. Watching with interest.

Jackie

1 Like

Thanks Jackie.

Not much happening this week. I’ve been busy with personal things and not trading. Next week might see action from Tuesday depending on how busy work is

1 Like

13/05/2025 EU session

I’m ill and in bed today so got the whole day to trade. Unfortunately, the markets don’t want to play ball. After yesterday’s big news they’re taking it easy and deciding what to do. Maybe the US will kick start something later…

Probably not what most would consider good trading here. I’ve added to losers, which I do more often than I would like. But with no news to move things and price stuck in a range, I felt confident that the chance of a small win was bigger than the chance of losing. However my stop loss was 3 times bigger than the profit, so maybe it was a bit too risky…

1 Like

Hoping you get away with adding to losers, and wishing you better quickly!

1 Like

It’s not just about adding to losers though, it’s about risk.

Yes, I added to a losing entry twice, but my risk had I let it run to the SL was 2.5%, based on the price action that seemed very unlikely to go down to the yellow line. I’d have highly likely closed before it got there if it broke below the range low and had more like a 1.5% loss.

I’d say my aim is to add to positions without having a high risk. If I start small, I can add to winners when we break out, or add to losers without risking the bank.

I’m glad you messaged though, because I realised my indicator is drawing the wrong line for the close price on the DAX and it should have been 1 hour later. This doesn’t change the sentiment, but price is bouncing around yesterday’s close, which is very much an indecision day.

And thanks

1 Like

13/5/2025 - US Session

No questions on direction here, buyers are fully in control. There’s a good chance I’m getting out way too early here, but I’m cashing out a big win and getting away from the computer for the afternoon.

1 Like

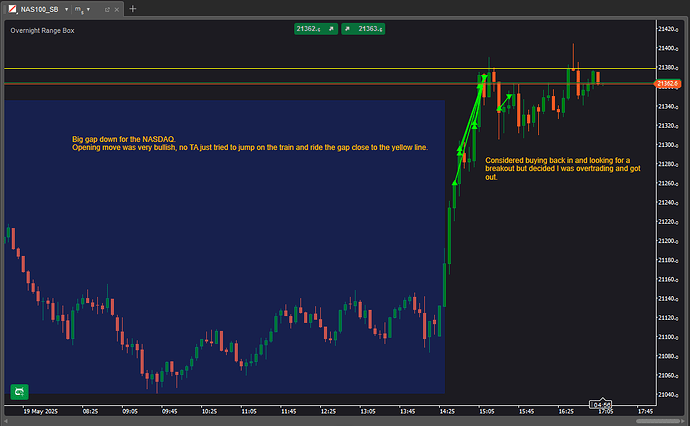

19/5/2020 Both Sessions

Back in work after being ill all last week, so trading from my phone and struggling to find time. Had a very good day with all winners and some eventually nice moves.

My win rate and profit ratio for May is about the highest it’s ever been. Not sure if that’s down to trying to stay disciplined or just luck that the markets are very much playing to my strong suit right now. I suppose there’s every chance I can grab defeat from the jaws of victory with 2 weeks left…

1 Like

You probably have twenty times as much trading experience as me, but I’m going to draw myself up to my maximum height (you’re probably taller, too) and try to sound authoritative and say “Well done, and that’s definitely the reason” and hope it sounds convincing.

No, that has little to do with it.

Not at all. You’ll have a good month, if you stay disciplined.

2 Likes